The Sanctuary of Dividend Kings

Embarking on the journey of investing, the realm of Dividend Kings emerges as a serene harbor for those seeking stability and growth. Flourishing in this exalted domain are venerable companies that have upheld the tradition of enriching shareholders for over five decades. Such dedication to enhancing investor value is a testament to their operational prowess and unwavering commitment to excellence.

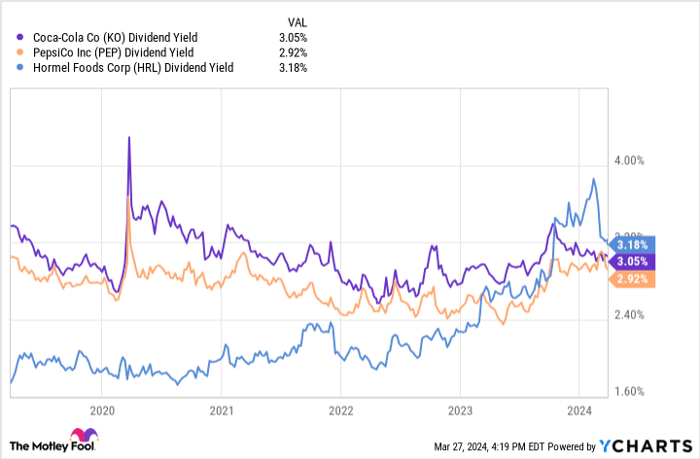

Among the esteemed members of the Dividend Kings lie revered entities: the iconic The Coca-Cola Company (NYSE: KO), its formidable rival PepsiCo (NASDAQ: PEP), and the stalwart food company Hormel Foods (NYSE: HRL). In the pantheon of dividend aristocrats, these three entities stand shoulder to shoulder, exuding resilience and prosperity in equal measure.

An Equilibrium in Excellence

As connoisseurs of dividends deliberate their investment choices, the dividend yield emerges as a pivotal parameter. Coca-Cola, Pepsi, and Hormel showcase a harmonious trifecta, each offering a dividend yield hovering around 3% – a generous return of $3 for every $100 invested.

Further delving into the nuances of dividend investments, the payout ratio emerges as a critical gauge of risk. Remarkably, Coca-Cola, Pepsi, and Hormel flaunt analogous payout ratios of 74%, 74%, and 76% respectively. Such alignment underscores their sound financial stewardship and prudent dividend policies.

Unveiling the Jewel: Hormel Shines Bright

Amidst this symphony of similarities, a precious gem beckons discerning investors – Hormel Foods. Prognosticating into the future, Hormel’s growth trajectory gleams brighter than its illustrious counterparts, Coca-Cola and Pepsi. The allure lies in its diverse portfolio, a tapestry of products poised to conquer the realm of convenience stores.

While Hormel’s Chili and Spam garner consumer recognition, its clandestine presence in convenience stores echoes a narrative of subtle dominance. From pizza toppings to Skippy peanut butter, Hormel weaves a narrative of culinary conquest in the realm of quick bites and savory indulgences.

Emboldened by the strategic acquisition of Planters in 2021, Hormel charts a course for expanded horizons. Leveraging the distribution prowess of Planters, Hormel aims to amplify the outreach of its illustrious offerings, promising a tapestry of culinary delights to tantalize discerning palates.

With a discernible edge in profit margins within convenience stores and foodservice domains, Hormel’s voyage towards enhanced profitability illuminates a path to burgeoning dividends and sustained growth, casting a luminous beacon for astute investors.

Pepsi: The Resilient Contender

While Hormel exudes an aura of promise and potential, Pepsi stands as a resilient contender in the realm of dividend aristocrats. As the talismanic growth in convenience-store channels beckons Hormel towards a promising future, a cloak of uncertainty shrouds its immediate horizon.

Anticipating a fiscal labyrinth in the year ahead, investors cast a discerning eye towards Pepsi as a steadfast beacon of stability and promise. With a robust international portfolio poised for exponential growth, Pepsi’s strategic foray into global markets heralds a tale of profit escalation and financial fortitude.

Underscoring the supremacy of its international operations, Pepsi revels in a 6% year-over-year revenue surge in 2023, catalyzing a resplendent 200% spike in international operating profit. With a strategic focus on international markets, Pepsi navigates towards profit proliferation, charting a trajectory of sustained growth and market ascendancy.

As Pepsi’s international franchise burgeons with unprecedented vigor, the promise of soaring profits and enhanced investor returns beckon, embodying a narrative of stability and resilience in a volatile economic landscape.

Should you invest $1,000 in Hormel Foods right now?

Bearing witness to the enchanting allure of Hormel Foods and the stalwart resilience of Pepsi, investors navigate a labyrinth of choices. As the siren song of dividends and growth beckons, Hormel and Pepsi stand as beacons of promise amidst a sea of uncertainty, offering solace and stability in an ever-evolving financial landscape.

Jon Quast maintains a neutral stance on the subject. The Motley Fool remains impartial in its evaluations with a dedication to transparency and disclosure.

The views and opinions expressed herein reflect the author’s perspective and do not necessarily align with the official stance of Nasdaq, Inc.