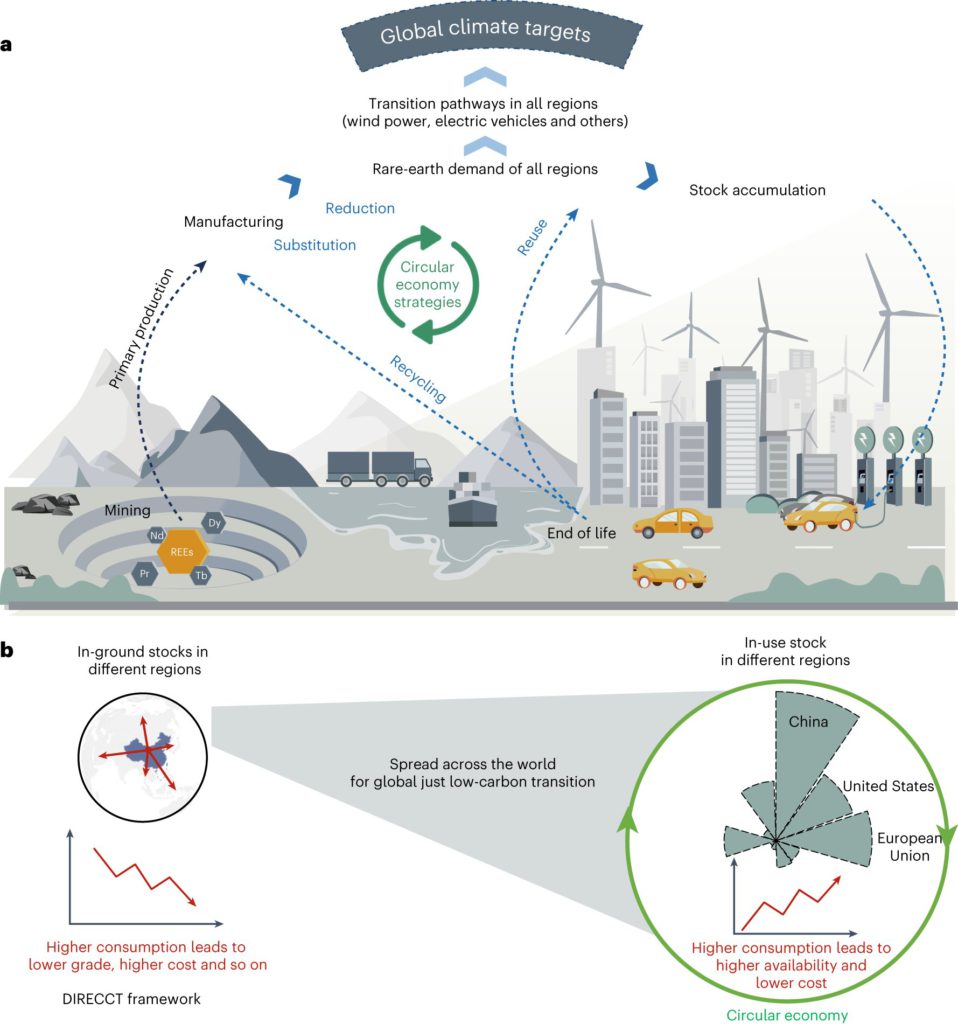

As our planet grapples with a rapidly evolving climate crisis, the significance of rare earth elements (REEs) in driving the transition towards a more sustainable future cannot be underestimated. A recent study has shed light on the pivotal role of circular economy strategies in increasing the global supply of REEs and reshaping the supply chains in the upcoming three decades.

Examining the specific impacts of circular economy strategies on the global REE supply and demand landscape, the study found a striking disparity between in-ground stocks, supply, and demand at regional and element levels. Notably, the mismatch in the supply of heavy rare earth elements emerges as a significant barrier to achieving net-zero emission targets.

The study underlines that the adoption of substitution, reuse, and recycling will revolutionize global REE supply chains. By embracing these strategies, there is projected growth in REE supply from urban mines over the next three decades, potentially reducing the reliance on traditional REE mining. Furthermore, certain regions, such as the EU, may even achieve a closed-loop REE supply through the implementation of circular economy strategies.

Professor Oliver Heidrich, co-author of the study and a distinguished faculty member at Newcastle University, emphasized the comprehensive nature of their model, which encompasses in-ground and in-use stocks. He stressed the dramatic geographic shift of these stocks across ten regions from 2001 to 2050 under three widely accepted climate scenarios. He further stated, “Our study sheds important light on the demands and supplies and provides a keen understanding of the geopolitical dynamics, climate goals, and the potential utilization of natural resources for political gains.”

Heidrich passionately asserts that the study’s findings can form the scientific foundation for fostering international cooperation in promoting circular economy strategies for REEs, thereby facilitating global and just low-carbon transitions.

Currently, the world’s rare earth element reserves are concentrated in a handful of nations, including China, Vietnam, Brazil, the US, Russia, and the Democratic Republic of the Congo. China stands as the dominant player, exerting control over more than 90% of the global supply and nearly 40% of the reserves. This concentration renders their availability vulnerable to supply fluctuations and price volatility due to conflicting geopolitical interests, posing a looming threat of conflicts.