PepsiCo Emerges as Long-Term Investment Choice Over Coca-Cola

When considering an investment inPepsiCo (NASDAQ: PEP), it’s essential to also look at Coca-Cola (NYSE: KO). These two beverage giants have become iconic players in the market, but their stock performance diverges significantly at present. For long-term dividend investors, PepsiCo may currently hold more appeal, especially following Coca-Cola’s recent price rally. Here is the analysis why.

Overview of Coca-Cola and PepsiCo

Coca-Cola predominantly focuses on a wide variety of beverages. The company excels in this arena, boasting a vast global distribution network, impressive research and development capabilities, and highly effective marketing strategies. As a key player in the consumer staples sector, Coca-Cola is well-positioned to consolidate the industry by acquiring companies with promising products and integrating them into its robust distribution framework. While it may seem one-dimensional, its expertise is noteworthy.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

Conversely, PepsiCo not only produces a diverse range of beverages but also offers a variety of snacks and packaged food products. Similar to Coca-Cola, PepsiCo benefits from a substantial global distribution network, strong research and development, and effective marketing. In the past, PepsiCo has successfully acquired smaller brands to enhance its portfolio as Coca-Cola does, with its latest acquisition being Mexican American food maker Siete, which specializes in snacks and packaged foods.

Despite PepsiCo previously competing closely with Coca-Cola in the beverage market, it now ranks third in the cola wars. Nonetheless, the company maintains its status as the leading snack brand and stands as a solid number two in the overall beverage sector. In the packaged food segment, PepsiCo performs well against larger competitors. This diversification may appeal to investors who favor broader business models.

Both Coca-Cola and PepsiCo are recognized as Dividend Kings, which highlights the strength of their underlying business models. Although Coca-Cola has a longer streak of dividend increases, both companies demonstrate effective business plans, allowing for over 50 consecutive years of increasing dividends, reflecting their operational stability.

Current Performance: Coca-Cola Outshines PepsiCo

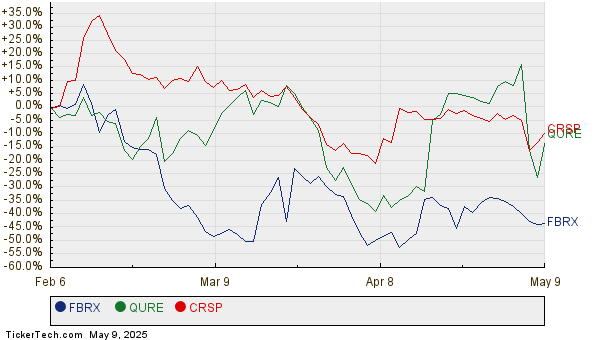

Every company experiences cycles of highs and lows. Currently, while Coca-Cola appears to be executing well, PepsiCo is facing some challenges. The stock charts of these companies reflect a shift in performance, with many investors adapting their strategies accordingly. It is crucial for long-term investors to focus less on short-term fluctuations and more on the fundamental management of both companies.

PEP data by YCharts

While both companies are well-managed, Coca-Cola currently outperforms PepsiCo. The latter has faced challenges, particularly following the inflation spikes post-COVID-19, which allowed it to implement significant price increases. However, it has since experienced only 2% growth in organic sales and 9% in core earnings for 2024, with similar expectations for 2025. While these figures are respectable in the consumer staples sector, they have elicited a market reaction: PepsiCo’s stock price has fallen about 20% from its peak in 2023, raising its yield to one of the highest levels in its history. Furthermore, its price-to-sales and price-to-earnings ratios are currently below their five-year averages, indicating it could be undervalued.

In contrast, Coca-Cola’s stock has experienced a recent uptick. Its dividend yield has decreased from historical highs, and its valuation metrics are now above their five-year averages. Coca-Cola was previously more attractively priced, but it now appears somewhat costly. This makes PepsiCo a more appealing prospect, especially considering the competitive environment.

Long-Term Perspective Favors PepsiCo Over Coca-Cola

This analysis does not imply that Coca-Cola is a poor investment; rather, it is currently not as attractively valued as PepsiCo, which remains a strong contender. The short-term focus of the market can obscure long-term opportunities. For income investors, PepsiCo’s historically high yield of 3.5% becomes increasingly appealing, particularly in light of Coca-Cola’s price surge.

Seize This Opportunity

If you’ve ever felt you missed out on top-performing stocks, this is your chance.

On rare occasions, our expert analysts recommend a “Double Down” Stock pick for companies they believe are poised for significant growth. If you’re concerned about missing your investment opportunity, now may be the best time to act. The evidence is compelling:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $292,207!

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $45,326!

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $480,568!

We are currently issuing “Double Down” alerts for three exceptional companies, and opportunities like this may not come around again soon.

Continue »

*Stock Advisor returns as of March 3, 2025

Reuben Gregg Brewer has positions in PepsiCo. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.