Cisco Prepares for First Quarter Earnings Release Amid Mixed Signals

Cisco Systems (CSCO) plans to announce its first-quarter fiscal 2025 results on November 13.

Revenue and Earnings Projections

The company expects revenues for the quarter to fall between $13.65 billion and $13.85 billion, with non-GAAP earnings forecasted to be between 86 and 88 cents per share.

According to the Zacks Consensus Estimate, revenue expectations stand at $13.76 billion, reflecting a decline of 6.17% compared to the same period last year. Earnings estimates have remained stable at 87 cents per share, indicating a year-over-year drop of 21.62%.

Historically, CSCO has consistently outperformed the Zacks Consensus Estimate, surpassing it in each of the last four quarters by an average of 4.93%.

Cisco Systems, Inc. Price and EPS Surprise

Cisco Systems, Inc. price-eps-surprise | Cisco Systems, Inc. Quote

Check Zacks Earnings Calendar for the latest EPS estimates and surprises.

Challenges Ahead: Networking Sales Lagging

Cisco has faced challenges in networking sales. Weak demand from telecommunication and cable service providers, coupled with intense competition, has weighed on growth. Additionally, customers have been left with excess inventory, further impacting performance.

In the fourth quarter of fiscal 2024, Cisco reported revenues of $13.64 billion, a drop of 10.3% year-over-year. This decline was mainly driven by a 15.4% reduction in product revenues, which accounted for 72.3% of total revenues.

The Zacks Consensus Estimate anticipates Networking revenues to be around $6.909 billion for the first quarter, reflecting a 21.7% decrease year-over-year. Meanwhile, Collaboration revenues are projected to be $1.065 billion, indicating a 4.7% decline compared to last year.

On a positive note, Cisco is experiencing growth in its security offerings, thanks to strong demand for solutions like XDR, Secure Access, and Multicloud Defense. Current estimates for Security revenues stand at $1.816 billion for the first quarter.

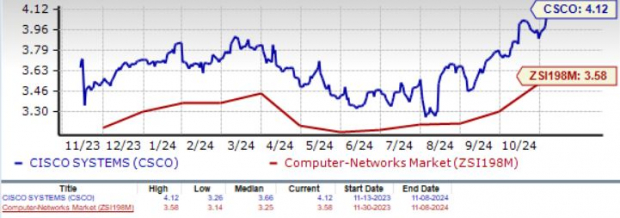

Stock Performance: Underperforming Sector but Beating Industry

Year-to-date, Cisco shares are up 14.9%, which lags behind the Zacks Computer & Technology sector’s average increase of 30.4%, although they outperformed the Zacks Computer Networking industry’s return of 14.2%.

Year-to-Date Performance Chart

Image Source: Zacks Investment Research

Even with these gains, Cisco’s Value Score of C indicates that its stock valuation may be stretched currently. The forward 12-month Price/Sales ratio for CSCO is 4.12, higher than the industry average of 3.58.

Price/Sales Ratio (F12M)

Image Source: Zacks Investment Research

Future Potential Linked to Innovative Strategies

Cisco sees significant growth opportunities in AI-related workloads, with an estimated market opportunity of $950 billion. The current markets project a compound annual growth rate (CAGR) of 6%, while expanding markets may experience a CAGR of 16% from 2025 to 2027.

The company’s investment in AI, cloud, and cybersecurity is substantial, with over $1 billion in AI orders already booked from hyperscalers and an additional $1 billion expected for fiscal 2025.

With a security-focused portfolio, Cisco’s offerings like XDR and Multicloud Defense are gaining traction. Current markets could see an 8% CAGR while expansion markets might achieve a 14% CAGR during the same period. The recent acquisition of Splunk could also enhance CSCO’s capabilities in this area, addressing markets valued at $118 billion.

In the infrastructure space, Cisco’s addressable market is expected to reach $221 billion, driven by the rise of AI and cloud technology amid ongoing digital transformation initiatives in enterprises.

A rebound in Networking demand would further bolster Cisco’s long-term outlook. Innovations in routing, switching, security, and observability are equipping customers to enhance operations through AI-powered solutions and improved supply-chain visibility.

Strong Partnerships Fueling Growth

Cisco’s robust partner ecosystem includes notable companies like Meta Platforms (META), Microsoft, NVIDIA (NVDA), Lenovo, and AT&T (T).

The collaboration with NVIDIA has led to the development of the Cisco Nexus HyperFabric AI cluster solution, aiming to optimize generative AI workloads. Additionally, Cisco is working with AT&T to enhance the digital buying experience for enterprises through the introduction of 5G Fixed Wireless Access via the Meraki MG52 and MG52E gateways.

The momentum around Cisco’s Silicon One remains strong, with Meta planning to adopt the Cisco 8501, which integrates the capabilities of the Cisco Silicon One G200 with advanced Cisco-designed hardware. Two new solutions, the Cisco 8122-64EH/EHF and Nexus 9364E-SG2, are set to support developments in AI and machine learning across enterprise data centers and hyperscalers.

Conclusion: A Wait-and-See Approach

In the short term, Cisco’s results are likely to reflect ongoing softness in the networking sector.

Nevertheless, its expanding portfolio, commitment to cybersecurity, and strong partner collaborations position CSCO for potential recovery in fiscal 2025.

Cisco is currently rated as Zacks Rank #3 (Hold). You can explore Zacks’ top-ranked stocks by checking out today’s #1 Rank (Strong Buy) listings.

Free Report: 5 Clean Energy Stocks with Massive Upside

Energy is a crucial part of our economy, encompassing a multi-trillion dollar industry that supports major global companies.

Cutting-edge technologies in clean energy are beginning to outpace traditional fossil fuels. Trillions of dollars are being funneled into clean energy projects, from solar initiatives to hydrogen innovations.

Identifying emerging leaders in this field may offer some of the most promising investment opportunities. Download “Nuclear to Solar: 5 Stocks Powering the Future” to discover Zacks’ top growth stocks for free.

Want ongoing expert recommendations from Zacks Investment Research? Download “5 Stocks Set to Double” today at no cost.

AT&T Inc. (T): Free Stock Analysis Report

Cisco Systems, Inc. (CSCO): Free Stock Analysis Report

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Meta Platforms, Inc. (META): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.