Citigroup Backs Parker-Hannifin with Strong Buy Rating Amid Promising Projections

On February 7, 2025, Citi has begun coverage of Parker-Hannifin (XTRA:PAR), issuing a Buy recommendation for the company.

Analyst Forecasts Indicate Potential 7.66% Price Increase

As of January 28, 2025, analysts set the average one-year price target for Parker-Hannifin at 712.69 €/share. Projections vary, with the lowest estimate at 471.96 € and the highest at 837.99 €. This average price target indicates a potential rise of 7.66% from the stock’s latest closing price of 662.00 € per share.

Projected Revenue Growth Shows Positive Momentum

Parker-Hannifin is anticipated to generate annual revenue of 20,951 million euros, reflecting a growth rate of 5.24%. Their expected non-GAAP earnings per share (EPS) is projected at 24.36.

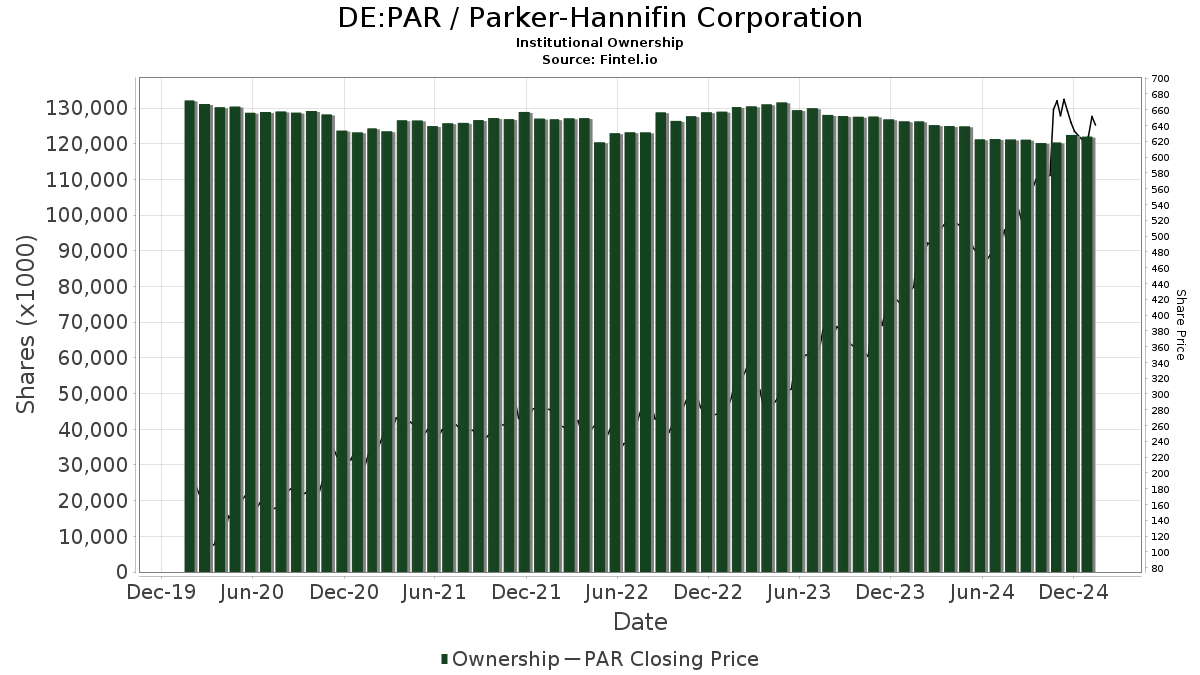

Growing Institutional Interest in Parker-Hannifin

Currently, 2,490 funds or institutions have positions in Parker-Hannifin, an increase of 40 owners (or 1.63%) in the last quarter. The average portfolio allocation for these funds in Parker-Hannifin stands at 0.41%, marked by an increase of 3.59%. The institutional ownership rose by 0.42% in the past three months, totaling 122,640K shares.

Institutional Shareholders Adjust Their Positions

Bank of America holds 4,169K shares, which accounts for 3.24% of the company. This represents a slight increase from their previous ownership of 4,167K shares, reflecting a 0.07% growth. The firm’s allocation in Parker-Hannifin rose by 17.43% this quarter.

Meanwhile, the Vanguard Total Stock Market Index Fund Investor Shares own 4,072K shares, translating to 3.16% ownership. Their prior filing indicated an ownership of 4,063K shares, marking a 0.22% increase and a 17.59% uptick in portfolio allocation.

The Vanguard 500 Index Fund Investor Shares possess 3,366K shares or 2.61% of Parker-Hannifin. Previously, they reported holding 3,300K shares, an increase of 1.98% and a 17.28% rise in allocation. Aristotle Capital Management owns 3,248K shares (2.52% ownership), having slightly reduced their holdings by 1.24%, while still increasing their allocation by 16.14% last quarter.

Geode Capital Management holds 2,578K shares, equating to a 2.00% stake. Their prior filing cited ownership of 2,548K shares, which indicates a 1.14% increase alongside a 16.51% rise in portfolio allocation.

Fintel offers one of the most comprehensive investment research platforms available to individual investors, traders, financial advisors, and small hedge funds. Their extensive data includes fundamentals, analyst reports, ownership insights, fund sentiment, and much more.

Click to Learn More

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.