The investment landscape for Colruyt Group N.V. has undergone a remarkable shift as the one-year price target for its Depositary Receipts (OTCPK:CUYTY) soars by 17.21% to 11.13 per share. This optimistic outlook marks a substantial increase from the earlier estimate of 9.50 on January 18, 2024. The new target reflects a consensus among analysts, with individual forecasts ranging from a pessimistic -0.25 to an ambitious 22.48 per share, averaging a 1.20% boost from the latest closing price of 11.00 per share.

Fund Sentiment Overview

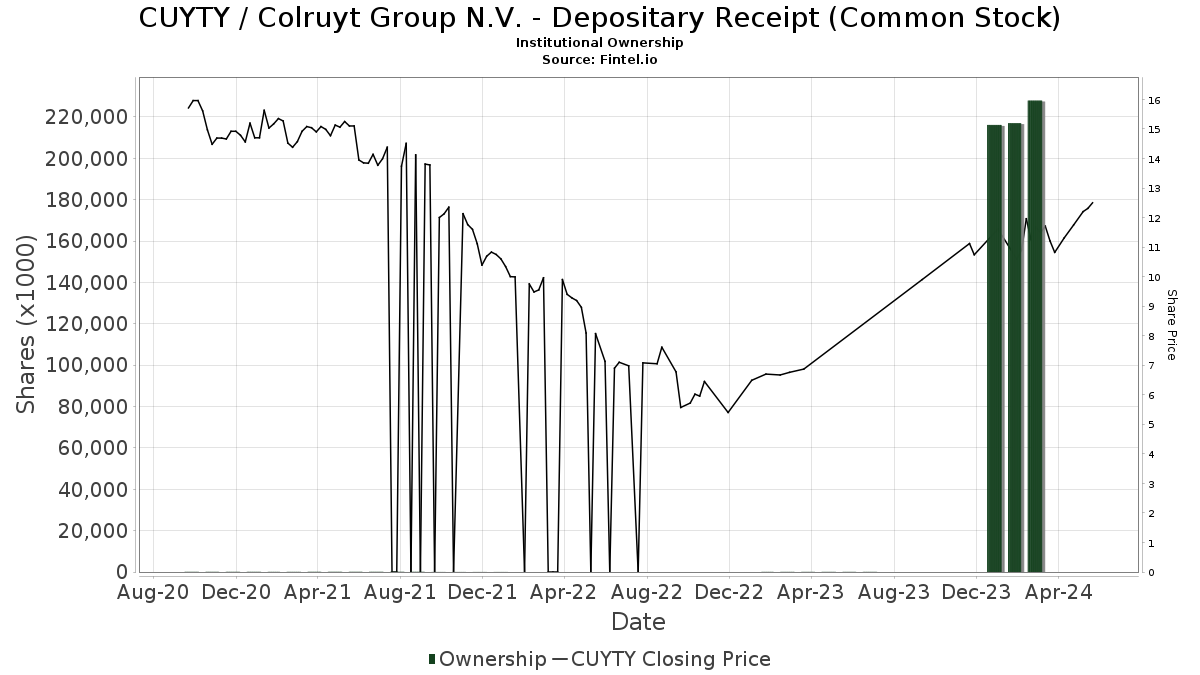

The latest data showcases robust investor confidence in Colruyt Group N.V., with 167 funds or institutions disclosing positions in its Depositary Receipts. This equates to a noteworthy increase of 15 owners or 9.87% over the last quarter. On average, these funds have allocated 0.26% of their portfolios to CUYTY, marking a substantial 4.57% surge. Collectively, institutional ownership has surged by 8.66% in the past three months, now totaling 217,343K shares.

Insights from Key Shareholders

Among the major shareholders, VGTSX – Vanguard Total International Stock Index Fund Investor Shares stands out with 26,905K shares, marking a substantial 97.53% increase from its previous stake of 665K shares. Impressively, the fund elevated its exposure to CUYTY by 53.72% in the last quarter.

In contrast, DFA INVESTMENT DIMENSIONS GROUP INC – DFA International Real Estate Securities Portfolio – Institutional Class, holds 20,653K shares, witnessing a decrease of 6.86% compared to its previous ownership of 22,070K shares. Notably, the firm boosted its allocation to CUYTY by 8.66% in the same period.

VTMGX – Vanguard Developed Markets Index Fund Admiral Shares holds 15,868K shares, a remarkable 97.54% surge from 391K shares held earlier. The fund increased its exposure to CUYTY by 54.99% in the last quarter, signaling growing confidence in the stock.

FISMX – Fidelity International Small Cap Fund maintains a stake of 14,231K shares with no change recorded in the recent quarter.

POSAX – Global Real Estate Securities Fund possesses 12,213K shares, indicating a 3.59% decrease from its previous ownership of 12,652K shares. Nevertheless, the fund augmented its commitment to CUYTY by 8.70% in the last quarter.

Embarking on a journey of financial exploration, Fintel offers a broad spectrum of investment research services catering to individual investors, traders, financial advisors, and small hedge funds. Our diverse data ecosystem spans the global financial realm, encompassing fundamentals, analyst insights, ownership metrics, and sentiment analysis across multiple investment channels. Delve into our exclusive stock selections, meticulously crafted using cutting-edge quantitative models to optimize investment returns.

For more insights, delve deeper into the exciting world of finance with us on Fintel!

Disclaimer: The opinions and views articulated herein represent the author’s perspective and not necessarily the stance of Nasdaq, Inc.