Citigroup Adjusts KeyCorp’s Outlook from Buy to Neutral

On November 7, 2024, Citigroup unexpectedly changed its rating on KeyCorp (WBAG:KEY) from Buy to Neutral, indicating a shift in market sentiment.

Analyzing Fund Sentiment

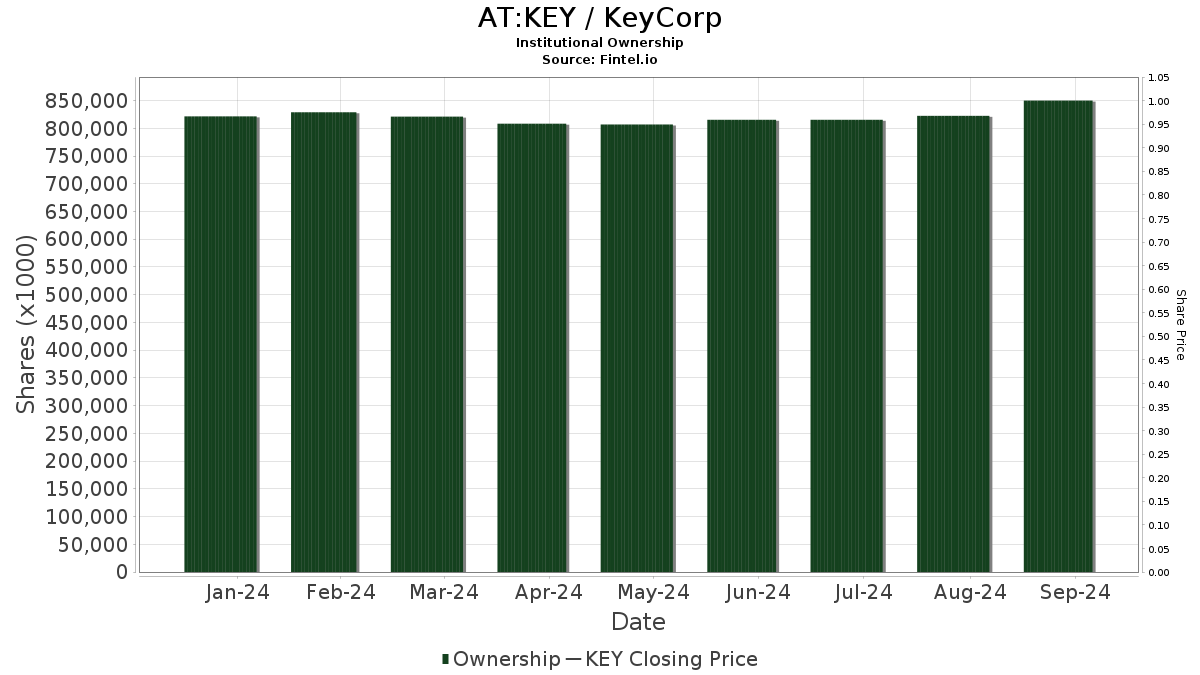

A total of 1,431 funds and institutions have reported holding positions in KeyCorp. This marks an increase of 8 new owners, or 0.56%, in the last quarter. The average portfolio weight of all funds in KeyCorp stands at 0.16%, reflecting a rise of 8.10%. Moreover, institutional ownership has grown by 6.08% over the past three months, now totaling 855,174K shares.

Actions of Other Shareholders

Charles Schwab Investment Management currently owns 30,613K shares, equating to 3.09% of KeyCorp. This is up from 30,271K shares in the previous report, demonstrating a modest increase of 1.11%. However, the firm reduced its portfolio allocation in KeyCorp by 24.99% last quarter.

The Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) holds 29,663K shares, representing 2.99% ownership of KeyCorp. This is an increase from the previous 29,466K shares, reflecting a rise of 0.66%. Like others, the firm also decreased its stake in KeyCorp, with a reduction of 12.01% last quarter.

Fuller & Thaler Asset Management holds 27,522K shares, accounting for 2.78% ownership. The firm increased its holdings from 26,792K shares, marking a gain of 2.65%, although it cut its portfolio allocation by 9.38% over the last quarter.

Vanguard 500 Index Fund Investor Shares (VFINX) owns 24,199K shares, which is 2.44% of the company. This is an increase from 23,602K shares, up by 2.47%, with a portfolio allocation decrease of 12.77% over the past quarter.

The Undiscovered Managers Behavioral Value Fund Class L (UBVLX) reports holding 22,221K shares, constituting 2.24% ownership, up from 21,541K shares—an increase of 3.06%. However, it too has reduced its portfolio allocation in KeyCorp by 7.11% last quarter.

Fintel offers comprehensive investing research tools for individual investors, traders, financial advisors, and small hedge funds.

The platform provides insights into fundamentals, analyst reports, ownership data, fund sentiment, insider trading, and more, using advanced quantitative models to support better investment decisions.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.