The roaring waves of finance have propelled Comet Holding (SWX:COTN) to new heights as the stock’s average one-year price target shoots up to a dazzling 320.48 per share, marking a stellar 12.05% surge from the previous estimate set on January 16, 2024. Like a comet streaking across the financial galaxy, this surge illuminates the sky, catching the eyes of analysts and investors alike.

Comet Holding’s Stellar Dividend Performances

Amidst this astronomical rise, Comet Holding (SWX:COTN) continues to shine in the realm of dividends, boasting a firm 1.20% dividend yield. Furthermore, with a payout ratio standing at a stable 0.51, the company strikes a harmonious balance between rewarding its shareholders and reinvesting in its own growth.

As the dividend growth rate glimmers at a promising 2.70% over the last 3 years, it’s evident that Comet Holding (SWX:COTN) is not just flashing brightly in the present but also projecting a trajectory of sustained growth and income generation.

Institutional Sentiment and Shareholder Dynamics

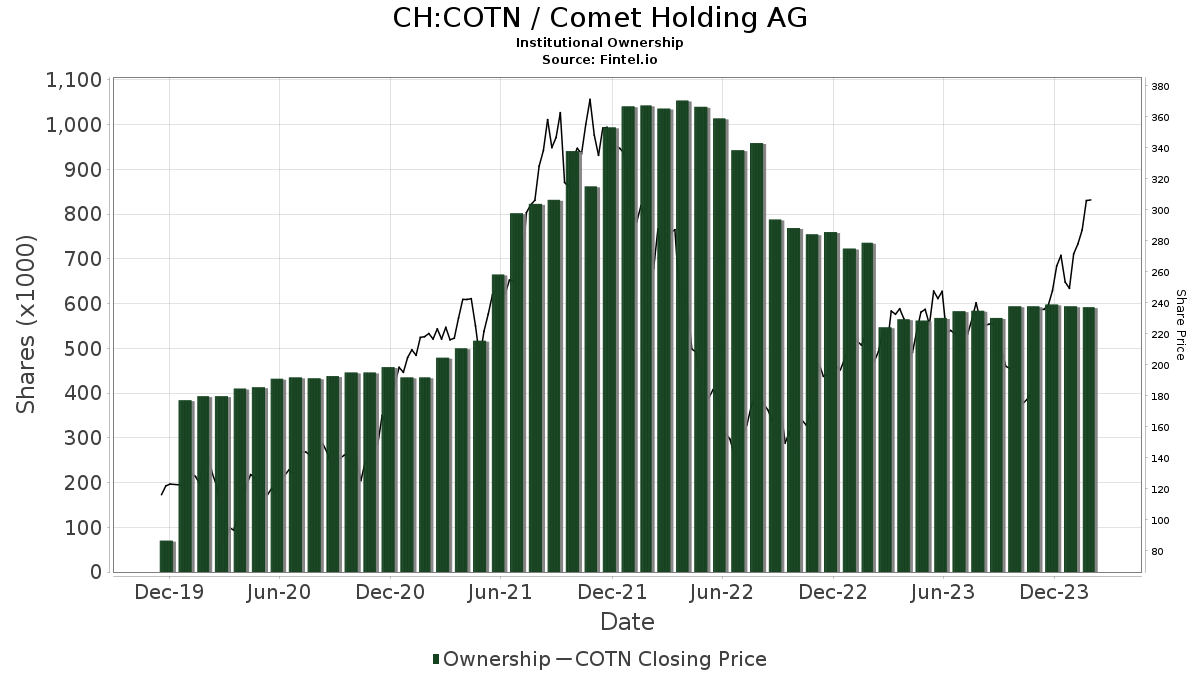

Peering into the star-studded space of institutional investments, 64 funds or institutions have reported positions in Comet Holding, showing a minor dip of 1.54% in ownership in the last quarter. However, the average portfolio weight dedicated to COTN remains constant at 0.10%.

Delving deeper into the constellation of shareholders, notable institutions have made moves in their allocations towards Comet Holding:

- VGTSX – Vanguard Total International Stock Index Fund Investor Shares: With 103K shares representing a 1.32% ownership of the company, the fund increased its holdings by 3.71% in the prior filing.

- VTMGX – Vanguard Developed Markets Index Fund Admiral Shares: Holding 60K shares, the fund’s ownership saw an uplift of 2.62%.

- IEFA – iShares Core MSCI EAFE ETF: The fund increased its stake by 2.19%, holding 48K shares.

- DFA Investment Trust Co – The Continental Small Company Series: Reporting a significant increase of 8.41%, the fund now holds 42K shares.

Last but not least, QCSTRX – Stock Account Class R1 holds 34K shares, maintaining its ownership at 0.44% over the last quarter.

Like celestial bodies gravitating towards a common center, these movements in institutional ownership shed light on the shifting dynamics and strategic positioning of shareholders within the Comet Holding universe, reflecting a tapestry of calculated decisions and market perceptions.

Fintel, a beacon of knowledge in the investing realm, stands as a guiding star, offering a myriad of insights and data to navigate the vast expanse of financial markets, empowering investors with tools to make informed decisions amidst the cosmic dance of stock fluctuations and market murmurations.

As investors journey through the celestial realm of financial markets, Comet Holding (SWX:COTN) emerges as a luminous entity, captivating attention with its trajectory of growth, stability, and dividend prowess. Like a comet streaking across the night sky, the company’s stock illuminates the path for investors, offering a glimmer of opportunity in the vast expanse of the market cosmos.

For those seeking to delve deeper into the mysteries of the investing universe and harness the power of data-driven insights, a voyage through Fintel’s realms promises to enlighten the mind and guide the hand in the ever-evolving landscape of finance.

Embark on your journey to financial enlightenment and navigate the celestial dance of markets. Venture forth and seize the opportunities that await in the boundless expanse of investment possibilities.

May your investments align with the stars, guiding you to prosperity and success in the grand tapestry of financial constellations.