Coca-Cola vs. Pepsi: Which Beverage Giant Is the Better Investment for 2025?

Coca-Cola KO and PepsiCo PEP have historically attracted hedge funds and institutional investors, demonstrating their solid stocks in the market.

Both companies are backed by major institutional investors like Vanguard Group and BlackRock BLK, showcasing their reliability.

As we approach 2025, let’s explore which of these iconic beverage makers might be the better investment choice.

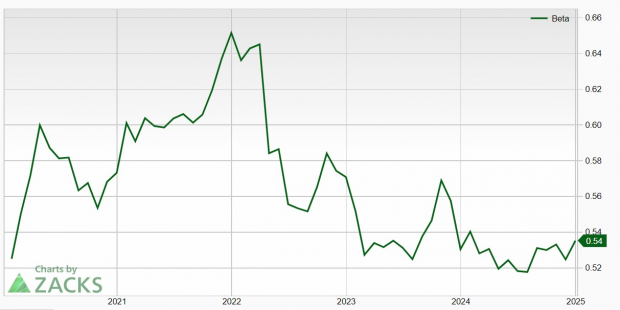

Stable Performers with Low Beta Ratios

Coca-Cola and Pepsi are often viewed as safe options for investors during economic downturns due to their stability.

Beta is a common measure of stock risk and volatility. Both KO and PEP have beta ratios below the S&P 500 Index baseline of 1.0. Pepsi has a slight advantage with a calculated beta score of 0.54, while Coca-Cola’s stands at 0.61.

Image Source: Zacks Investment Research

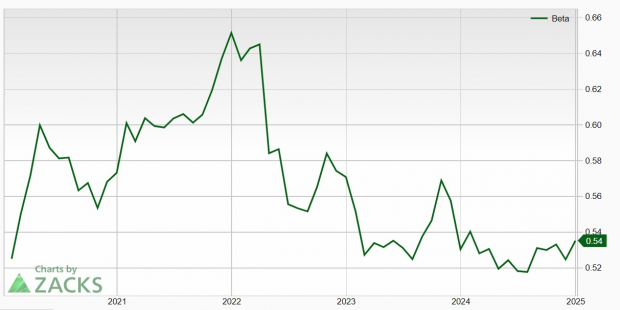

Growth Potential and Market Outlook

PepsiCo also leads in growth prospects thanks to its successful snack brands like Frito-Lay and Sun Chips. Projected sales for Pepsi are expected to rise by 1% in fiscal 2024 and by another 3% in FY25, reaching $94.8 billion.

The company’s earnings are estimated to grow by 7% in FY24 and by 5% in FY25, hitting $8.59 per share.

Image Source: Zacks Investment Research

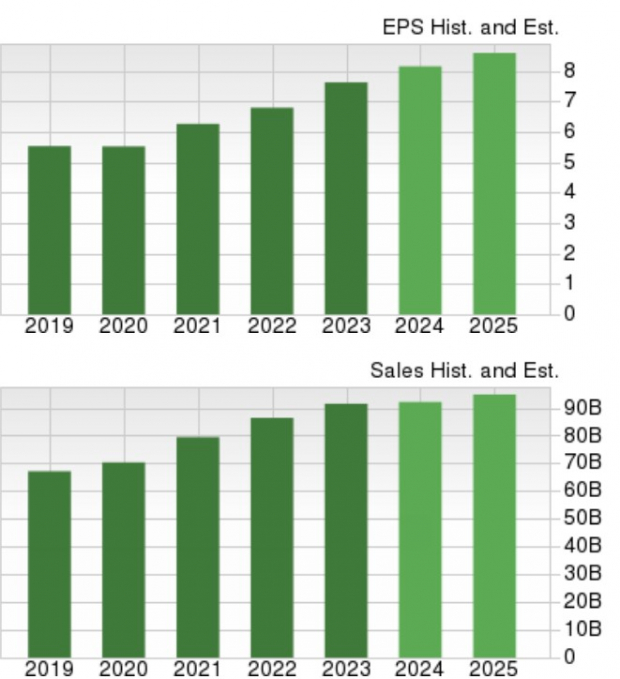

In contrast, Coca-Cola projects a 1% sales increase in FY24, followed by a 4% increase in FY25, reaching $48.02 billion. Earnings per share (EPS) for Coca-Cola are expected to grow by 6% in FY24 and by 3% in FY25 to $2.96.

Image Source: Zacks Investment Research

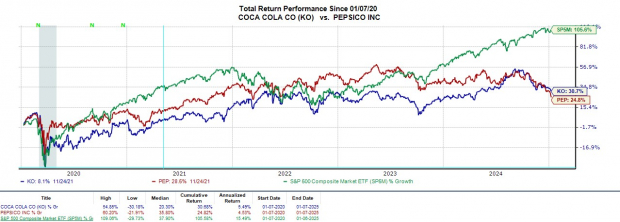

Performance and Valuation Analysis

Coca-Cola outperformed Pepsi over the past year, with KO providing a total return of +4%, including dividends. While this lags behind the S&P 500’s +27%, it is notably better than Pepsi’s -11% return.

Over a five-year period, both companies have significantly underperformed the broader market’s total return of +105%.

Image Source: Zacks Investment Research

Currently, KO and PEP are trading at slightly lower forward price-to-earnings (P/E) multiples compared to the S&P’s 20.5X, with KO at 20.5X and PEP at 17X. Pepsi’s valuation is more favorable, trading at less than 2X sales, while Coca-Cola trades at 5.6X sales.

Image Source: Zacks Investment Research

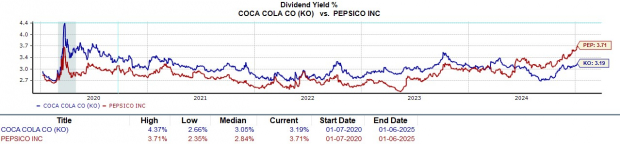

Dividend Yield Comparison

Pepsi’s 3.71% dividend yield offers a better return compared to Coca-Cola’s 3.19%. Both yields surpass the average S&P 500 yield of 1.2%.

Image Source: Zacks Investment Research

Conclusion

Currently, both Coca-Cola and Pepsi hold a Zacks Rank #3 (Hold). While Pepsi exhibits advantages in several financial areas, Coca-Cola may still appeal to long-term investors.

Investors might also consider other options within the consumer staples sector, particularly in light of potential market fluctuations in 2025.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3%, and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Coca-Cola Company (The) (KO) : Free Stock Analysis Report

PepsiCo, Inc. (PEP) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.