Citigroup Downgrades AGCO Outlook from Buy to Neutral

On May 30, 2025, Citigroup revised its outlook for AGCO (BMV:AGCO), changing it from Buy to Neutral.

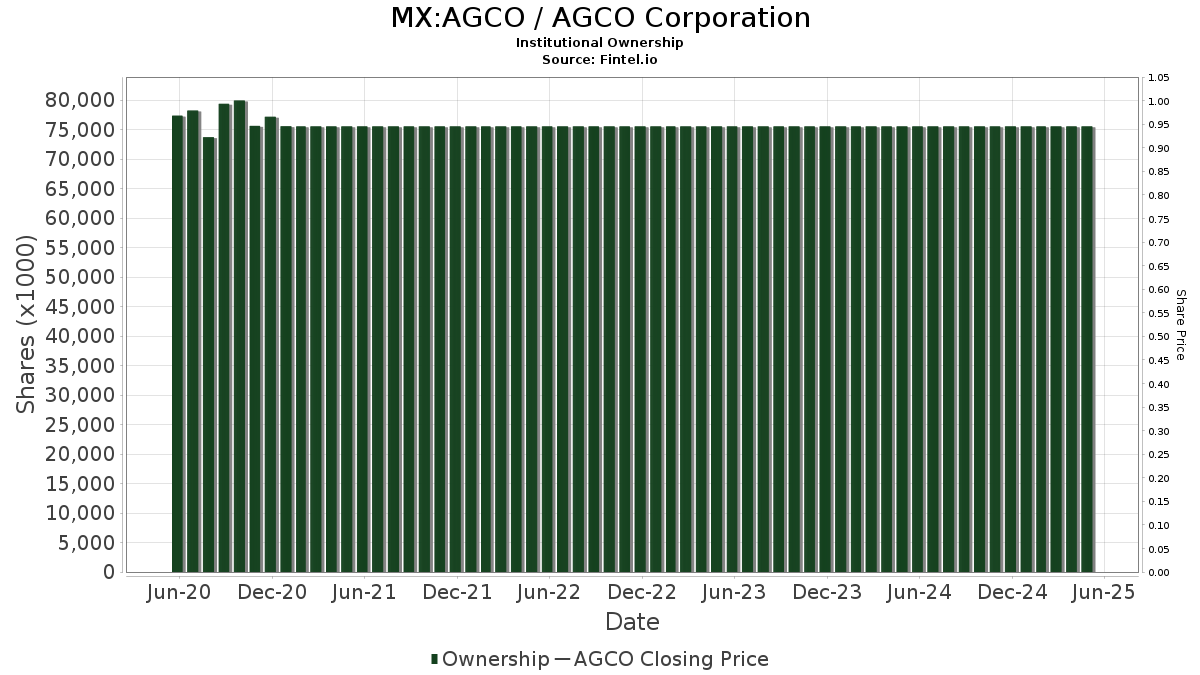

Fund Sentiment Overview

Currently, 852 funds or institutions have reported positions in AGCO. This marks an increase of 40 owners, or 4.93%, compared to last quarter. The average portfolio weight assigned to AGCO among these funds is 0.28%, which is up 24.74%. However, total shares owned by institutions saw a decline of 0.24%, totaling 75,538K shares over the last three months.

Changes in Major Shareholders

Price T Rowe Associates has increased its stake to 6,985K shares, now owning 9.32% of AGCO. This represents a growth from 6,504K shares, a rise of 6.89%. Nevertheless, the firm decreased its portfolio allocation in AGCO by 44.43% last quarter.

Victory Capital Management reported holding 3,331K shares, accounting for 4.44% ownership, down from 3,427K shares—a reduction of 2.87%. The firm also slashed its portfolio allocation in AGCO by 34.85% in the previous quarter.

UBS Asset Management Americas now owns 3,307K shares, equal to 4.41% of AGCO. This is an increase from 2,902K shares, reflecting a rise of 12.25%. However, the firm decreased its portfolio allocation by 83.28% last quarter.

Fuller & Thaler Asset Management holds 2,742K shares, representing 3.66% of the company. This number reflects a minor decrease from 2,744K shares, a change of 0.08%, while increasing its allocation by 1.48% last quarter.

LSV Asset Management owns 2,579K shares, holding 3.44% of AGCO, down from 2,840K shares, marking a decrease of 10.12%. The firm reduced its portfolio allocation by 6.49% in the last quarter.