A Beacon of Growth: Analysts Raise Average Price Target

With a surge like never before, CMC Markets (LSE:CMCX) witnesses a meteoric rise in its average one-year price target, now standing tall at 153.51 / share. The remarkable increment of 41.31% from the prior estimate of 108.63, dated January 16, 2024, reflects a newfound optimism among analysts. The latest targets portray a diverse range, from a low of 64.64 to a high of 210.00 / share. Despite this exhilarating journey, this breathtaking ascent still represents a decrease of 7.86% from the most recent closing price of 166.60 / share.

Diving into Dividends: Steady at 2.94%

At present, CMC Markets boasts a resilient dividend yield of 2.94%. Delving deeper, the dividend payout ratio stands at 1.35, offering a glimpse into the company’s financial ethos. A payout ratio below one signifies a sustainable dividend payment, while a figure exceeding one indicates a potentially risky scenario. Companies treading the path of growth often choose to reinvest earnings, leading to a lower payout ratio. In contrast, those focusing on stability lean towards higher ratios. Interestingly, the company’s 3-Year dividend growth rate indicates a slight decline at -0.67%.

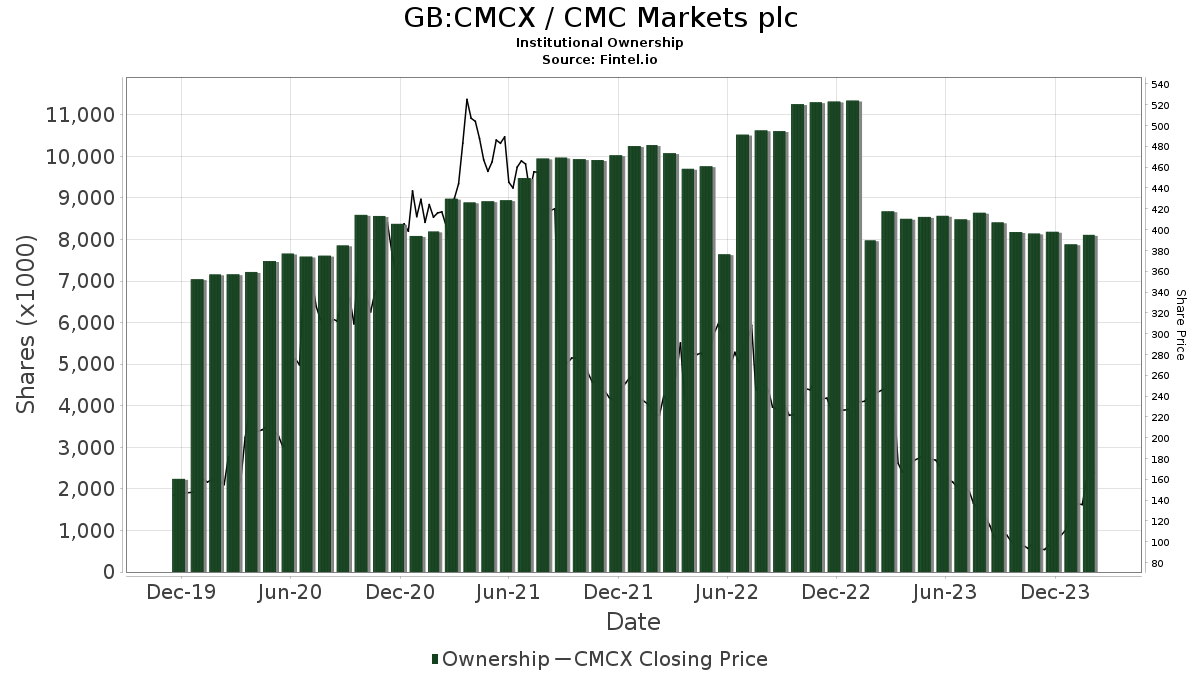

The Pulse of the Market: Tracking Fund Sentiment

Amidst the whirlwind of change, 44 funds or institutions maintain positions in CMC Markets, marking a consistent figure from the last quarter. The average portfolio weight, a mere 0.02%, has seen a decline of 28.16%. Concurrently, institutions’ total shares have decreased by 0.40% in the last three months, amounting to 8,110K shares.

Insights into Shareholder Movements

Among significant stakeholders, VGTSX – Vanguard Total International Stock Index Fund Investor Shares stands strong with 1,666K shares, reflecting 0.60% ownership and no changes in the last quarter. AVDV – Avantis International Small Cap Value ETF has notably increased its ownership by 24.44%, now holding 847K shares, representing 0.30% ownership. Equally remarkable, VTMGX – Vanguard Developed Markets Index Fund Admiral Shares experienced a slight increase of 0.60%, with a holding of 815K shares constituting 0.29% ownership. Lastly, Dfa Investment Trust Co – The United Kingdom Small Company Series witnessed a decrease in ownership by 24.56%, currently holding 775K shares amounting to 0.28% ownership.

Fintel, a beacon of financial insights, dedication, and information, illuminates the path to informed investing decisions. As a valued platform for investors, traders, advisors, and hedge funds alike, Fintel offers a comprehensive array of data encompassing fundamentals, analyst reports, ownership insights, fund sentiment, and much more. With exclusive stock picks backed by rigorous quantitative models, Fintel stands at the forefront of empowering financial decisions.

Discover more on how to elevate your investment game with Fintel’s cutting-edge resources.

This article was originally published on Fintel.

The views and opinions expressed here are those of the author and may differ from those associated with Nasdaq, Inc.