Illuminating the path for investors considering Janux Therapeutics Inc (Symbol: JANX) shares, there exists a clever alternative to paying the current market price of $35.70/share. By pondering the option of selling puts, investors can spice up their methods. One particular put contract worth noting is the November put at the striking price of $25. At the time of crafting this narrative, the bid stands at a solid $4.10. An investor collecting this bid as a premium would relish a 16.4% return against the $25 commitment, or a juicy 26.5% annualized rate of return, which, at Stock Options Channel, is known as the YieldBoost.

A put sale does not provide the same access to JANX’s upward potential as owning shares would, as the put seller only transitions to owning shares if the contract materializes. The counterparty would only opt to exercise at the $25 strike if doing so yields a better result than selling at the current market price. This leads to a cost basis of $20.90 per share (after subtracting the $4.10 from $25) if the contract is exercised, presenting a delicate balance where the sole benefit to the put seller lies in pocketing the premium for an alluring 26.5% annualized rate of return.

Examining Historical Data and Volatility

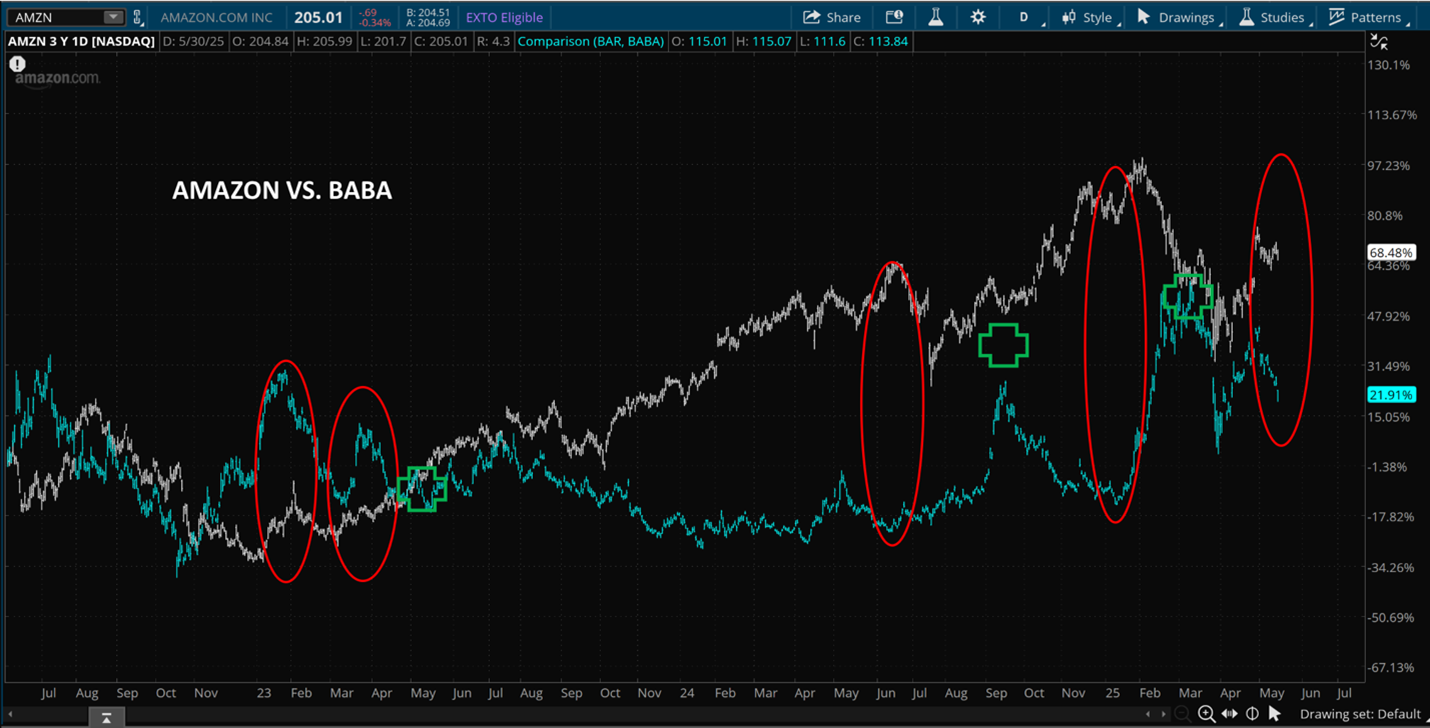

A visual representation of Janux Therapeutics Inc’s journey over the last twelve months can be seen below, with the $25 strike highlighted in green to provide context:

Augmenting fundamental analysis with the stock’s historical volatility and the above chart can serve as a compass to determine if selling the November put at the $25 strike for a luscious 26.5% annualized rate of return is a commendable move. Based on our calculations, the trailing twelve-month volatility for Janux Therapeutics Inc, encompassing the last 250 trading day closing values along with today’s price of $35.70, stands at 142%. For more put options contract ideas across different available expirations, venture to the JANX Stock Options page on StockOptionsChannel.com.

Expand Your Financial Horizon:

Dive into the Preferred Stock Investing 5th Edition eBook for a wealth of knowledge

Peep into the world of ESES Insider Buying

Uncover the Top Ten Hedge Funds Holding LFG

The insights shared within are the author’s and may not necessarily echo Nasdaq, Inc.’s perspective.