The Coca-Cola Company (NYSE:KO) investors eagerly await February each year as historically, the company’s annual dividend increases have been announced on the third Thursday of the month. For me, personally, this anticipation encompasses not only the thrill of potentially increased returns but also the opportunity to set expectations within the Seeking Alpha community, evident from prior articles.

It is now time to delve into the intricacies of the highly probable 62nd consecutive dividend increase expected in the coming weeks.

Anticipating the Dividend Increase

Coca-Cola is likely to declare its 62nd consecutive dividend increase on February 15th, 2024. This announcement speaks volumes about Coca-Cola’s stability and predictability. Traditionally, the company tends to unveil its annual dividend increase on the third Thursday of February.

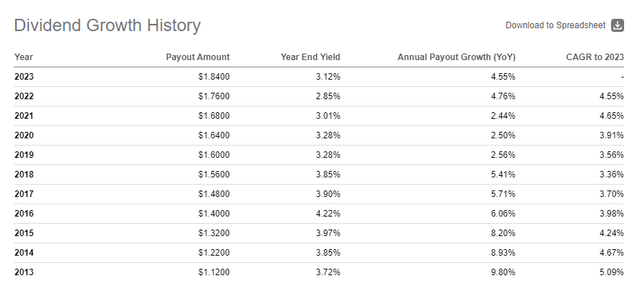

In 2023, the dividend increase was approximately 4.50%. Despite paling in comparison to inflation, this marked the second consecutive year of a 4%+ increase, signaling a positive trend.

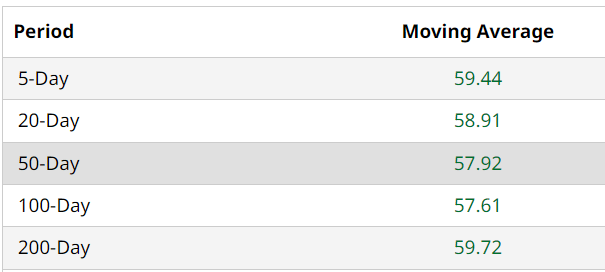

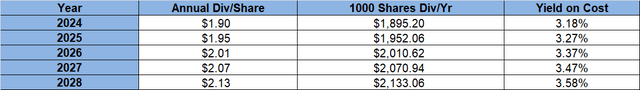

Previously, modest assumptions of 2% to 3% annual dividend growth rates were utilized. However, recent pleasant surprises from Coca-Cola, including a 5% increase in 2022 and a 4.50% increase in 2023, have enhanced the projected returns. A potential 3% increase per year could elevate the yield on cost to almost 3.60% for current buyers at $59.65, presenting a more favorable outlook compared to previous evaluations.

Coca-Cola has historically rarely yielded over 4%, with the “base” yield typically ranging between 3.30% and 3.50%, attracting numerous buyers. The escalating dividends, even if diminishing, tend to elevate the stock’s floor price. Yet, the question lingers: does Coca-Cola possess the capability to exceed the presumed 3% DGR and sustain a 5% increase?

- The current outstanding share count stands at 4.323 Billion, similar to the previous year.

- A 5% dividend increase next month would equate to a quarterly dividend of 48.3 cents per share.

- This elevation would represent a commitment of $2.08 Billion/quarter towards dividends (4.325 Billion shares times 48.3 cents).

- Coca-Cola’s free cash flow[FCF], on paper, should not worry investors. However, scrutiny is imperative.

- The current average quarterly FCF is $2.54 billion, slightly higher than the $2.50 billion last year, resulting in a payout ratio of nearly 82% ($2.08 billion divided by $2.54 billion). Utilizing the five-year average quarterly FCF of $2.411 billion, the payout ratio nears 87%, raising concerns.

- Projected new quarterly dividend of 48.3 cents per share, based on forward earnings per share projections of $2.68, would indicate a 72% payout ratio, exhibiting improvement from previous periods.

- In summary, while the payout ratio based on EPS appears favorable, the progressively deteriorating ratio based on FCF raises apprehension. Consequently, an estimate suggests another sub 5% dividend increase, aligning with the recent pattern. The prediction stands at a new quarterly dividend of 48 cents or $1.92 annualized, offering marginal relief in the payout ratios given the 2023 increase.

Additional Insights and Conclusion

Although Coca-Cola underperformed significantly in 2023, the stock currently exchanges at a rich premium of 22 times forward earnings. While advocating against selling the stock, it does not manifest an outright buy rating. The recommendation remains a hold rating, coupled with the strategic reinvestment of dividends, while eagerly awaiting the impending milestone.

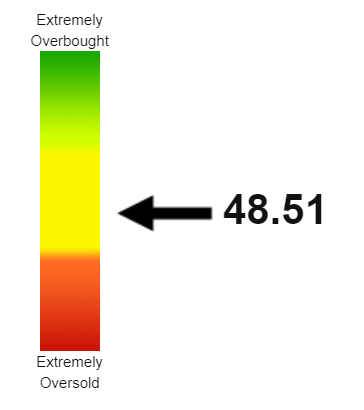

The stock recently surpassed prevailing moving averages and remains closer to oversold levels than being overbought. This aspect bodes well preceding the forthcoming earnings report, underpinning fairly subdued expectations. As 2024 unfolds and amidst the faltering commencement of big tech, Coca-Cola’s enviable position might appeal to investors seeking stability post last year’s volatile tech stock surge. These initial indicators might augur a more favorable year for Coca-Cola stocks compared to the previous year.

However, certainties remain elusive. Although, one near certainty prevails – the impending dividend increase in February. Await the outcome with bated breath!