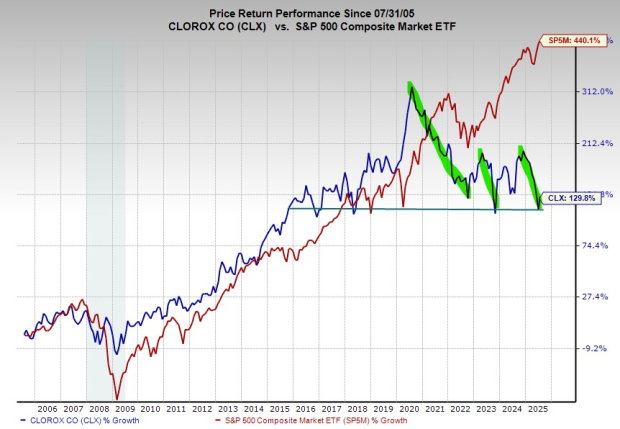

The Clorox Company (CLX) has experienced a significant decline in stock value, dropping approximately 45% over the past five years, including a 20% decrease in 2025. The company, renowned for its cleaning products, has seen its earnings outlook diminish, with revenue expected to dip in fiscal years 2025 and 2026.

As of its most recent earnings report for Q3 FY25, which ended on March 31, Clorox missed estimates by 8% and received a Zacks Rank #5 (Strong Sell). The company’s CEO, Linda Rendle, attributed the slowdowns in sales to heightened macroeconomic uncertainties and evolutionary shopping behaviors. Clorox projections indicate a potential 19% drop in Q1 FY26 earnings year-over-year and an overall decline of more than 8% for full year 2026.

Despite an anticipated adjusted earnings increase of 15% in FY25, Clorox’s stock remains near 10-year lows as investors await the Q4 FY25 results, scheduled for release on July 31.