“`html

The Coca-Cola Company (KO) has implemented an “all-weather” strategy aimed at ensuring consistent earnings growth regardless of economic cycles or shifting consumer trends. This strategy focuses on decreasing demand volatility, enhancing pricing power, and expanding its global reach.

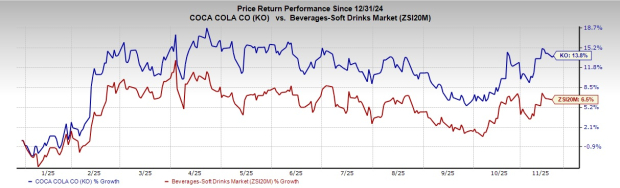

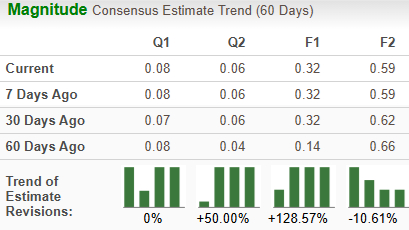

As of 2023, KO’s shares have risen 13.8% year-to-date, outperforming the industry growth of 6.5%. The company is trading at a forward price-to-earnings ratio of 22.15, compared to the industry average of 17.87. Additionally, the Zacks Consensus Estimate predicts KO’s earnings per share (EPS) will grow by 3.5% in 2025 and 8% in 2026.

Coca-Cola competes with PepsiCo, Inc. (PEP) and Monster Beverage Corporation (MNST). PEP emphasizes affordability and productivity, while MNST leads in the energy drinks category, maintaining market share through strategic pricing and product variety.

“`