The Race for AI Supremacy: Nvidia, AMD, and Micron in Focus

Artificial Intelligence (AI) continues to be a hot topic, driving growth in the current bull market. While some may argue that it’s just a passing trend, its transformative impact is undeniable.

AI integration spans multiple sectors, including healthcare, finance, manufacturing, and consumer electronics, leading to an increased demand for edge and cloud-based computing solutions. This surge has significantly benefited the semiconductor industry, where chipmakers compete to meet the demand for specialized chips that can manage vast amounts of data and execute complex tasks.

In this environment, companies have rushed to develop AI-focused chips, and Nvidia (NASDAQ:NVDA) has emerged as a clear leader. With its strong market presence, Nvidia has effectively established itself as the premier maker of AI chips.

Nevertheless, AMD (NASDAQ:AMD) poses a noteworthy challenge to Nvidia’s position. Under the leadership of Lisa Su, AMD has successfully narrowed the competitive gap with Intel in the CPU market.

Earlier this year, Chris Caso, a top analyst at Wolfe Research, included AMD in the firm’s Wolfe Alpha List, labeling it as a compelling alternative to Nvidia amidst its stock’s rapid rise. However, Caso has recently adjusted his focus, now favoring another semiconductor player, Micron (NASDAQ:MU). This shift is due to Micron’s critical role in supplying advanced memory and storage solutions, which are essential for AI applications requiring high-speed data processing.

Caso remains optimistic about AMD’s potential in the AI space and anticipates further gains in server CPUs. Yet, he recognizes Micron’s larger growth opportunity as AI demand escalates. He also believes previous worries about memory supply imbalances and price issues, particularly regarding DRAM and HBM, have been overstated.

“Our thesis in memory has been that the imbalance between supply and demand in DRAM memory, driven by constrained CapEx levels and supplier focus on HBM, would drive industry shortages and pricing growth,” Caso explains. While fears of an oversupply in 2024 and 2025 had surfaced, he now considers those concerns excessive.

Consequently, Micron has overtaken AMD on the Wolfe Alpha List. Despite this, Caso retains an Outperform (Buy) rating on AMD with a $210 price target, indicating a potential upside of 42% over the next year. In contrast, Micron holds an Outperform rating with a $200 price target, projecting a possible 79% gain within the same timeframe. (For details on Caso’s track record, click here)

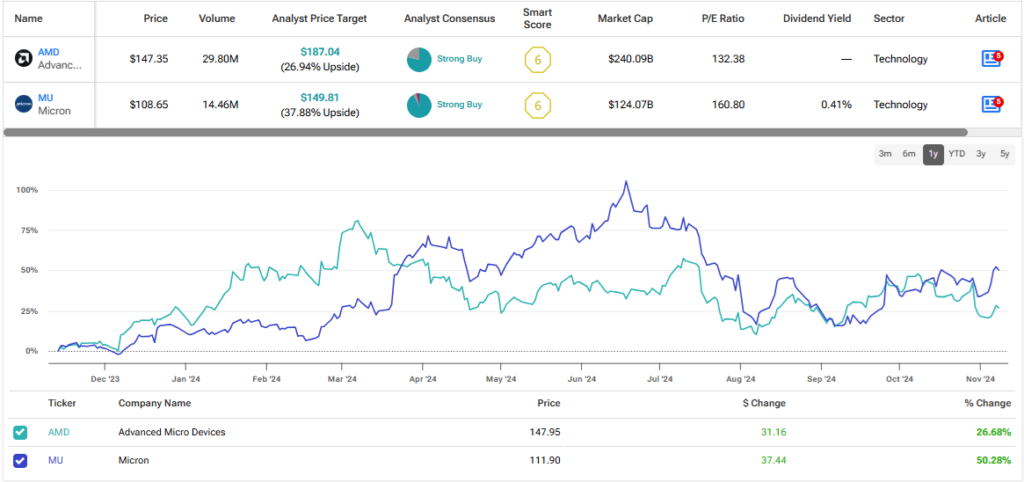

Support from the analyst community is strong for both companies. AMD enjoys a Strong Buy consensus rating, with 26 Buys against 6 Holds, while its average price target sits at $187.04, suggesting a 27% increase over the next year. (See AMD stock forecast)

Similarly, Micron has garnered a Strong Buy consensus rating, backed by 23 Buys and just 1 Hold. The average price target of $149.81 implies approximately 38% growth for the stock in the coming year. (See Micron stock forecast)

For strategies on selecting stocks with attractive valuations, check out TipRanks’ Best Stocks to Buy, which consolidates TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended for informational purposes only. Perform your own analysis before making any investment decisions.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.