Despite the Middle East crisis-driven volatility, oil prices surged ahead on Friday following OPEC’s decision to maintain its oil output policy. The benchmarks were set for weekly losses, but the oil-producing group stated that it would decide in March whether or not to extend the voluntary oil production cuts in place for the first quarter.

The looming and dizzying specter of rising geopolitical tensions provided an additional impetus, with Iran-aligned Houthi group’s attacks on Red Sea shipping stoking fears of trade and supply disruptions from the region. Brent crude remained valiantly above $81 a barrel on Thursday, finding support from expectations of interest rate cuts.

Meanwhile, gold prices lingered near a one-month high as the market turned its attention to the U.S. non-farm payrolls data for insights into the Federal Reserve’s rate path, following a rise in U.S. weekly jobless claims. Spot gold stood its ground at $2,054.37 an ounce by 6 am ET.

Phillip Streible, chief market strategist at Blue Line Futures, humorously described gold as still in a “bad hangover” post-Fed’s reaction, with a small rally triggered by the initial claims number, according to Reuters.

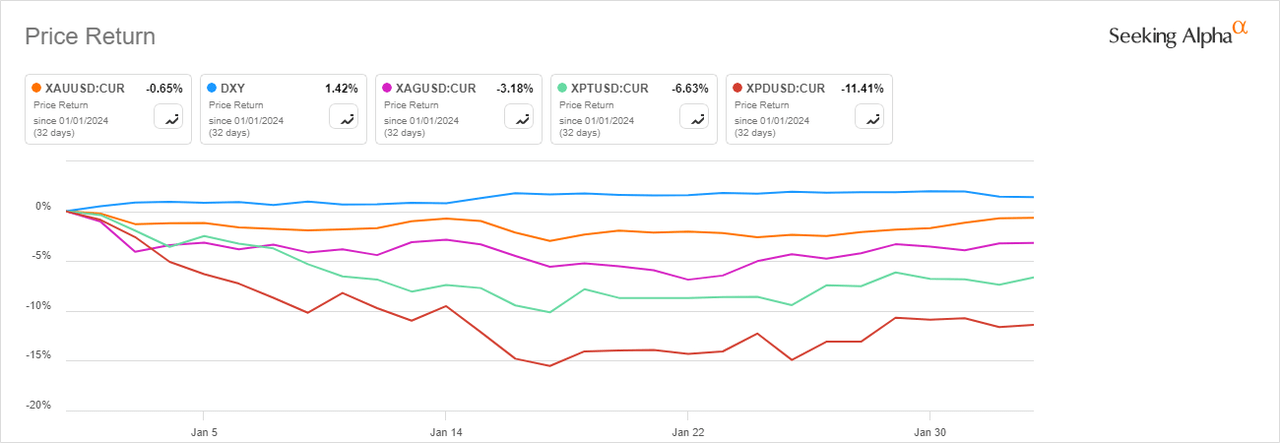

YTD: A Glimpse into Precious Metal Movement

Base metals, on the other hand, faced downward pressure as copper futures headed for a weekly loss amidst delayed rate cut speculations and concerns over demand in China. “Nevertheless, supply side issues remain on the mind of investors. The speed with which producers in the metal industry have shut down capacity in the face of falling margins is unexpected. It should lead to a stabilization in prices, but further upside will depend on them maintaining discipline until demand recovers,” ANZ analysts said in a note. Prices for metals, including nickel and lithium, remain well below the highest cost producers, brokerage confirmed.

Elsewhere in the agricultural commodities arena, soybean and cocoa prices witnessed a tumble, while wheat emerged as the gainer. As per reports, the USDA attaché sees higher Ukraine grain output, boosting export estimates.

Summary of Recent Commodity Price Movements

-

Energy

- Crude oil (CL1:COM) +0.68% to $74.32.

- Natural Gas (NG1:COM) +1.40% to $2.08.

Exploring Commodity ETFs

Gold ETFs:

- SPDR Gold Shares ETF (GLD)

- VanEck Gold Miners ETF (GDX)

- VanEck Junior Gold Miners ETF (GDXJ)

- iShares Gold Trust ETF (IAU)

- Direxion Daily Gold Miners Index Bull 2X Shares ETF (NUGT)

- Sprott Physical Gold Trust (PHYS)

Other Metal ETFs:

- iShares Silver Trust ETF (SLV)

- Sprott Physical Silver Trust (PSLV)

- Global X Silver Miners ETF (SIL)

- U.S. Copper Index Fund, LP ETF (CPER)

- abrdn Physical Palladium Shares ETF (PALL)

Oil ETFs:

- U.S. Oil Fund, LP ETF (USO)

- Invesco DB Oil Fund ETF (DBO)

- U.S. 12 Month Oil Fund, LP ETF (USL)

- U.S. Brent Oil Fund, LP ETF (BNO)

- U.S. Natural Gas Fund, LP ETF (UNG)

- U.S. Gasoline Fund, LP ETF (UGA)

Agriculture ETFs:

- Invesco DB Agriculture Fund ETF (DBA)

- Teucrium Soybean ETF (SOYB)

- Teucrium Wheat ETF (WEAT)

- Teucrium Corn Fund ETF (CORN)