Citigroup Upgrades Hasbro Outlook: Institutional Ownership Trends

Fintel reports that on April 25, 2025, Citigroup upgraded their outlook for Hasbro (BMV: HAS) from Neutral to Buy.

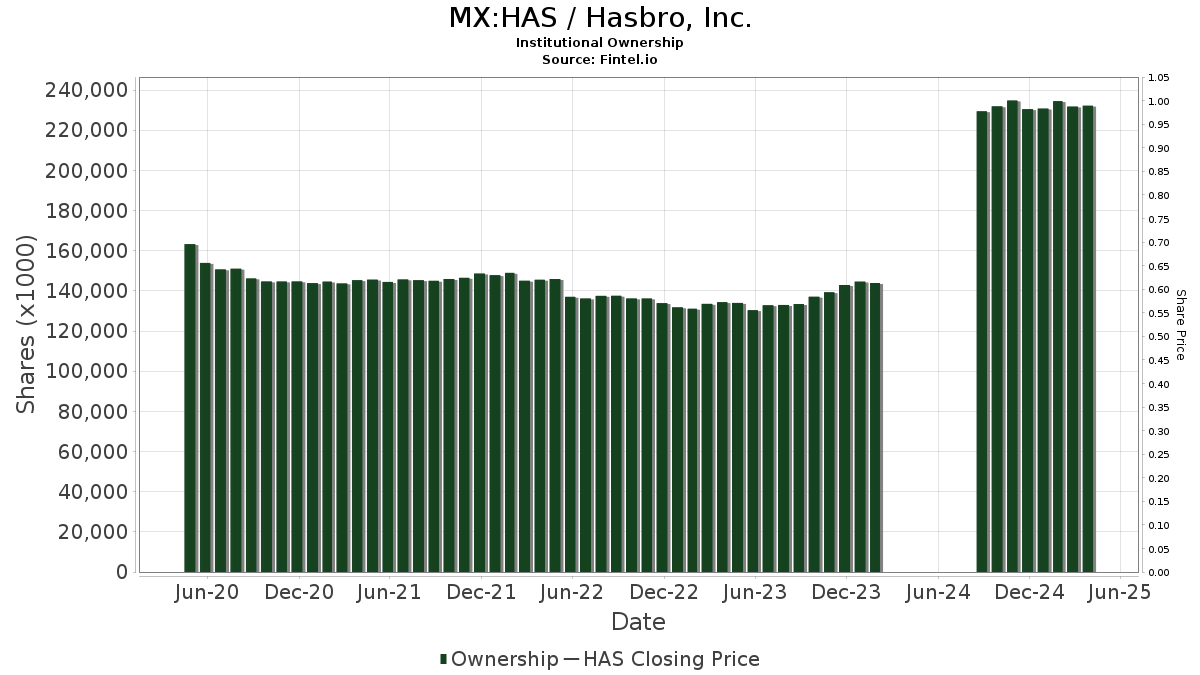

Current Fund Sentiment towards Hasbro

There are currently 1,208 funds or institutions that report holding positions in Hasbro. This represents a slight increase of one owner, or 0.08%, over the last quarter. The average portfolio weight dedicated to Hasbro among these funds is 0.20%, showing a 2.83% rise. However, total shares owned by institutions have decreased by 0.53% in the last three months, bringing the total to 201,387K shares.

Insights from Major Shareholders

OAKEX – Oakmark International Small Cap Fund Investor Class holds 26,718K shares, accounting for 19.07% ownership of Hasbro. In its previous filing, the firm reported owning 29,229K shares, indicating a decrease of 9.40%. Its portfolio allocation towards Hasbro has declined by 1.53% over the last quarter.

VGTSX – Vanguard Total International Stock Index Fund Investor Shares has 21,962K shares, representing 15.67% ownership. Previously, the firm held 22,118K shares, marking a decrease of 0.71%. The allocation towards Hasbro shrank by 6.75% in the last quarter.

Capital Research Global Investors owns 14,522K shares, equating to 10.36% of the company. The prior report showed ownership of 15,045K shares, resulting in a decrease of 3.60%. Their portfolio allocation in Hasbro was cut by 26.18% over the last quarter.

VTMGX – Vanguard Developed Markets Index Fund Admiral Shares holds 13,618K shares, representing 9.72% ownership. This is a slight increase from the 13,512K shares reported previously, showing an increase of 0.78%. Their allocation to Hasbro decreased by 12.35% in the recent quarter.

HILAX – The Hartford International Value Fund has 13,569K shares, reflecting 9.68% ownership. This is an increase from the 13,408K shares previously held, showing an increase of 1.19%. However, their portfolio allocation in Hasbro decreased by 21.58% over the last quarter.