Toyota sold 2.33 million vehicles in the U.S. in 2023, a 3.7% increase from 2022, maintaining its position as the No. 2 automaker in the market. Ford, with 2.07 million vehicles sold, showed a year-over-year increase of 4.2%. However, globally, Toyota outsold Ford significantly, moving 10.8 million vehicles compared to Ford’s 4.5 million in 2024. Toyota’s market cap stands at $250 billion, while Ford’s is $40 billion.

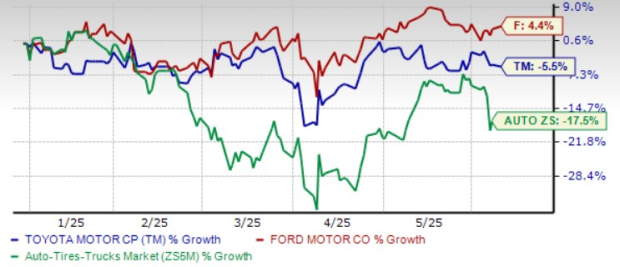

Year-to-date, Toyota’s shares have declined by 5.5%, whereas Ford’s shares have increased by 4.4%, both surpassing the auto sector’s performance. Ford carries $27 billion in cash and $45 billion in liquidity, but faces challenges in its gas-powered unit and growing losses in its EV division, amounting to over $5 billion in 2024. Toyota, while also expecting a 21% drop in operating income due to material costs and tariffs, projects a rise in vehicle sales to 9.8 million for fiscal 2026.

Capital efficiency favors Toyota, with a return on invested capital of 4.8%, compared to Ford’s 1.77%. As both companies navigate increased competition and market shifts, Toyota’s strategic approach and strong capital discipline may offer it a slight edge in the evolving automotive landscape.