Citigroup Upgrades Bank of America to ‘Buy’ with Positive Fund Sentiment

Fund Sentiment on the Rise

According to a report from Fintel, Citigroup upgraded its outlook for Bank of America (SNSE:BAC) from Neutral to Buy on November 8, 2024.

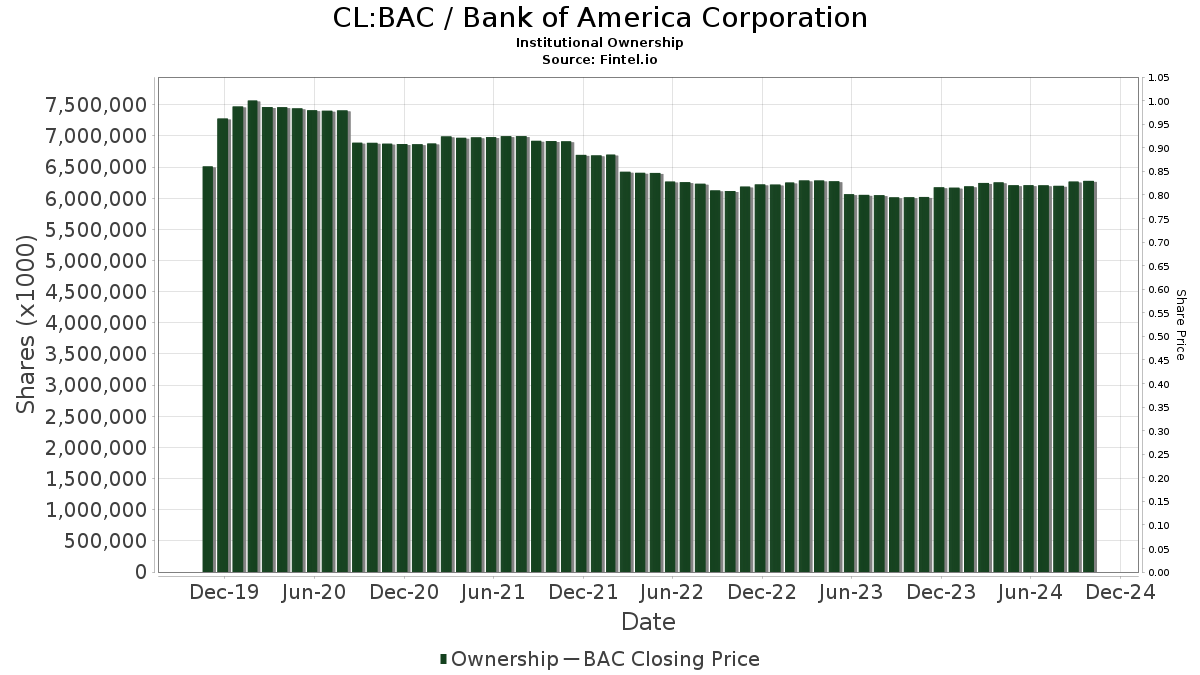

Current Holdings of Funds in BAC

Currently, 4,247 funds and institutions hold positions in Bank of America. This represents an increase of 50 owners, or 1.19%, since last quarter. The average portfolio weight dedicated to BAC among all funds stands at 0.66%, which has grown by 4.57%. Additionally, total shares owned by institutions rose by 3.83% over the past three months, reaching 6,304,416K shares.

Key Shareholders and Their Moves

Berkshire Hathaway remains the largest shareholder, holding 1,032,852K shares, which accounts for 13.46% ownership. This stake has not changed in the last quarter.

The Vanguard Total Stock Market Index Fund (VTSMX) owns 209,897K shares, representing 2.74% ownership. Their latest filing shows a slight decrease from 210,263K shares, marking a 0.17% drop. However, they have increased their portfolio allocation to BAC by 1.81% over the last quarter.

Vanguard 500 Index Fund (VFINX) reports holding 174,622K shares, equating to 2.28% ownership. They have increased their share count from 173,507K shares, reflecting a 0.64% rise. However, their overall allocation to BAC has decreased by 0.08% during the same period.

JPMorgan Chase holds a stake of 149,404K shares, representing 1.95% ownership. This is an increase from their previous holding of 147,816K shares, totaling a 1.06% rise; yet, they significantly cut their BAC portfolio allocation by 93.70% last quarter.

Geode Capital Management owns 138,556K shares, or 1.81% of Bank of America. Their latest filing shows an increase from 137,026K shares, demonstrating a 1.10% increase, alongside a portfolio increase of 0.63% for BAC over the last quarter.

Fintel stands out as a robust research platform for individual investors, traders, financial advisors, and small hedge funds. Their extensive data includes fundamentals, analyst reports, ownership statistics, fund sentiment, insider trading, and more. Their stock selections are backed by sophisticated quantitative models aimed at enhancing profits.

This story initially appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.