Coca-Cola’s Strong First Quarter Signals Long-Term Investment Potential

Coca-Cola (NYSE: KO) remains a prominent name in the beverage industry, yet some investors overlook its value as a long-term investment. The company consistently outperforms its competitors due to its strong brand, effective marketing, and exceptional global distribution network.

In late April, Coca-Cola reported its first-quarter operating results, showcasing robust performance during challenging market conditions. Here’s why this update underscores the company’s potential as a compelling buy right now.

Resilience Amid Challenges

The business landscape has been difficult, especially in major markets like the U.S. and Latin America, where demand for Coca-Cola products was subdued. Nevertheless, the company’s global reach resulted in positive outcomes, with total sales volumes rising by 2% and organic revenue increasing by 6%. These results align with management’s long-term objectives, even as economic growth rates slow and geopolitical challenges persist.

Market share also expanded in the ready-to-drink beverage sector. CEO James Quincey highlighted that this performance illustrates the effectiveness of their all-weather strategy. Such stability becomes particularly valuable for investors during periods of market volatility.

Financial Performance Insights

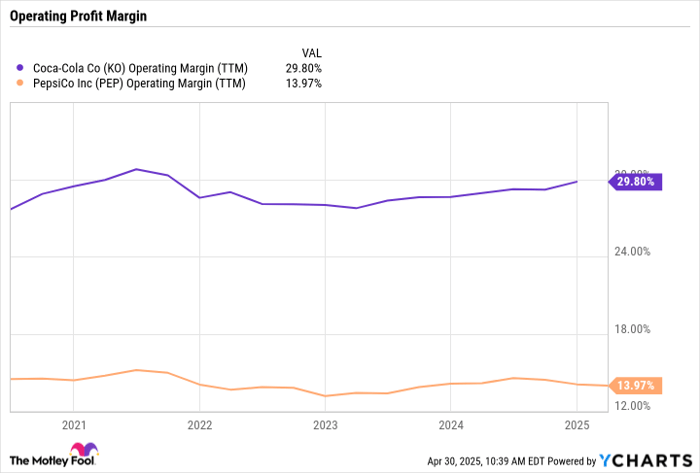

Coca-Cola’s financial results were strong as well, with year-over-year cash flow increases and profit margins expanding. Earnings per share (EPS) rose by 1%, despite a five-percentage-point headwind due to currency exchange rate fluctuations. The company’s operating profitability now stands at 30% of sales—more than double that of its key rival, PepsiCo (NASDAQ: PEP).

KO Operating Margin (TTM) data by YCharts.

These financial resources enable management to invest in growth areas, such as expanding into energy drinks, health drinks, and sparkling waters. The launch of new products under the Simply brand and the expansion of Fuze Tea into additional markets are recent successes, bringing the total number of billion-dollar brands under Coca-Cola to over 30.

Future Growth Prospects

Coca-Cola aims for continued growth leading into 2025, remaining on track to meet management’s targets despite a slow start in key markets. The company expects organic sales growth of 5% to 6%, while EPS may see a rise of 2% to 3%, influenced by unfavorable currency exchange rates. With a dividend yield nearing 3% and a history of increasing dividends for over 60 years, Coca-Cola appears poised for stable yet meaningful returns in 2025.

While investors may find faster growth in other sectors, Coca-Cola presents a solid mix of stable sales, expanding profits, and relatively low risk of sharp declines during economic downturns. Its current valuation is just under 30 times earnings and below six times annual sales—metrics that, while not drastically undervalued, reflect investor confidence in the company’s strengths amid global economic fluctuations.

Thus, Coca-Cola is a worthy consideration for those seeking consistent dividend income and a reliable growth story. It may be worthwhile to add this beverage leader to your watchlist for May.

Should You Invest $1,000 in Coca-Cola Now?

Before making an investment in Coca-Cola, consider this:

The analyst team has recently identified what they believe are the 10 best stocks for investors, and Coca-Cola is not among them. The stocks selected could yield significant returns in the upcoming years.

For instance, when Netflix was recommended in December 2004, a $1,000 investment would have grown to $623,685 today. Similarly, the recommendation of Nvidia in April 2005 would now be worth $701,781.

Meanwhile, the total average return for these recommendations is 906%, vastly outpacing the S&P 500’s growth of 164%. Consider reviewing the latest list for potential investments.

Demitri Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.