Newmont Faces Challenges as CLSA Issues Underperform Rating

Overview of Fund Sentiment Towards Newmont

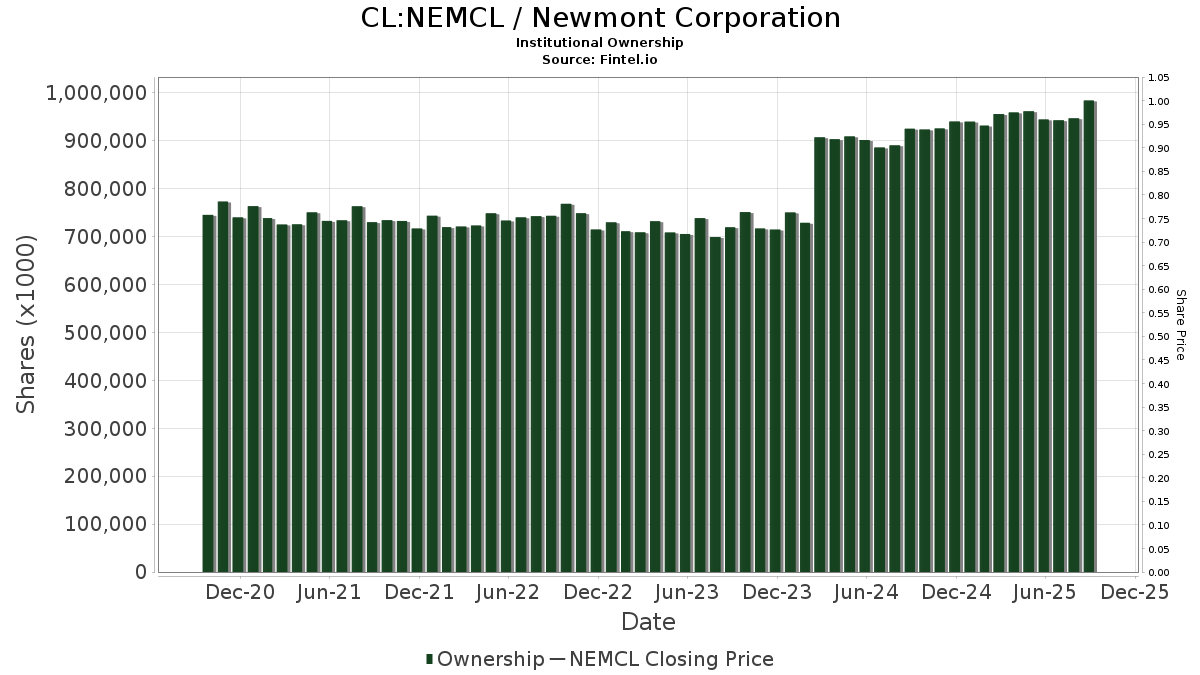

On November 29, 2024, CLSA began covering Newmont (SNSE:NEMCL) with an Underperform recommendation. Currently, 1,973 funds and institutions hold positions in Newmont, an increase of 106, or 5.68%, from the previous quarter. The average portfolio weight for all funds in NEMCL is 0.46%, which has risen by 9.42%. However, total institutional shares owned have decreased by 1.03% in the last three months, bringing the total to 939,995K shares.

Recent Activity Among Major Shareholders

BlackRock currently holds 120,301K shares, which constitutes 10.61% ownership of Newmont. This reflects a modest increase from their previous holding of 119,251K shares, representing a growth of 0.87%. Over the last quarter, BlackRock escalated its portfolio allocation in NEMCL by 19.44%.

Conversely, Van Eck Associates holds 48,950K shares, making up 4.32% of the company. In earlier reports, they noted 50,918K shares, leading to a decrease of 4.02%. Despite this reduction, they raised their portfolio allocation in NEMCL by 4.77% in the last quarter.

The VanEck Vectors Gold Miners ETF (GDX) has 41,436K shares, representing 3.66% ownership. This is down from a previous allocation of 43,624K shares, a drop of 5.28%. However, the fund increased its portfolio allocation by 4.41% over the past quarter.

Vanguard’s Total Stock Market Index Fund (VTSMX) owns 36,545K shares, or 3.22% of Newmont. This shows a small increase from their last reported 36,485K shares, amounting to a rise of 0.16%, with a 20.10% increase in portfolio allocation in NEMCL noted last quarter.

Finally, the Vanguard 500 Index Fund (VFINX) holds 30,052K shares, accounting for 2.65% ownership. This is up from 29,595K shares, reflecting an increase of 1.52% and a 19.29% boost in their portfolio allocation for NEMCL last quarter.

Fintel is an extensive investment research platform available to individual investors, traders, financial advisors, and small hedge funds. Our comprehensive data includes fundamentals, analyst reports, ownership data, fund sentiment, options sentiment, and insider trading trends, among other vital information. Our exclusive stock picks leverage advanced, backtested quantitative models for enhanced profitability.

This article was originally published on Fintel.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.