CME Group Reports Strong Q1 Earnings with Rising Revenues

CME Group (CME) announced an operating income of $2.80 per share for the first quarter of 2025, surpassing the Zacks Consensus Estimate by 0.4%. This reflects a 12% increase year-over-year. Improved revenues fueled the quarterly results, primarily due to higher clearing and transaction fees, alongside market data and information services fees. Elevated market volatility also contributed to increased trading volumes.

Detailed Performance Insights

For the quarter, CME Group reported revenues of $1.6 billion, representing a 10.4% rise compared to the prior year. The increase was primarily driven by a 10.6% growth in clearing and transaction fees, a 10.9% rise in market data and information services, and an increase of 6.7% in other revenue streams. However, this revenue figure fell short of the Zacks Consensus Estimate by 0.5%.

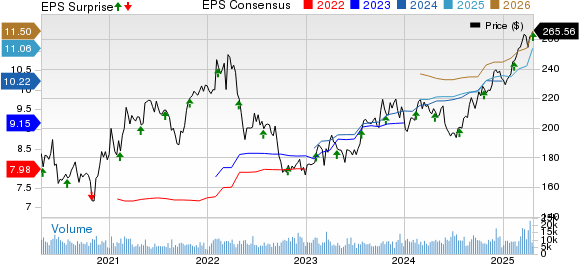

CME Group Inc. Price, Consensus and EPS Surprise

CME Group Inc. price-consensus-eps-surprise-chart

| CME Group Inc. Quote

Total expenses rose 1.1% year-over-year to $534.3 million, mainly due to increased compensation and benefits, technology, and licensing fees. This figure exceeded our estimate of $492.4 million.

Operating income increased by 15.5% from the previous year to $1.1 billion, surpassing our estimate of $1 billion.

In light of heightened economic uncertainty, the average daily volume (ADV) reached a record 29.8 million contracts. volumes in commodities increased by 19%, financials by 12%, while ADV outside the United States hit a record of 8.8 million contracts, marking a 19% increase year-over-year. The total average rate per contract settled at 68.6 cents.

Financial Overview

As of March 31, 2025, CME Group held $1.5 billion in cash and marketable securities, a decline of 49.5% from the end of 2024.

Long-term debt stood at $3.4 billion as of March 31, 2025, reflecting a 27.7% increase from the previous year.

Shareholders’ equity amounted to $26.5 billion, a 2% rise from the end of 2024.

Capital Distribution

CME Group declared dividends of $2.6 billion in the first quarter of 2025. Since adopting its variable dividend policy in early 2012, the company has returned over $28.6 billion to its shareholders.

Zacks Rank Update

CME presently holds a Zacks Rank #1 (Strong Buy). For more details, you can view the full list of today’s Zacks #1 Rank stocks here.

Upcoming Earnings Reports

Nasdaq (NDAQ) will release its first-quarter 2025 earnings on April 24, prior to market opening. The Zacks Consensus Estimate predicts earnings per share of 77 cents, indicating a 22.2% rise from the previous year’s figures. Nasdaq has beaten earnings estimates in three of its last four quarters, missing only once.

Intercontinental Exchange (ICE) is set to report its first-quarter 2025 results on May 1, before the market opens. The Zacks Consensus Estimate expects earnings per share of $1.70, a 14.9% increase from the same quarter last year. ICE has exceeded earnings expectations in two of the last four quarters while meeting estimates in two.

Cboe Global Markets (CBOE) will announce its first-quarter 2025 results on May 2, before the market opens. The Zacks Consensus Estimate anticipates earnings per share of $2.29, representing a 6.5% increase from the year-ago quarter’s reported figure. CBOE has beaten estimates in three of the last four quarters, with one miss.

Investment Opportunities

Recently released: Financial experts have highlighted seven exceptional stocks from the current list of 220 Zacks Rank #1 Strong Buys. They believe these stocks have the potential for significant early price increases.

Since 1988, the full list has consistently outperformed the market, boasting an average gain of +23.9% per year. These handpicked stocks deserve your immediate attention.

Intercontinental Exchange Inc. (ICE): Free Stock Analysis Report

CME Group Inc. (CME): Free Stock Analysis Report

Nasdaq, Inc. (NDAQ): Free Stock Analysis Report

Cboe Global Markets, Inc. (CBOE): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.