Cisco’s Recent Performance Reflects Resilience Amid Market Challenges

Cisco Systems (CSCO) shares have decreased by 10.8% over the past month, slightly better than the Zacks Computer Networking industry’s decline of 11% and the broader Zacks Computer & Technology sector’s drop of 13.9%. These declines come as Cisco navigates a complex macroeconomic environment marked by rising recession fears and tariffs impacting trade relations with China, Mexico, and Canada. Additionally, the company faces stiff competition within the networking sector.

Despite these challenges, Cisco’s aggressive initiatives in artificial intelligence (AI) and its growth in security services present a positive outlook. Collaborating with NVIDIA (NVDA), Cisco has introduced AI factory architecture that is expected to enhance its revenue from AI-driven solutions. By the end of the first half of fiscal 2025, Cisco reported over $700 million in AI infrastructure orders, aiming to exceed $1 billion by fiscal year-end.

Several AI-focused enterprises are actively purchasing Cisco’s integrated systems such as Nexus and UCS, which are crucial for powering their AI applications. The ongoing expansion of AI-powered robotics and industrial security is beneficial for Cisco’s Internet of Things (IoT) division. Notably, orders in the first half of fiscal 2025 jumped by more than 40%, with second-quarter growth exceeding 50%.

CSCO Stock Performance

Image Source: Zacks Investment Research

In comparison to its peers, Cisco shares have held up relatively well against NETGEAR (NTGR) and Extreme Networks (EXTR). Those stocks have dropped 10.4% and 25.9%, respectively, during the same period.

With Cisco’s recent dip in share price, investors may ponder whether this presents a suitable buying opportunity. Let’s explore this further.

Cisco Gains Advantage from Strong Portfolio and NVIDIA Collaboration

The strengthened partnership with NVIDIA aims to provide solutions that build AI-ready data center networks, which is a significant development for Cisco. The Cisco Secure AI Factory, utilizing NVIDIA’s Spectrum-X Ethernet networking platform, emphasizes security while enabling businesses to simplify, deploy, manage, and secure AI infrastructure at scale. Additionally, the introduction of 800-gig Nexus switches, powered by Cisco’s 51.2 terabit Silicon One chip launched in April, is expected to attract orders from AI-driven cloud customers.

Strategically, Cisco is integrating AI into its Security and Collaboration platforms, enhancing its offerings. The deployment of Agentic AI aims to improve customer experiences, exemplified by the release of the Renewals Agent and a new Assistant designed to assist customers in digitizing and managing Network Change Management.

The strong demand in Cisco’s security segment, particularly for Cisco Secure Access and XDR, has resulted in both products gaining over 1,000 customers in the last year, with each serving approximately one million enterprise users. Cisco’s Hypershield is also gaining market traction.

Furthermore, Cisco has incorporated Talos into Splunk’s Enterprise Security 8.0 and AppDynamics into Splunk’s log observer in the second quarter of fiscal 2025. The company has also introduced Splunk on Azure, Splunk Federated Analytics, and an AI Assistant for Splunk Observability.

Its latest innovation, Cisco AI Defense, is designed to facilitate and secure AI transformation within enterprises. As AI usage expands, risks such as data breaches and misuse rise alongside it. Cisco AI Defense intends to mitigate these risks with advanced network visibility and control, ensuring that enterprises can adopt AI technologies securely.

CSCO Provides Positive Guidance for 2025

Looking ahead to fiscal 2025, Cisco forecasts revenues between $56 billion and $56.5 billion, with non-GAAP earnings projected to be between $3.68 and $3.74 per share.

The Zacks Consensus Estimate puts fiscal 2025 revenues at $56.42 billion, which represents a year-over-year growth of 4.86%. The consensus for Cisco’s 2025 earnings stands at $3.72 per share, a slight decline of 0.27% compared to last year.

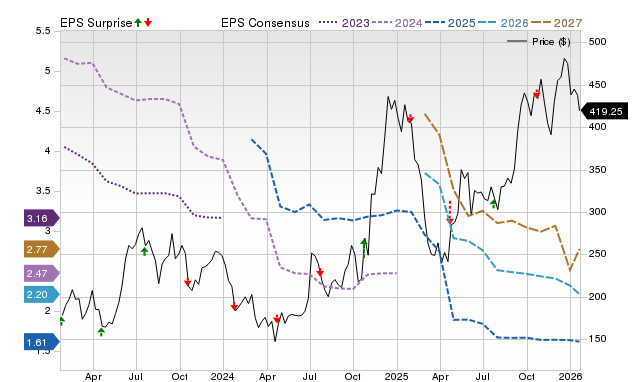

Notably, CSCO has consistently outperformed the Zacks Consensus Estimate for earnings in the previous four quarters, with an average surprise of 4.07%. (Explore the latest EPS estimates and surprises on Zacks earnings Calendar.)

Cisco Systems, Inc. Stock Price and Consensus

Cisco Systems, Inc. price-consensus-chart | Cisco Systems, Inc. Quote

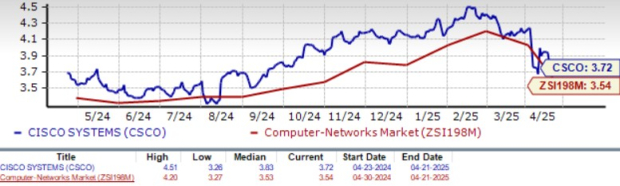

Cisco Shares Valued at a Premium

CSCO’s stock currently trades at a forward 12-month price/sales ratio of 3.72X, which is higher than the industry’s 3.54X, as well as NETGEAR’s 0.9X and Extreme Networks’ 1.22X. Despite this, its Value Score of C suggests a potentially stretched valuation.

Forward Price/Sales Ratio

Image Source: Zacks Investment Research

Currently, Cisco shares are trading below both the 50-day and 200-day moving averages, indicating a bearish market trend.

CSCO Stock Trend Analysis

Conclusion: Is CSCO Stock a Buy?

With an innovative and expanding portfolio, Cisco appears well-prepared for ongoing growth in the tech sector. The company’s robust AI initiatives and increasing presence in security services support its valuation premium.

CSCO holds a Zacks Rank #2 (Buy), suggesting that now could be an advantageous time for investors to begin accumulating shares. For more insights, you can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

5 Stocks Set to Double

Handpicked by a Zacks expert, these stocks are projected to gain +100% or more in 2024. While not all selections may succeed, previous recommendations have yielded returns of +143.0%, +175.9%, +498.3%, and even +673.0%.

Most stocks in this report are currently underappreciated by Wall Street, presenting an excellent opportunity for early investment. Discover these 5 potential home runs >>

Want the latest recommendations from Zacks Investment Research? Download the top 7 stocks anticipated for the next 30 days. Click for this free report

Cisco Systems, Inc. (CSCO): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

NETGEAR, Inc. (NTGR): Free Stock Analysis report

Extreme Networks, Inc. (EXTR): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.