Cisco Systems Expected to Propel Stock Prices Higher in 2025

Cisco Systems’ (NASDAQ: CSCO) stock price is poised for upward momentum in 2025, driven by strong quarterly performance, AI integration, and positive analyst ratings. Key elements influencing this outlook include FQ3 outperformance, guidance for FQ4, the rise of AI, analyst upgrades, and robust capital returns. The underlying message is clear: AI is enhancing business growth, leading to better guidance and a promising outlook for fiscal 2026.

The potential growth for Cisco’s stock price hinges on the longevity of AI advancements and the ongoing cycle of analyst upgrades. Current demand across existing markets is substantial, and new contracts—such as those with Saudi Arabia’s HUMAIN—will further bolster Cisco’s position. Collaborations with firms like NVIDIA (NASDAQ: NVDA), Advanced Micro Devices (NASDAQ: AMD), and Super Micro Computers (NASDAQ: SMCI) also contribute to its strength.

Recent analyst activity has led to increased price targets, with many projecting Cisco’s stock in the $70-$75 range, indicating a potential 15% upside—enough to create a new all-time high. Furthermore, trends such as heightened coverage and favorable sentiment are affirming Cisco’s positive outlook.

stock price” width=”917″ height=”455″ loading=”lazy”>

stock price” width=”917″ height=”455″ loading=”lazy”>

Strong Performance Across All Segments in 2025

Cisco’s Q3 results demonstrate impressive growth across various sectors and regions, further supported by increasing AI demand. The company reported $14.15 billion in net revenue, reflecting an 11.4% year-over-year improvement and surpassing MarketBeat’s consensus by 65 basis points. The Americas saw the highest growth, with a 14% increase, while EMEA and APJC regions reported gains of 8% and 9%, respectively.

Product sales were the primary growth driver, increasing by 15%, followed closely by a 3% rise in services. Noteworthy growth was noted in all end markets, particularly a remarkable 54% surge in Security, signaling positive trends for leaders in cybersecurity, including Palo Alto Networks. Large enterprises also played a critical role, as web-scale businesses invest heavily in data center expansions and networking infrastructure.

[content-module:DividendStats|NASDAQ:CSCO]

Margin news is promising. While GAAP and adjusted measurements show mixed results, the overall outcome remains stable compared to last year. This stability results in adjusted earnings of $0.96, about 200 basis points above consensus, providing a 9% gain for investors. More importantly, cash flow and free cash flow are robust, ensuring continued balance sheet health and favorable capital returns.

The guidance is also strong, with the Q4 and fiscal year targets raised, while analyst consensus remains at or slightly below the lower bounds of these forecasts.

Cisco is recognized for its aggressive capital returns, offering an above-average dividend while trading at a below-average valuation. The annual dividend distribution is approximately 2.7%, with shares currently around $65.50—close to 16 times the current year’s earnings. This valuation is notably lower than many leading AI infrastructure companies, suggesting considerable upside potential. The company has s

$15 billion remaining under its current buyback authorization, enough for around 10 quarters based on the Q3 repurchase rate, which reduced shares by 1.4%.

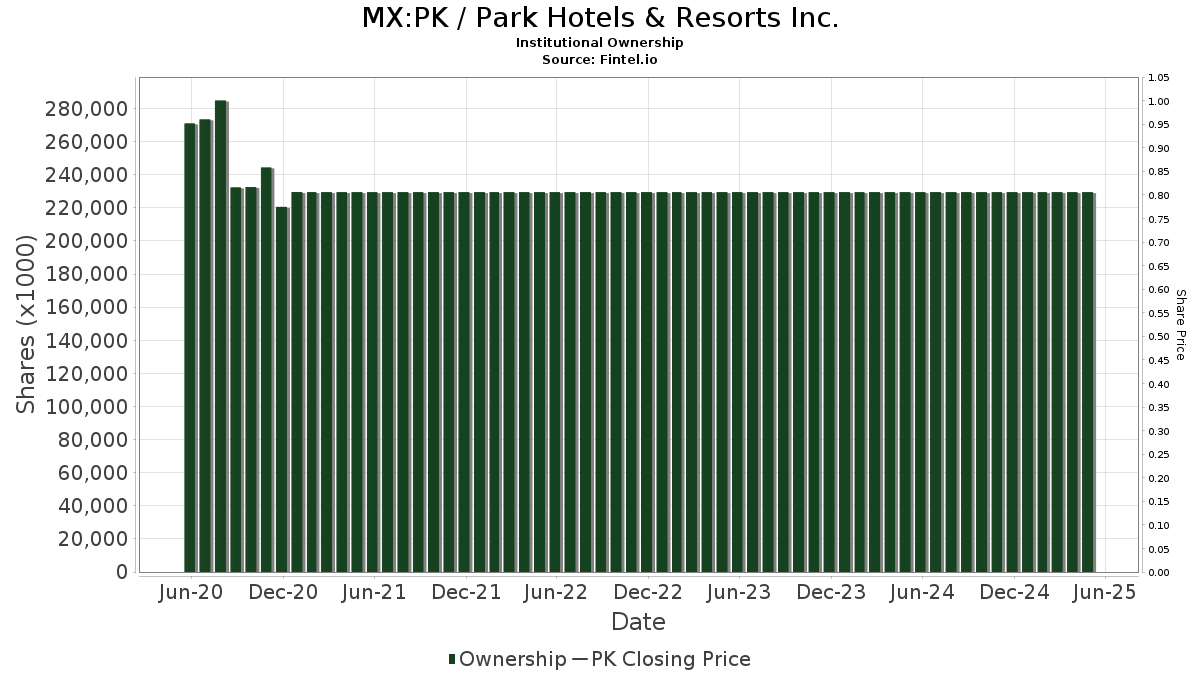

Institutional Trends Favor Cisco’s Stock Price Movement

[content-module:Forecast|NASDAQ:CSCO]

Institutional trends are providing a favorable backdrop for Cisco’s stock price in 2025, with expectations of continued support as the year advances. Many institutions are reverting to a buying strategy at the end of 2024, leading to increased bullish momentum in 2025. With these investors holding nearly 75% of the stock, they represent a solid support base that is unlikely to sell.

The stock price action post-results was positive, with CSCO stock climbing over 5% to close at a new peak. Looking ahead, Cisco’s stock is expected to continue rising, assuming the market embraces this positive trend. If momentum fails, however, the CSCO market may stabilize at current levels until later this year.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.