Cloud Giants Race Ahead: A Closer Look at Amazon, Microsoft, and Alphabet

As cloud computing continues to reshape the digital world, major players like Microsoft (MSFT), Amazon (AMZN), and Alphabet (GOOGL) lead the charge with their cloud services—Azure, AWS, and Google Cloud. These tech giants are heavily investing in AI, data storage, and innovative technologies, all aimed at grabbing more business and expanding their market share. Currently, Amazon tops the cloud market with 31%, followed by Microsoft at 20% and Alphabet at 12%.

A report from Synergy Research Group highlights that in the third quarter of 2024, global spending on cloud infrastructure increased by $15.7 billion, or 23%, from the previous year, totaling over $84 billion for the quarter ending September 30. For the past year, cloud infrastructure revenue reached $313 billion, showcasing fierce competition in this evolving sector. Notably, this growth is accelerating, marking the fourth straight quarter of year-over-year gains.

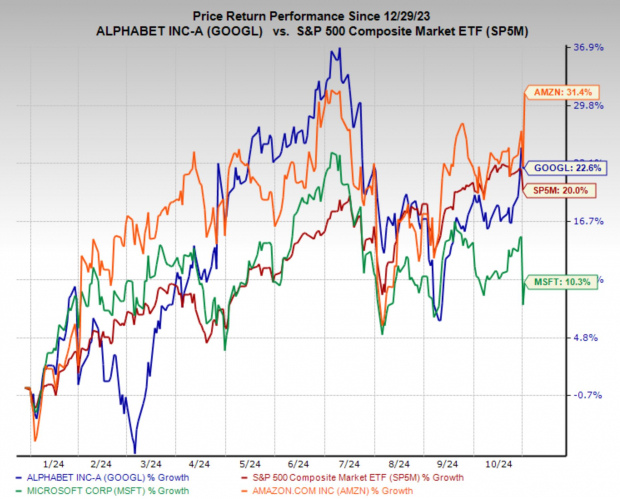

This week, the financial results of all three companies came under the spotlight. Both Amazon and Alphabet received positive responses from the market, while Microsoft experienced some declines following its earnings call. Despite this, all three companies exceeded sales and earnings estimates. Year-to-date (YTD), Amazon has outperformed the market, Alphabet’s performance has been on par, whereas Microsoft has lagged behind.

Image Source: Zacks Investment Research

Earnings Insights for AMZN, GOOGL, and MSFT

While Amazon, Alphabet, and Microsoft have all made progress in cloud computing, their earnings revisions and growth outlooks differ. Currently, Amazon and Microsoft both hold a Zacks Rank #3 (Hold), reflecting a stable earnings revision trend. Conversely, Alphabet boasts a Zacks Rank #2 (Buy), indicating a more optimistic outlook backed by recent upward adjustments to its earnings estimates.

When considering long-term earnings projections, Amazon shines with an anticipated growth rate of 27.2% over the next three to five years, primarily due to AWS. Alphabet is expected to grow at 17.6% per annum, driven by its cloud services, YouTube, and innovations in self-driving technology through Waymo. Microsoft, with a projected annual growth rate of 14.7%, continues to make steady gains in both cloud services and software, particularly with Azure and Office 365.

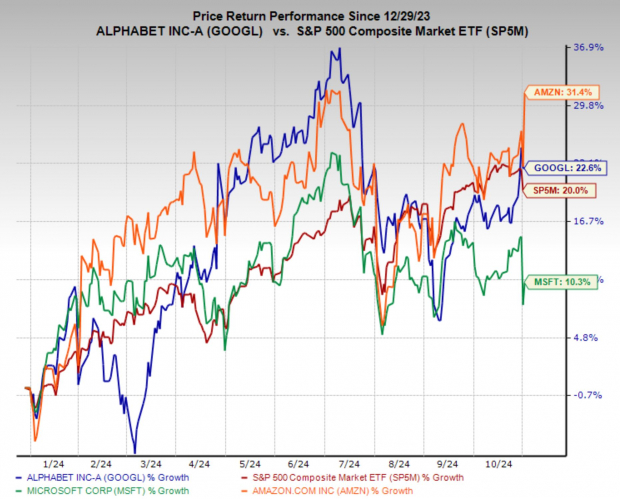

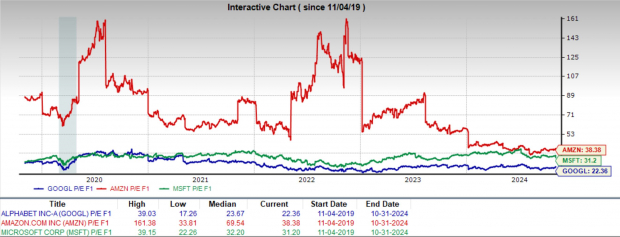

Investigating their valuations reveals important perspectives for investors. Today, Alphabet trades at a forward earnings multiple of 22.4x, which is under its 10-year median of 25.8x. Amazon’s multiple is at 38.4x, below its 10-year median of 92.4x, while Microsoft sits at 31.2x, exceeding its 10-year median of 26.5x.

Image Source: Zacks Investment Research

Investing Choices: AMZN, GOOGL, or MSFT?

For those exploring the best investment options, GOOGL and AMZN emerge as the most appealing among cloud leaders. Both companies not only reflect strong earnings growth forecasts—with Amazon leading the pack—but also present attractive valuations compared to Microsoft in light of growth expectations and historical comparisons.

Alphabet’s recent achievements in the cloud and its ongoing investments in AI and self-driving cars suggest promising potential. Its forward price-to-earnings ratio remains inviting relative to its growth outlook. Similarly, Amazon’s growth prospects are strengthened by its dominant e-commerce position and the expansion of AWS, which continues to lead the cloud infrastructure market. Its valuation appears favorable, especially when weighed against its growth rate and historical averages, making it an attractive choice for long-term investors.

In comparison, Microsoft’s heavy investment in AI and advanced technologies—while likely to drive future growth—has raised concerns about short-term returns. Although Microsoft remains a key player in cloud services and AI, its current elevated costs may make it less appealing to potential investors.

In summary, Alphabet and Amazon present a blend of solid growth forecasts and favorable valuations, positioning them as prime choices for investors looking for growth at a reasonable price.

Zacks’ Research Chief Names “Stock Most Likely to Double”

Our team of experts has just released the 5 stocks with the greatest probability of gaining +100% or more in the coming months. Of those 5, Director of Research Sheraz Mian highlights the one stock set to climb highest.

This top pick is among the most innovative financial firms. With a fast-growing customer base (already 50+ million) and a diverse set of cutting-edge solutions, this stock is poised for big gains. Of course, all our elite picks aren’t guaranteed winners, but this one could far surpass earlier Zacks’ Stocks Set to Double, like Nano-X Imaging which surged +129.6% in just over 9 months.

Free: See Our Top Stock And 4 Runners Up

Want the latest recommendations from Zacks Investment Research? Today, you can download 5 Stocks Set to Double. Click to get this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

Microsoft Corporation (MSFT): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.