Citigroup Upgrades Bank of America Preferred Stock to ‘Buy’

On November 8, 2024, Citigroup changed its outlook for Bank of America Corporation – Preferred Stock (NYSE:BML.PRJ) from Neutral to Buy.

Update on Fund Sentiment

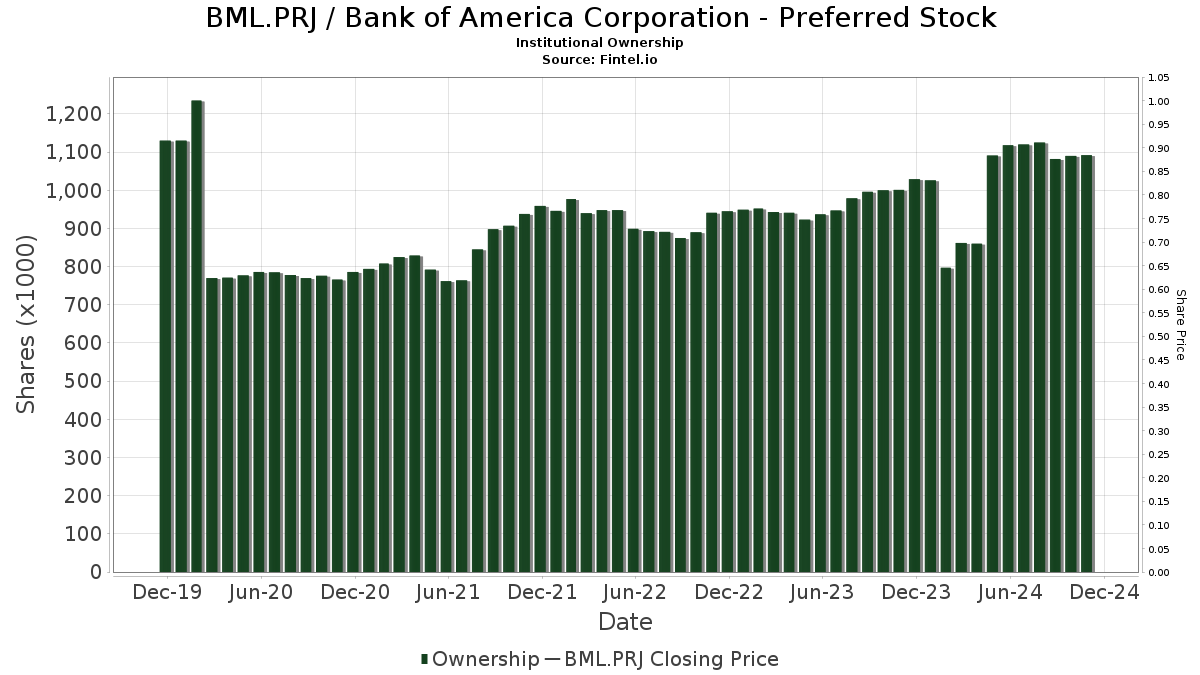

A total of 14 funds and institutions are now reporting positions in Bank of America Corporation – Preferred Stock, marking an increase of 1 owner or 7.69% from the previous quarter. The average portfolio weight for these funds dedicated to BML.PRJ stands at 0.18%, reflecting a rise of 1.96%. However, total shares owned by institutions fell by 2.97% over the last three months, totaling 1,093K shares.

Shareholder Actions

PFF – iShares Preferred and Income Securities ETF currently holds 388K shares, down from its prior 428K shares, indicating a reduction of 10.40%. This firm has reduced its portfolio allocation in BML.PRJ by 4.54% in the last quarter.

Pnc Financial Services Group maintains its position with 227K shares unchanged from its previous filing, showing a minor decrease of 0.21%. Their portfolio allocation in BML.PRJ increased by 1.25% this quarter.

PFFD – Global X U.S. Preferred ETF has raised its holdings slightly, now at 145K shares compared to 144K shares previously, translating to a modest increase of 0.75%. Their portfolio allocation in BML.PRJ fell by 2.59% over the last quarter.

PFFV – Global X Variable Rate Preferred ETF reports a decrease in holdings from 87K to 85K shares, a drop of 2.59%. This firm increased its allocation in BML.PRJ by 0.08% during the past quarter.

Lastly, VRP – Invesco Variable Rate Preferred ETF reduced its holdings to 63K shares from 64K, reflecting a 1.22% decrease, along with a 4.30% reduction in portfolio allocation in BML.PRJ.

Fintel serves as a comprehensive research platform for investors, traders, financial advisors, and small hedge funds, providing a wealth of data including fundamentals, analyst reports, and fund sentiment.

This information originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.