Citigroup Downgrades Texas Roadhouse Outlook to Neutral

Fintel reports that on April 23, 2025, Citigroup downgraded its outlook for Texas Roadhouse (BMV:TXRH) from Buy to Neutral.

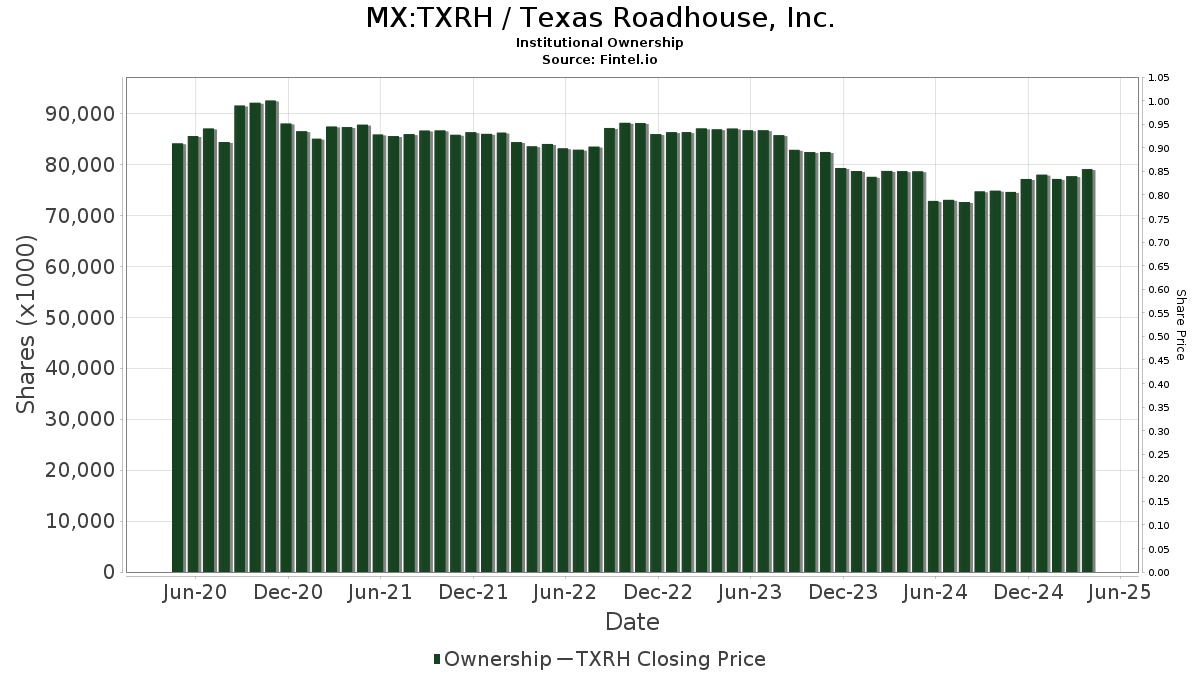

Current Fund Sentiment

Currently, there are 768 funds or institutions reporting positions in Texas Roadhouse. This represents a decrease of 31 owners, or 3.88%, in the last quarter. The average portfolio weight of all funds dedicated to TXRH is 0.26%, which reflects an increase of 12.62%. However, total shares owned by institutions dropped in the last three months by 6.04%, bringing the total to 86,506K shares.

Actions of Other Shareholders

Invesco currently holds 2,479K shares, equating to 3.73% of the company. This is an increase from its previous holding of 2,341K shares, representing an increment of 5.59%. The firm has raised its portfolio allocation in TXRH by 3.63% over the last quarter.

iShares Core S&P Mid-Cap ETF (IJH) owns 2,165K shares, making up 3.26% ownership. The previous filing indicated 2,084K shares, marking an increase of 3.74%. This firm has also lifted its portfolio allocation in TXRH by 1.94% in the last quarter.

Vanguard Total Stock Market Index Fund Investor Shares (VTSMX) has 2,095K shares, or 3.15% ownership. Previously, this fund reported 2,108K shares, which is a slight decrease of 0.62%. They have increased their portfolio allocation in TXRH by 0.06% over the last quarter.

Vanguard Small-Cap Index Fund Investor Shares (NAESX) holds 1,699K shares, representing 2.56% ownership, up from 1,669K shares. This increase of 1.76% demonstrates their growing interest in TXRH, with a portfolio allocation rise of 1.58% over the last quarter.

Neuberger Berman Group maintains 1,687K shares, or 2.54% ownership. An increase from its earlier holding of 1,643K shares translates to an increase of 2.59%. However, this firm has significantly reduced its portfolio allocation in TXRH by 44.48% over the last quarter.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.