Cincinnati Financial Corporation Prepares for Q1 Earnings Report

Cincinnati Financial Corporation (CINF), valued at $20.6 billion, offers property casualty insurance across the United States. Established in 1959 and based in Fairfield, Ohio, it operates through five divisions: Commercial Lines Insurance, Personal Lines Insurance, Excess and Surplus Lines Insurance, Life Insurance, and Investments.

Upcoming Earnings Report and Analyst Expectations

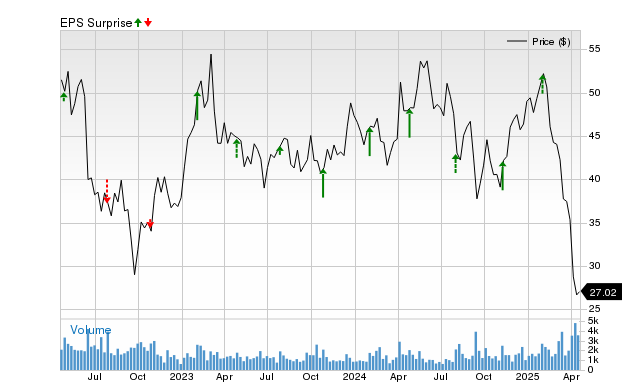

The financial services company is due to report its Q1 earnings on Monday, April 28, following the market’s closure. Analysts predict that CINF will incur a loss of $0.50 per share, a significant drop of 129.1% compared to a profit of $1.72 per share in the same quarter last year. Notably, CINF has beaten analysts’ earnings estimates in three of the past four quarters, only missing once. In the last quarter, it reported EPS of $3.14, exceeding the consensus estimate by 65.3%, thanks to increased earned premiums and investment income.

Projections for the Coming Years

For the fiscal year 2025, analysts estimate that CINF will report EPS of $5.03, a decline of 33.6% from $7.58 in fiscal 2024. However, the outlook is more promising for fiscal 2026, where earnings are expected to rise 58.9% year-over-year to $7.99 per share.

Recent Stock Performance

Over the last year, CINF shares have increased by 8.9%, outperforming the S&P 500 Index, which saw gains of 2.1%. However, CINF underperformed compared to the Financial Select Sector SPDR Fund, which surged 12.3% in the same period.

Q4 Results and Analyst Sentiment

On February 10, CINF’s shares fell by 1% following the announcement of its Q4 results. The company’s revenue was reported at $2.5 billion, representing a 24% year-over-year decrease. Despite this, non-GAAP operating income rose 38% year-over-year to $497 million. Nonetheless, net income dropped significantly by 66%, amounting to $405 million.

Despite these results, analysts maintain a cautiously positive outlook for CINF. The stock carries a “Moderate Buy” rating overall, with nine analysts covering it. Their opinions vary, including three “Strong Buys,” one “Moderate Buy,” and five “Holds.” Furthermore, with a mean price target of $167, CINF suggests a possible upside of 19.3% from its current trading levels.

On the date of publication, Kritika Sarmah did not hold (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are provided solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the author’s and do not necessarily reflect those of Nasdaq, Inc.