Citigroup Upgrades Bank of America to Buy: A Look at Institutional Sentiment

On November 8, 2024, Citigroup raised its forecast for Bank of America (SNSE:BACCL) from Neutral to Buy.

Fund Sentiment at a Glance

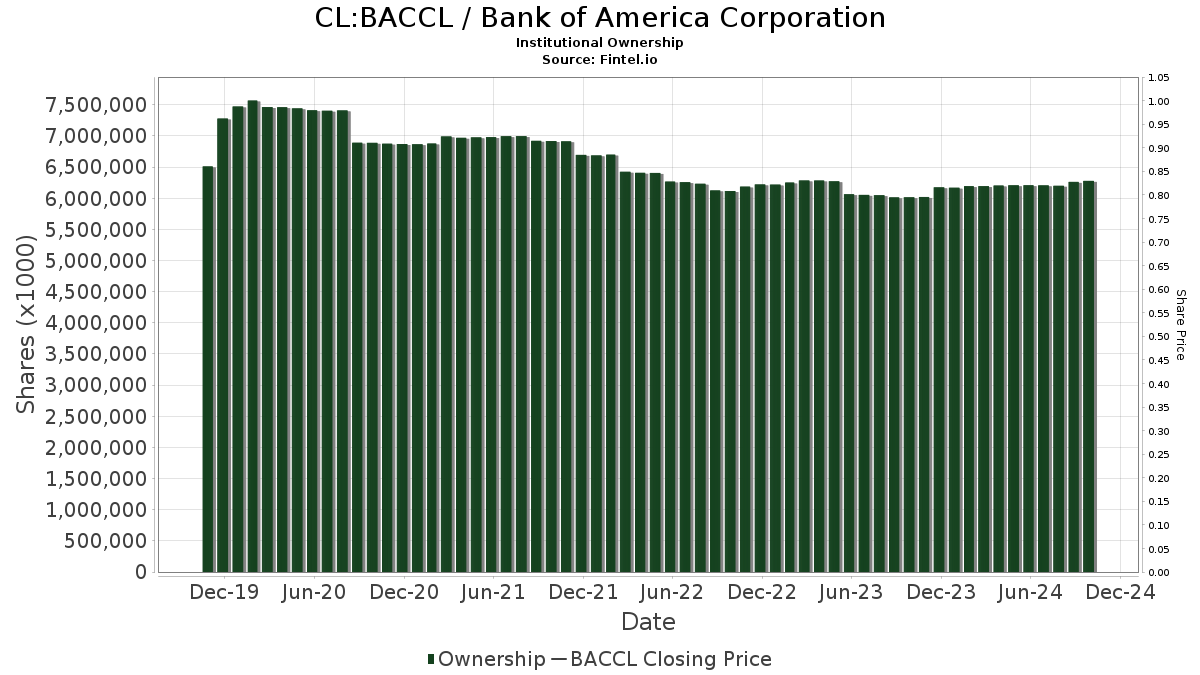

A total of 4,247 funds or institutions currently hold shares in Bank of America, reflecting an increase of 50 owners, or 1.19%, in the last quarter. The average portfolio weight dedicated to BACCL stands at 0.66%, showing a rise of 4.53%. Over the past three months, institutional ownership increased by 3.83%, bringing the total to 6,304,416K shares.

How Are Other Major Shareholders Positioned?

Berkshire Hathaway holds 1,032,852K shares, which accounts for 13.46% ownership, with no change reported in the last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 209,897K shares, representing 2.74% of ownership. Previously, the firm reported 210,263K shares, indicating a decrease of 0.17%. However, its allocation to BACCL increased by 1.81% over the last quarter.

The Vanguard 500 Index Fund Investor Shares (VFINX) possesses 174,622K shares, or 2.28% ownership. This is up from 173,507K shares in the prior report, showcasing a 0.64% increase. Despite this, the firm reduced its allocation in BACCL by 0.08% in the previous quarter.

JPMorgan Chase holds 149,404K shares, equating to 1.95% of the company. In comparison to its previous filing, where it owned 147,816K shares, this signifies a 1.06% increase. However, JPMorgan’s overall portfolio allocation in BACCL fell significantly by 93.70% last quarter.

Geode Capital Management increased its stake to 138,556K shares, which corresponds to 1.81% ownership, up from 137,026K shares previously—a 1.10% rise. The firm also raised its portfolio allocation in BACCL by 0.63% over the last quarter.

Fintel offers a comprehensive platform for investing research, aimed at individual investors, traders, financial advisors, and small hedge funds.

Our extensive data encompasses fundamentals, analyst reports, ownership statistics, fund and options sentiment, insider trading, unusual options trades, and more. Exclusive stock picks are derived from advanced, backtested quantitative models designed to enhance profitability.

Click to Learn More

This article first appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.