A Noteworthy Dividend Declaration

Climb Global Solutions made waves on February 27, 2024, with the announcement from its board of directors declaring a regular quarterly dividend of $0.17 per share, amounting to $0.68 annualized. This figure remains unaltered from the company’s previous dividend payout of $0.17 per share. To be eligible for this dividend, investors must secure their shares before the ex-dividend date on March 8, 2024. Shareholders as of March 11, 2024, are scheduled to receive this dividend on March 15, 2024.

Reflecting on Historical Dividend Yields

Delving into the past, looking at a five-year span with weekly samplings, Climb Global Solutions flaunts an average dividend yield of 1.53%. While this number stands strong, the spectrum showcases the lowest yield bottoming out at 1.01% and the highest soaring to 2.20%. Crunching the numbers further, the standard deviation of these yields tallies up at 0.29 (n=58). An interesting twist lies in the fact that the current dividend yield trails 1.80 standard deviations below this historical average.

Analyzing the Dividend Payout Ratio

Steering towards the company’s dividend payout ratio, which looms at 0.24, gives us insight into the proportion of Climb Global Solutions’ income distributed as dividends. A ratio of 1.0 signifies a full 100% payout of the company’s earnings as dividends, with anything above indicating a dip into savings to sustain dividends—a precarious scenario. Firms with limited growth prospects often channel the bulk of their income into dividends, translating to a payout ratio of 0.5 to 1.0. Conversely, companies eyeing growth are prone to holding back earnings to nurture prospects, reflecting in a payout ratio of zero to 0.5. On an additional note, Climb Global Solutions has maintained a static dividend over the past three years.

Analyst Projections Spell Downside

Focusing on analyst forecasts as of February 24, 2024, the one-year average price target for Climb Global Solutions stands at $48.96, echoing an estimated downward slide of 26.83% from the recent closing price of $66.91. This indicates a cautious outlook. Moving forward, the company’s projected annual revenue is poised to reach $357 million, marking a slight increase of 1.39%. Similarly, the projected annual non-GAAP EPS is projected to settle at 4.22.

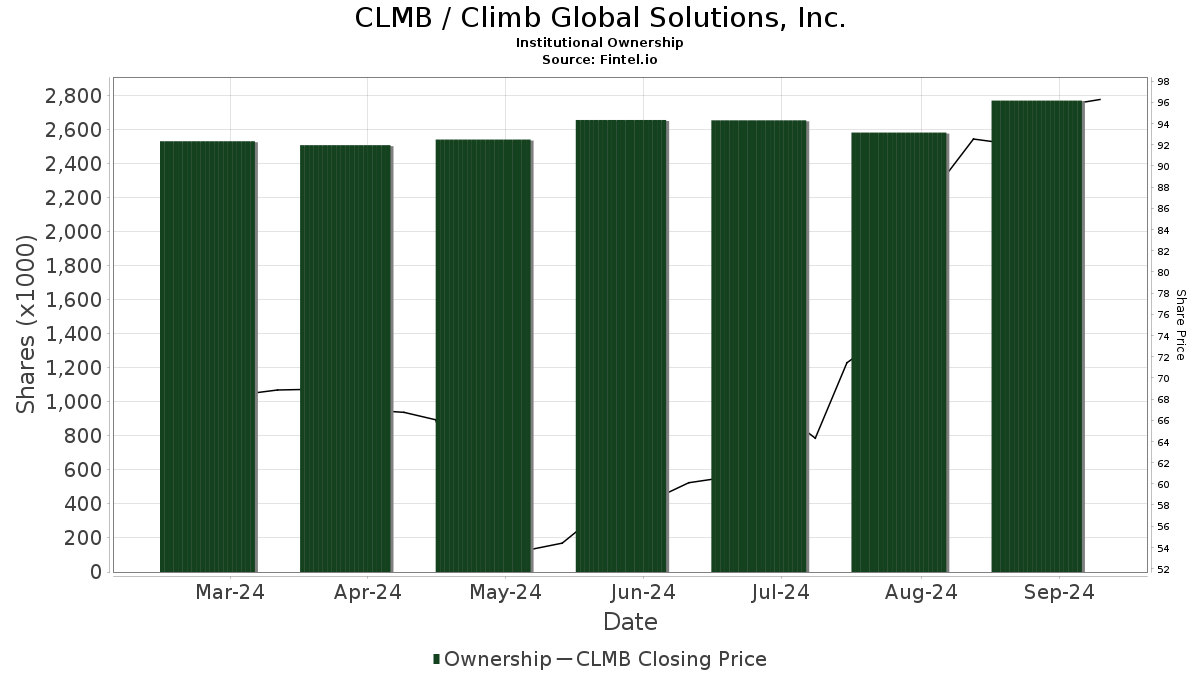

Insight into Shareholder Activity

Zooming into shareholder activities, various prominent entities within the investing realm have made notable shifts in their Climb Global Solutions holdings. Cove Street Capital exhibits a reduction in its share count by 4.15%, accompanied by a significant decrease of 27.98% in its CLMB portfolio allocation over the preceding quarter. On the flip side, Renaissance Technologies showcases a reduction in shares by 5.27% but, conversely, propelled its portfolio allocation in CLMB with a 9.94% rise over the same period. Punch & Associates Investment Management and Tieton Capital Management also displayed fluctuations, alongside VTSMX – Vanguard Total Stock Market Index Fund Investor Shares which demonstrated an increase in its CLMB portfolio allocation by 16.96% over the last quarter.

Peek into Climb Global Solutions’ Backdrop

Providing a brief backdrop on Climb Global Solutions, the company operates as a cloud-based, value-added IT distribution and solutions entity, zeroing in on emerging technologies. Its operations span across the US, Canada, and Europe through multiple distinct business units, such as Climb Channel Solutions, Sigma, Grey Matter, Interwork, and TechXtend. Focused niches include Security, Data Management, Cloud, Connectivity, Storage & HCI, Virtualization, and Software & ALM industries.

For further reading:

- Read more about Climb Global Solutions’ recent Fourth Quarter and Full Year 2023 results showcasing record highs in various areas.

- Insight into the company’s Third Quarter 2023 results highlighting consistent profitability improvements.

- Delve into the Share Purchase Agreement from October 6, 2023, outlining key transactions within Climb Global Solutions.

Fintel stands as a premier investing research platform, catering to individual investors, traders, financial advisors, and small hedge funds. Offering diverse datasets worldwide, including fundamentals, analyst reports, ownership data and fund sentiment, Fintel remains a go-to hub for potent investment insights. Their exclusive stock picks, powered by refined quantitative models, pave the way for enhanced profitability.

Take the leap and Click to Learn More about Fintel, your gateway to insightful investment analysis. This article was originally penned on Fintel, offering a dedicated space for robust financial discourse.

Kindly note that the opinions and viewpoints expressed here reflect those of the author and may not align with those of Nasdaq, Inc.