Coinbase Gains Traction as Crypto Market Rebounds

Coinbase Global: A Look at the Market Leader

Coinbase Global (COIN) holds the crown as the largest crypto exchange in the United States by trading volume. With a favorable Zacks Rank #2 (Buy), Coinbase thrives on the growing global acceptance of cryptocurrencies, bolstered by its diverse range of offerings.

After its 2021 debut amidst the “crypto winter,” COIN shares faced challenges as crypto prices dropped and its top competitor, FTX, collapsed. However, the company’s stock and fundamentals are now on a swift upswing thanks to increased crypto adoption, new innovations, and a strong financial position. Let’s explore why Coinbase is likely to maintain its momentum.

Exciting News: Coinbase Partners with Apple Pay

A significant challenge for the crypto world has been making it easy to convert traditional money (fiat) into crypto. On Monday, Coinbase announced a new initiative to simplify this process, stating, “Today, we’re excited to announce the launch of Apple (AAPL) Pay for all fiat-to-crypto purchases via Coinbase Onramp, the easiest tool to build onramps into your existing products.”

Earlier in the year, Coinbase also teamed up with Stripe, another major payment processor, to enhance global adoption. These partnerships place Coinbase in a strong position to benefit from the growing trend in crypto usage.

SEC Changes Present Opportunities for Coinbase

Coinbase may see more benefits from a potential shift in political leadership. The recent election of Donald Trump could lead to the dismissal of SEC Chair Gary Gensler, who has been seen as a barrier to clear regulations for crypto assets—creating uncertainty for companies like Coinbase.

Surge in Altcoins Amid Regulatory Developments

While Gensler remains in place for now, investors are favoring alternative cryptocurrencies, known as “alt coins,” as they anticipate future changes. For instance, Ripple (XRP) has soared more than 300% since the election, reflecting growing optimism among investors.

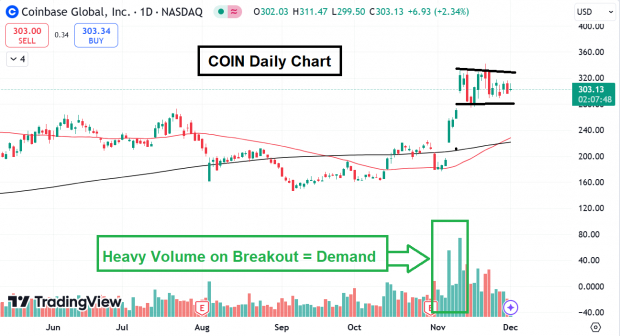

Image Source: TradingView

The increased market activity is beneficial for Coinbase, which earns commissions that can range from 0.5% to 4.5%, depending on the cryptocurrency.

Bitcoin ETFs Gain Ground

The rise of Bitcoin ETFs, such as the iShares Bitcoin Trust ETF (IBIT), Fidelity Wise Origin Bitcoin ETF (FBTC), and ARK 21 Shares Bitcoin ETF (ARKB), has been remarkable. Coinbase is well-positioned to benefit as it provides custody services for many of these funds. Additionally, firms like Semler Scientific (SMLR) and Rumble (RUM) may follow in MicroStrategy’s (MSTR) footsteps by adopting the “Bitcoin Standard.”

Positive Market Indicators for COIN

Following a notable breakout on election day, COIN shares are forming a classic bull flag pattern. Furthermore, strong call option buying suggests a positive outlook among investors, adding confidence to the current market trend.

Image Source: TradingView

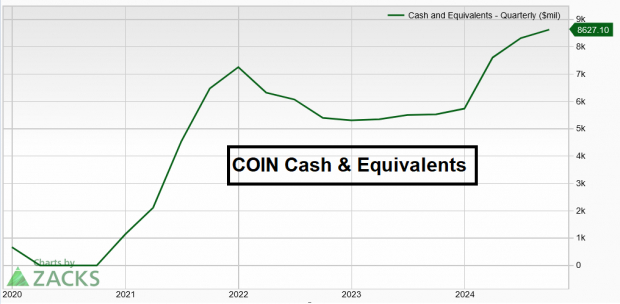

Strong Financial Position for Coinbase

Despite the challenges often associated with the volatile crypto industry, Coinbase maintains a solid balance sheet and an increasing cash reserve.

Image Source: Zacks Investment Research

Final Thoughts on Coinbase’s Future

As a key player in the crypto market, Coinbase stands to gain from continuing global crypto adoption, strategic partnerships, and its strong financial foundation.

Discover Zacks’ Recommendations for Just $1

No gimmicks here.

A few years back, we made headlines by offering 30-day access to all our stock recommendations for only $1, with no strings attached. Many took advantage; others doubted. We aim for you to explore our portfolio services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which successfully closed numerous positions with impressive gains in 2023.

Check Out Our Stock Picks >>

Interested in the latest stock recommendations from Zacks Investment Research? Download our report on 5 Stocks Set to Double for free today.

Free Stock Analysis Reports:

- Apple Inc. (AAPL)

- MicroStrategy Incorporated (MSTR)

- Coinbase Global, Inc. (COIN)

- Rumble Inc. (RUM)

For more insights, visit Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.