Citigroup Launches Neutral Rating for Ford Motor Company

Fintel reports that on April 23, 2025, Citigroup initiated coverage of Ford Motor (NYSE:F) with a Neutral recommendation.

Analyst Price Forecast Indicates Slight Decline

As of April 23, 2025, the average one-year price target for Ford Motor stands at $9.50 per share. Forecasts range from a low of $7.07 to a high of $14.70. Compared to Ford’s latest reported closing price of $9.76 per share, this average represents a decrease of 2.67%.

Revenue and Earnings Projections

The projected annual revenue for Ford Motor is $159,665 million, reflecting a decline of 13.69%. Additionally, the projected annual non-GAAP EPS is 1.70.

Fund Sentiment Overview

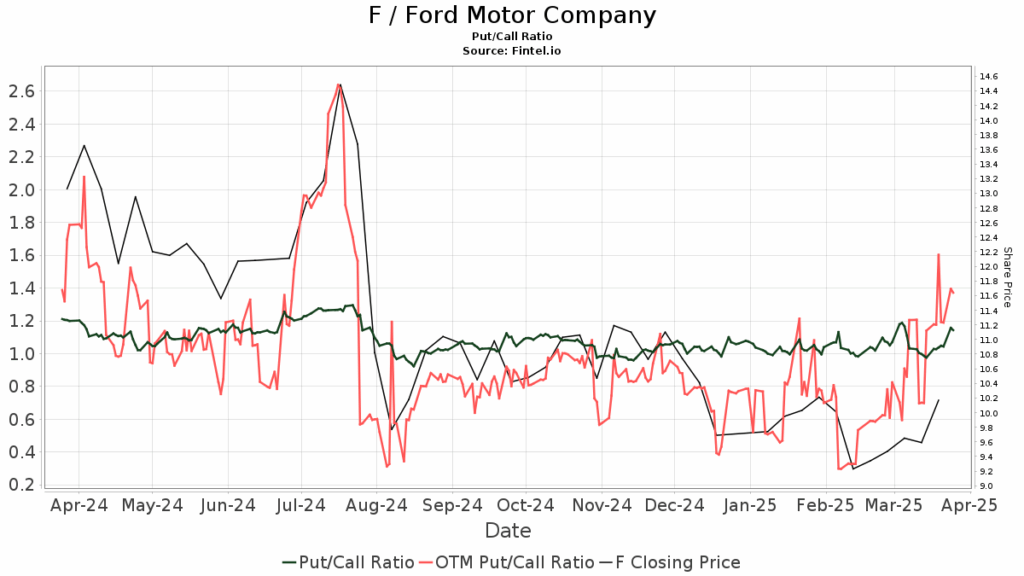

Currently, 2,336 funds or institutions hold positions in Ford Motor, marking an increase of 37 owners, or 1.61%, over the last quarter. The average portfolio weight of all funds in Ford is 0.02%, which has risen by 30.39%. Institutional ownership rose by 6.28% in the past three months, totaling 2,470,821K shares.  The put/call ratio for Ford is 1.00, signaling a bearish outlook.

The put/call ratio for Ford is 1.00, signaling a bearish outlook.

Recent Changes in Institutional Ownership

Newport Trust holds 152,645K shares, which accounts for 3.91% of the company. Previously, the firm reported ownership of 156,134K shares, indicating a decrease of 2.29%. The firm also reduced its allocation in Ford by 8.41% last quarter.

Charles Schwab Investment Management currently has 129,106K shares, representing 3.31% ownership. This is an increase from 122,609K shares reported in the last filing, reflecting a 5.03% uptick. However, their portfolio allocation in Ford decreased by 4.65% over the same period.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) owns 122,373K shares, comprising 3.13% of Ford. Previously, they reported 123,591K shares, marking a decrease of 1.00%, with an 8.52% reduction in their allocation for Ford.

Vanguard 500 Index Fund Investor Shares (VFINX) maintains 105,664K shares, representing 2.71% ownership, up from 102,260K, or an increase of 3.22%. Their allocation in Ford has declined by 8.35% recently.

Schwab U.S. Dividend Equity ETF (SCHD) holds 99,620K shares, representing 2.55% ownership. This marks an increase from 92,100K shares, equating to a 7.55% rise, although their allocation in Ford decreased by 4.09% over the last quarter.

About Ford Motor Company

Ford Motor Company, based in Dearborn, Michigan, designs, manufactures, markets, and services a full line of Ford vehicles, including cars, trucks, SUVs, electrified vehicles, and Lincoln luxury vehicles. The company also offers financial services through Ford Motor Credit Company and is focused on leadership in electrification and mobility solutions, including self-driving and connected services. Ford employs approximately 187,000 people worldwide.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.