Citigroup Upgrades Bath & Body Works to Buy: Fund Trends Revealed

Fintel reports that on February 28, 2025, Citigroup upgraded its outlook for Bath & Body Works (WBAG:BBWI) from Neutral to Buy.

Fund Sentiment Update

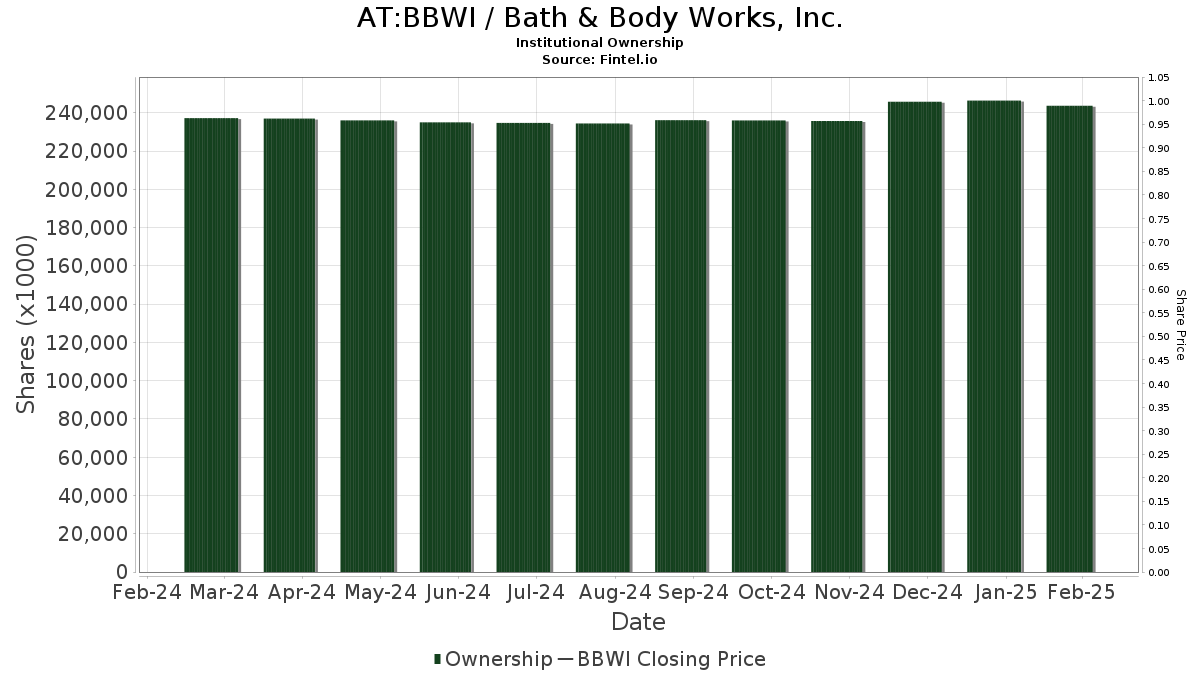

Currently, 1,160 funds or institutions have reported positions in Bath & Body Works, reflecting an increase of 83 owners, or 7.71%, from the previous quarter. The average portfolio weight of all funds dedicated to BBWI is 0.18%, which shows a rise of 23.86%. Total shares owned by institutions grew by 11.03% in the last three months, reaching 262,007K shares.

Shareholder Actions

The iShares Core S&P Small-Cap ETF (IJR) holds 14,134K shares, representing 6.53% ownership of Bath & Body Works. T. Rowe Price Investment Management has increased its stake to 10,235K shares, which is 4.73% ownership, marking an increase from 9,812K shares and a 4.13% rise in shareholding. Moreover, T. Rowe Price boosted its allocation in BBWI by 29.61% last quarter.

Price T Rowe Associates owns 8,494K shares (3.92% ownership), having raised its shares from 8,048K for a 5.25% increase and a 28.35% boost in portfolio allocation. Conversely, J.P. Morgan Chase currently holds 6,987K shares (3.23% ownership), down from 8,287K shares—an 18.60% reduction, signifying an 81.74% decrease in their investment in BBWI over the last quarter. Lastly, the Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 6,903K shares, representing 3.19% ownership; this reflects a decrease from 7,035K shares, or 1.90%, along with a 24.66% reduction in portfolio allocation.

Fintel is recognized as a comprehensive investing research platform for individual investors, traders, financial advisors, and small hedge funds.

The platform provides a wealth of data including fundamentals, analyst reports, ownership data, fund sentiment, options trading, insider activity, and much more. Our exclusive Stock picks derive from advanced, backtested quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.