Citigroup Boosts Bank of America Preferred Security Rating

On November 8, 2024, Citigroup elevated its outlook for Bank of America Corporation – Preferred Security (NYSE:MER.PRK) from Neutral to Buy.

Fund Manager Sentiment Shifts

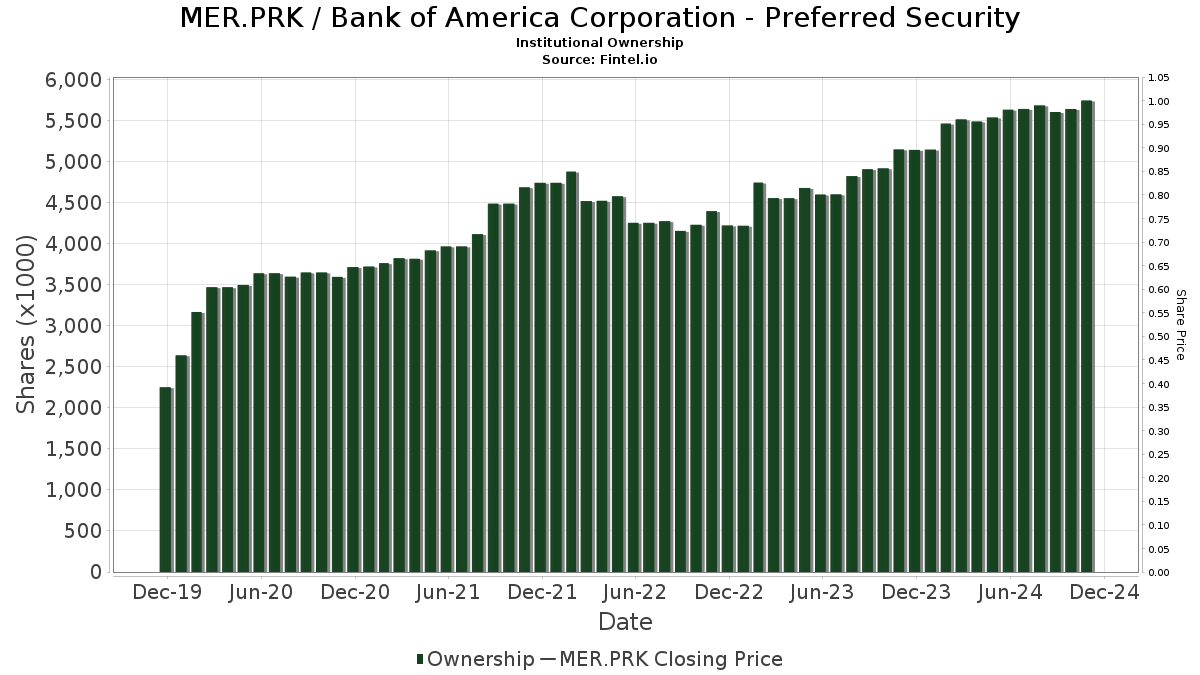

Currently, 18 funds or institutions report holdings in Bank of America Corporation – Preferred Security, marking an increase of 5.88% with one new owner in the past quarter. The average portfolio weight dedicated to MER.PRK across all funds has risen to 0.69%, up by 1.26%. Institutional ownership saw a growth of 1.06% in the last three months, totaling 5,741K shares.

Movements Among Major Shareholders

The PFF – iShares Preferred and Income Securities ETF holds 2,028K shares, having decreased from 2,102K shares, representing a drop of 3.68%. Despite this, the firm increased its stake in MER.PRK by 0.32% over the last quarter.

Meanwhile, the PGX – Invesco Preferred ETF reported an increase in holdings to 1,348K shares from 1,292K shares, which reflects a growth of 4.19%. This fund also raised its portfolio allocation to MER.PRK by 4.14%.

The PFFD – Global X U.S. Preferred ETF acquired 743K shares, up from 728K shares, indicating a rise of 1.91%. Similarly, this firm boosted its allocation in MER.PRK by 0.63% in the last quarter.

The PFFV – Global X Variable Rate Preferred ETF added to its position, now holding 455K shares, increased from 429K shares, showing a growth of 5.84%. They also raised their allocation in MER.PRK by 5.27% last quarter.

In contrast, the VRP – Invesco Variable Rate Preferred ETF saw a slight decline, holding 326K shares as compared to 330K shares, representing a 1.24% decrease. This fund reduced its portfolio allocation in MER.PRK by 2.31% over the past quarter.

Fintel serves as a comprehensive investing research platform tailored for individuals, traders, financial advisors, and small hedge funds.

Our global data encompasses fundamentals, analyst insights, ownership details, and fund sentiment. We also provide information on options sentiment and insider trading, along with advanced stock picks powered by quantitative models aimed at enhancing profits.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.