CJS Securities Upgrades AAON with Strong Outlook and Price Target

Fintel reports that on February 28, 2025, CJS Securities upgraded their outlook for AAON (NasdaqGS:AAON) from Market Perform to Market Outperform.

Analyst Price Forecast Indicates Significant Upside

As of February 19, 2025, the average one-year price target for AAON is $138.72 per share. Predictions vary from a low of $120.19 to a high of $162.75. This average target reflects a potential increase of 80.62% from the most recent closing price of $76.80 per share.

See our leaderboard of companies with the largest price target upside.

Revenue and Earnings Projections

The projected annual revenue for AAON is $1,187 million, indicating a slight decrease of 1.14%. The expected annual non-GAAP EPS stands at 3.78.

Fund Sentiment Analysis

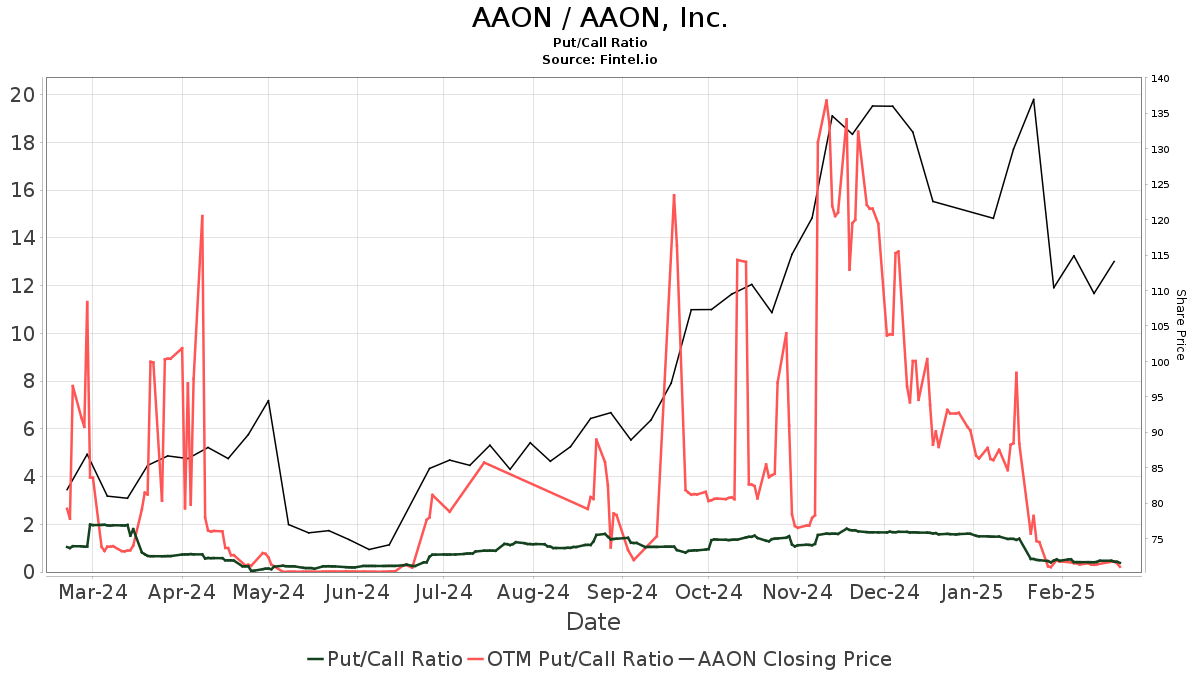

Currently, 859 funds or institutions hold positions in AAON, marking a decline of 17 owners, or 1.94%, from the last quarter. The average portfolio weight of all funds devoted to AAON is 0.33%, which has increased by 2.99%. Total shares owned by institutions fell by 6.61% over the past three months, totaling 77,867K shares.  The put/call ratio for AAON is 0.28, suggesting a bullish sentiment among investors.

The put/call ratio for AAON is 0.28, suggesting a bullish sentiment among investors.

Institutional Shareholder Actions

JPMorgan Chase presently holds 2,984K shares, which represents 3.67% ownership of the company. Previously, the firm reported owning 3,261K shares, reflecting a decrease of 9.26%. They’ve significantly reduced their portfolio allocation in AAON by 82.19% over the last quarter.

Kayne Anderson Rudnick Investment Management owns 2,396K shares, accounting for 2.95% of the company. In their previous filing, they reported 3,493K shares, a decrease of 45.82%. Their overall portfolio allocation to AAON decreased by 48.59% in the last quarter.

Meanwhile, IJH – iShares Core S&P Mid-Cap ETF has increased its stake to 2,190K shares, representing 2.69% ownership, up from 2,102K shares, an increase of 4.01%. They’ve raised their portfolio allocation in AAON by 9.18% over the most recent quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 2,081K shares or 2.56% of the company. Previously, they reported 2,064K shares, marking an increase of 0.82%. Their investment in AAON has increased by 17.06% recently.

Additionally, Invesco has increased their holdings to 2,032K shares, accounting for 2.50% of the company, compared to their prior ownership of 1,758K shares, a rise of 13.49%. However, they have significantly decreased their total portfolio allocation in AAON by 89.08% over the past quarter.

Company Overview

AAON Background Information

(This description is provided by the company.)

AAON, Inc. specializes in engineering, manufacturing, marketing, and selling air conditioning and heating equipment. This includes standard, semi-custom, and custom rooftop units, chillers, packaged outdoor mechanical rooms, air handling units, makeup air units, energy recovery units, condensing units, geothermal/water-source heat pumps, coils, and controls. Since its founding in 1988, AAON has consistently focused on designing and delivering high-performance heating and cooling products that exceed customer expectations.

Fintel is a comprehensive investing research platform catering to individual investors, traders, financial advisors, and small hedge funds.

Our extensive data covers global markets, providing insights on fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, insider trading, options flow, and unusual trades. Furthermore, our exclusive Stock picks utilize advanced, backtested quantitative models to enhance profitability.

Click to Learn More.

This story originally appeared on Fintel.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.