An Encouraging Surge

A revealing light has been cast on Cielo (BOVESPA:CIEL3), as its one-year price target sets sail for new horizons at 5.39 / share. This stirring development marks a remarkable 5.36% growth spurt from the previous target of 5.12, dated January 16, 2024.

These figures aren’t merely scribbles on a page; they signify a tangible rise in investor confidence and financial promise. The price target paints a canvas of optimism and ambition, an aspiration towards lofty peaks that once seemed beyond reach.

Deciphering Fund Sentiment

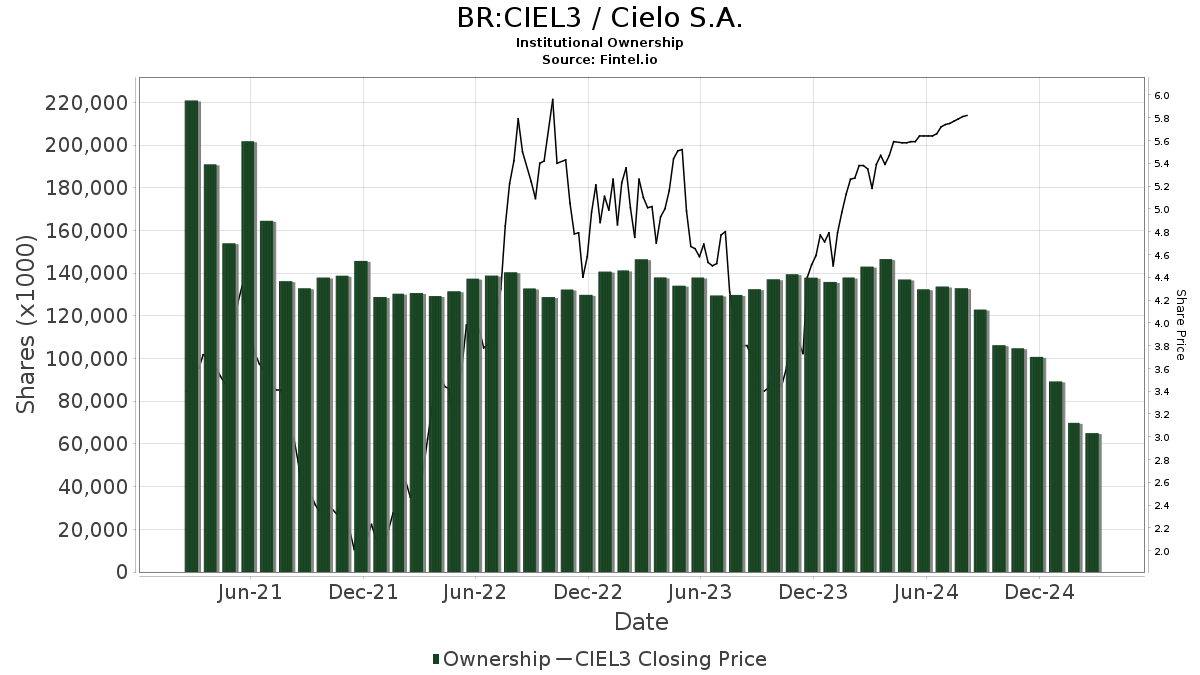

Venture further into the shadows, and you’ll find 68 funds or institutions laying bare their positions in Cielo. A secretive tango unfolds as 5 owners step back, marking a 6.85% decrease in the last quarter. The average portfolio weight clings to 0.18%, a downward plummet of 8.06%, hinting at a subtle retreat as new dynamics come into play.

While these changes may seem small, they paint a larger picture of evolving sentiments and calculated moves within the financial landscape. Each figure represents a chess piece in a grand game of strategy and insight, where every move echoes with significance and deliberation.

Unraveling Other Shareholder Actions

PEIFX – PIMCO RAE Emerging Markets Fund Institutional Class proudly holds 18,495K shares, a testament to its ownership of 0.69% of the company’s heart. In a daring move, the firm’s prior filing revealed ownership of 20,543K shares, marking a notable decline of 11.07%. The winds of change blow fiercely as the firm rethinks its alignment with CIEL3, signaling a shift in the financial ether.

Meanwhile, VEIEX – Vanguard Emerging Markets Stock Index Fund Investor Shares stands firm with 15,654K shares, claiming 0.58% ownership of the company. A steadfast stance in uncertain times calls for its own brand of courage and conviction, showcasing the resilience of long-standing strategies.

VGTSX – Vanguard Total International Stock Index Fund Investor Shares fiercely asserts its claim on 15,569K shares, embodying 0.58% of the company’s essence. In a surprising twist, the firm increased its stake by 2.25%, defying the ebb and flow of conventional wisdom in the turbulent waters of market unpredictability.

IEMG – iShares Core MSCI Emerging Markets ETF confidently holds 10,348K shares, solidifying 0.38% ownership. Like a master sculptor revising a masterpiece, the firm slashed its ownership by 20.74%, a calculated move signaling adaptability and strategic finesse in the face of evolving landscapes.

POEYX – Origin Emerging Markets Fund, a steadfast companion, remains poised with 8,045K shares, a steadfast anchor in the tempest of change. A timeless presence, echoing a sense of continuity and resilience amidst shifting tides.

Fintel emerges as a guiding light in the labyrinth of investment research, offering a beacon for investors, advisors, and hedge funds alike. Our platform, a treasure trove of data, presents a nuanced perspective on the financial realm, empowering decisions with insights, wisdom, and foresight.

The threads of financial tapestry are interwoven with nuances, intricacies, and whispers of intent. With each decision, each shift in sentiment, a story unfolds—a story of volatility, resilience, and the unwavering spirit of the market.

Amidst the pages of financial journals and reports lie the beating heart of the market—a dance of numbers, sentiments, and aspirations. What unfolds beneath the surface shapes the narrative of the financial world—a narrative governed by shrewdness, insight, and unyielding tenacity.

The essence of this narrative lies not in mere speculation but in the symphony of voices, movements, and intentions that converge to sculpt the ever-changing landscape of finance. As shadows lengthen and daylight wanes, the figures behind Cielo (BOVESPA:CIEL3) reveal a tale of transformation, resilience, and the enduring pursuit of financial prosperity.