Cleveland-Cliffs (NYSE:CLF) has reported an exceptional performance in the fiscal year 2023 and has provided a robust outlook for the extended fiscal year 2024. Despite flat production guidance for eFY24, the company is expected to benefit from ongoing cost reductions and advancements in its hydrogen-reduced steelmaking process, which is likely to create favorable conditions for its operations and foster continued growth. Based on these developments, I stand by my previous recommendation for CLF with a BUY rating and a price target of $27.65 per share.

Latest Developments in US Steel (X) Merger

The anticipated merger between Nippon (OTCPK:NISTF) and US Steel is currently awaiting antitrust approval. The involvement of a foreign entity in this deal has raised concerns about potential anticompetitive actions and their detrimental impact on the domestic steel market. A complex web of factors, such as historical steel dumping practices, tariffs, and the influence of the USW union, has made the merger a topic of intense speculation in the industry. Given the uncertainties surrounding this development, it is essential for investors to remain vigilant and consider the potential implications for Cleveland-Cliffs’ offer if the deal were to encounter regulatory roadblocks.

This evolving situation requires a cautious approach, and any adjustments to Cleveland-Cliffs’ offer should be carefully evaluated in light of these external factors.

“That transaction is no longer available, it’s no longer a backstop for their failure. If they can’t close — I don’t know where they are at this point — that offer is gone, that offer no longer exists.”

Lourenco Goncalves, CEO

Listening to the q4’23 earnings call, management’s assertive stance on the merger underscores their confidence in the potential benefits that the consolidation could bring. The suspension of coverage ratings by JP Morgan for both Cleveland-Cliffs and US Steel indicates that the prospects of a merger are still viable and could hold promising outcomes for the industry.

Operational Milestones

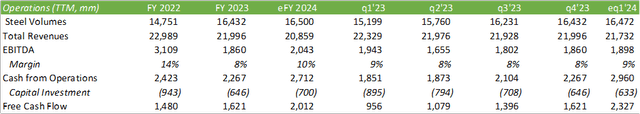

Cleveland-Cliffs achieved record steel shipments totaling 16.4 million tons in the fiscal year 2023. The company’s resilience during the UAW strike and the subsequent surge in service center steel sales, driven by inventory replenishment, has bolstered its position in the market. Notably, the improvement in steel prices contributed to the replenishment of steel inventories at an enhanced value, signifying a positive trend for the company.

Through stringent cost-control measures, the management has realized substantial cost savings of $80 per ton of steel, amounting to an annual run rate of $1.3 billion. This efficiency drive is expected to yield an additional $30 per net ton in cost savings throughout 2024, primarily attributed to strategic supply agreements and optimized natural gas hedges.

Despite the projected slight decrease in revenue for FY24 compared to FY23, Cleveland-Cliffs is anticipated to witness margin expansion and robust free cash flow generation. The company’s enhanced focus on working capital balances and its plans to allocate a significant portion of free cash flow towards debt reduction and share repurchasing should be perceived as favorable indicators for the shareholders.

The company’s strategic initiatives to capitalize on pricing opportunities in the hydrogen-reduced steelmaking process, and its proactive participation in the hydrogen hub development, mark significant strides toward sustainable and innovative operations. Cleveland-Cliffs’ alignment with industry trends and its proactive measures to integrate hydrogen solutions into its production processes further solidify its position as an industry leader.

The Cleveland Cliffs Journey: Steel Breakthrough with Debt Reduction and Share Buybacks

Debt Restructuring

An exhilarating transformation is underway at Cleveland Cliffs, replete with the rousing clang of steel on steel. Revelatory trials at their blast furnace are lighting up the industry, signaling an eruption of potential. The company bolstered this magnetic fervor by deciding to shun debt and shackle their financial burdens. The erstwhile net debt of $4 billion, which squealed heavily in FY22, has evanesced to a lean $2.9 billion. The firm no longer carries any burdensome baggages under their ABL credit facility, snipping $500 million from their net debt since third-quarter 2023.

The transformative shift denotes a seismic departure in Cleveland Cliffs’ fortunes, deftly navigating the crests and troughs of their financial landscape. Their maneuver has orchestrated a move that bushels debt and magnifies liquidity, laying down a compelling exhortation that reverberates beyond the confines of their quarterly reports. With equanimity, they steered away from turbulent waters, drawing forth a net debt reduction strategy that could light up the sky with its financial wizardry.

Valuation & Shareholder Value

The company’s enterprise value of $13 billion now rests on the stout foundation of a 7.10x EV/EBITDA ratio. Cleveland Cliffs has thrown down the gauntlet, entwining their financial resurgence with a vigorous capital allocation plan, one brimming with ambition and promise. The prospect looms large that their commitment to share buybacks may usher in a buoyant era, one ripe with the sweet fruits of shareholder value. The adept juggling act that accommodates a 50/50 allocation for debt reduction and share buybacks sets the stage for a mesmerizing show, where both their balance sheet and investor confidence shall pirouette in tandem.

While the initial ripple of enthusiasm enveloped shareholders post-earnings, the waters may have appeared calm. Yet, an undercurrent of tranquility belies the brewing storm. The company’s audacious ventures beckon towards an eventful horizon, where the sizzling synergy of share repurchases and debt slaying could fan the spark that ignites the furnace of Cleveland Cliffs’ valuation. The unfurling tale of transformation spells out the tantalizing likelihood of a $24 per share valuation, crowned with the blush of a $27.65/share price target, where investors could reap a bountiful harvest.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.