New Outlook: Decreased Price Target for CM Hospitalar S

After the recent revision, the one-year price target for CM Hospitalar S (BOVESPA:VVEO3) has taken a hit, now standing at 22.08 per share. This represents a notable drop of 14.60% from the previous forecast of 25.86, marked on January 16, 2024.

Analysts’ Insights on Price Targets

This price target is an aggregate of numerous estimations put forth by market analysts. The most recent projections vary widely, spanning from a low of 9.60 to a high of 33.60 per share. The average price target signifies a significant surge of 170.29% from the last reported closing price of 8.17 per share.

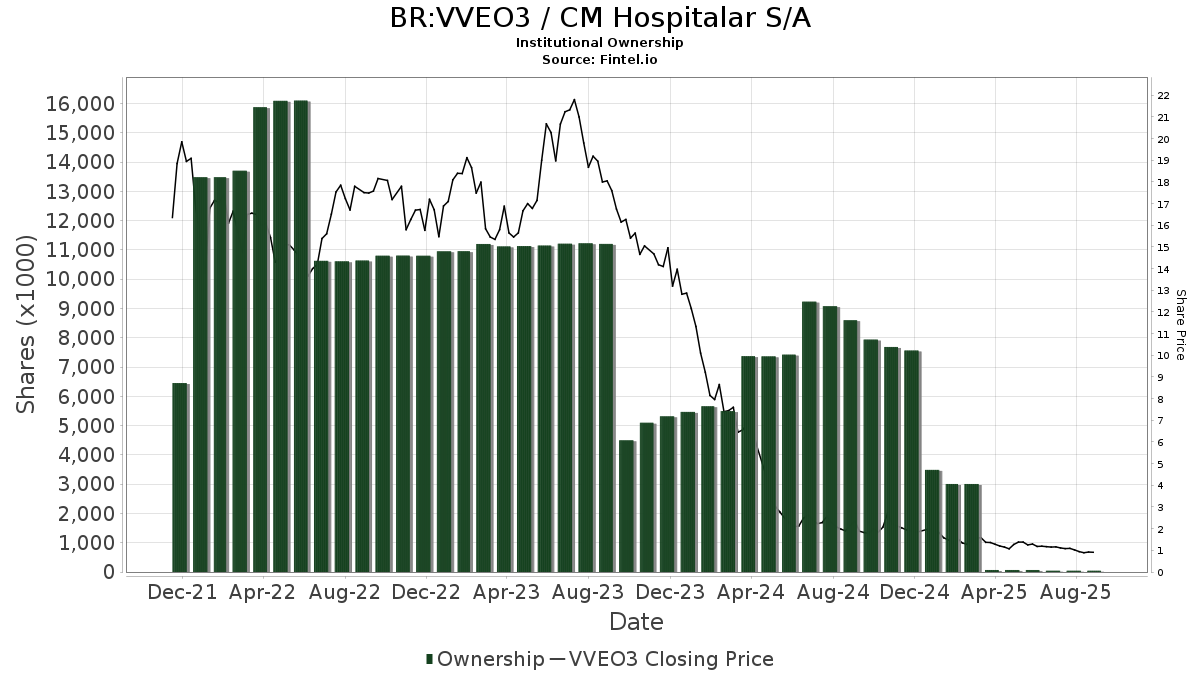

Fund Sentiment in Focus

The all-important question lingers – how are the funds positioned? As per the latest data, there are currently 20 funds or institutions holding positions in CM Hospitalar S. This showcases a recent uptick, with 1 additional owner or a 5.26% rise in the last quarter. The average portfolio weight across all funds dedicated to VVEO3 has settled at 0.20%, marking an uptrend of 18.66%. Moreover, the total shares owned by institutions have also seen an upswing over the past three months, climbing by 11.07% to reach 5,661K shares.

Detailed Look at Shareholders’ Movements

Delving into the specifics, let’s analyze what some other shareholders are up to. VEIEX – Vanguard Emerging Markets Stock Index Fund Investor Shares continues to hold 1,300K shares, representing 0.41% ownership of the company, with no alterations in the previous quarter.

Similarly, FLATX – Fidelity Latin America Fund maintains its position with 1,282K shares, translating to 0.40% ownership of the company, reflecting stability over the last quarter. On the flip side, VGTSX – Vanguard Total International Stock Index Fund Investor Shares increased its stake by 8.92%, now owning 1,060K shares, representing 0.33% ownership. The firm reduced its portfolio allocation in VVEO3 by 19.71% during the last quarter.

Furthermore, EWZS – iShares MSCI Brazil Small-Cap ETF also saw an increase in its shareholding, with 691K shares owned, up by 13.94% from 595K shares. However, this was accompanied by a portfolio allocation decrease of 29.36%. Another player, VFSNX – Vanguard FTSE All-World ex-US Small-Cap Index Fund Institutional Shares, recorded an upward trajectory, standing at 356K shares, a growth of 15.83% from the prior quarter. This move was coupled with a 5.48% drop in portfolio allocation in VVEO3.

Fintel stands proud as an encompassing research hub for individual investors, traders, financial advisors, and small hedge funds. With a worldwide scope, our data encompasses fundamentals, analyst reports, ownership data, and fund sentiment, among others.

Feast on our repository, rich with options sentiment, insider trading details, options flow, unusual options trades, and beyond. Moreover, be privy to our exclusive stock picks driven by advanced quantitative models, meticulously backtested for amplified returns.

Curious to unravel more? Click to Learn More, and dive deep into the wealth of insights offered. Remember, this narrative unfolded first on Fintel.

The expressions and viewpoints articulated herein solely reflect those of the author and do not necessarily align with the stance of Nasdaq, Inc.