New Options for Chord Energy Corp Offer Potential Financial Strategies

Today, investors in Chord Energy Corp (Symbol: CHRD) have new options available for January 2026 expiration. With 253 days until expiration, these new contracts may provide opportunities for put and call sellers to secure higher premiums than those offered for contracts expiring sooner.

Our analysis of the CHRD options chain has highlighted one put and one call contract worth noting. The put contract at the $85.00 strike price currently has a bid of $7.20. Investors selling-to-open this contract would commit to purchasing the stock at $85.00 while also collecting the premium. This brings the effective cost basis for shares down to $77.80—well below the current trading price of $92.56. For investors interested in acquiring CHRD shares, this could serve as an attractive alternative.

This $85.00 strike represents an approximate 8% discount compared to the current trading price, placing it out-of-the-money by that percentage. Current analytical data suggest there’s a 62% chance that the put contract could expire worthless. Over time, our tracking will monitor how these odds fluctuate, providing updates on our contract detail page. Should the contract expire without value, the premium would yield an 8.47% return on the cash commitment, or an annualized rate of 12.22%, a figure we refer to as YieldBoost.

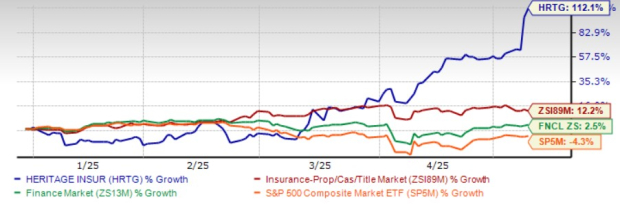

Below is a chart showing the trailing twelve-month trading history for Chord Energy Corp, with the $85.00 strike price highlighted relative to this history:

Looking at the call side of the options chain, the call contract at the $95.00 strike price has a current bid of $7.80. If investors purchase shares of CHRD at the current price of $92.56 and then sell-to-open that call contract as a covered call, they would agree to sell the stock at $95.00. This strategy could yield a total return of 11.06% if the stock is called away by the January 2026 expiration (before broker fees). However, substantial upside may be lost if CHRD shares appreciate significantly, thus emphasizing the importance of analyzing the company’s business fundamentals and historical performance.

Below is a chart illustrating CHRD’s trailing twelve-month trading history, with the $95.00 strike highlighted:

The $95.00 strike price represents about a 3% premium above the current trading price, making it out-of-the-money by that percentage. There exists the possibility that the covered call contract could expire worthless, allowing investors to retain both their shares and the collected premium. Current data indicate a 50% chance of this occurring. As with the put contract, our site will track how these odds evolve over time, offering insights on the trading history of the option contract. If the covered call expires worthless, the premium would equate to an 8.43% increase in returns for the investor, or an annualized 12.16%, also recognized as YieldBoost.

The implied volatility for the put contract stands at 40%, while the call contract’s implied volatility is at 42%. Our calculations show that the actual trailing twelve-month volatility, based on the previous 250 trading days and today’s price of $92.56, is 39%. For more insights on various put and call options, investors can explore additional resources.

![]() Top YieldBoost Calls of the S&P 500 »

Top YieldBoost Calls of the S&P 500 »

Explore More Options:

- BDC Baby Bonds and Preferreds

- Apparel Stores Mergers and Acquisitions

- HII Stock Split History

The views expressed in this article do not necessarily reflect those of any financial institution.