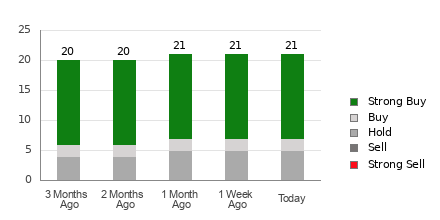

Communication Services ETF Enters Oversold Territory, Market Insights

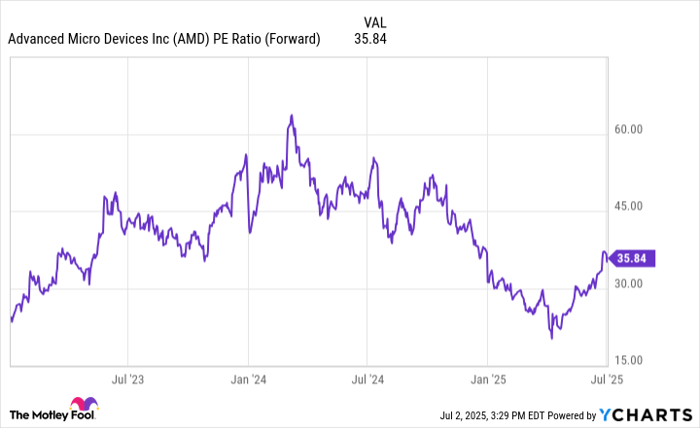

On Thursday, in trading activity, shares of the Communication Services Select Sector SPDR Fund ETF (Symbol: XLC) reached an oversold condition, with prices dipping to $94.62 per share. We assess oversold conditions using the Relative Strength Index (RSI), a technical analysis tool that evaluates momentum on a scale from zero to 100. A stock is generally deemed oversold when its RSI falls below 30.

For the Communication Services Select Sector SPDR Fund, the RSI recorded a value of 29.8. In contrast, the RSI for the S&P 500 stands at 28.4. This suggests that investors might interpret XLC’s RSI of 29.8 as an indication that recent selling pressure could be diminishing, which may prompt them to identify potential buying opportunities.

Examining the one-year performance chart below, we see XLC has established a 52-week low at $76.48 per share and a high of $105.58. The most recent trading price for XLC is $94.94, reflecting a decline of approximately 1.9% for the day.

![]()

Click here to discover 9 other oversold dividend stocks worth considering »

Also see:

- Top Ten Hedge Funds Holding GTN

- Teradyne Technical Analysis

- Institutional Holders of CISO

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.