MSCI Inc. Reports Earnings While Navigating Market Fluctuations

MSCI Inc. (MSCI), based in New York, delivers essential tools and solutions to the investment sector for managing investment processes. With a market capitalization of $48.4 billion, it specializes in portfolio construction and risk management products, along with analysis of Environmental, Social, and Governance (ESG) factors, and real estate research, reporting, and benchmarking services.

Understanding MSCI’s Market Position

Considered a “large-cap” stock, MSCI is categorized among companies with valuations of $10 billion or more. With over five decades of experience in research, data, and technology, MSCI empowers clients to understand the key factors influencing risk and return, leading to the construction of more effective investment portfolios.

Recent Stock Performance and Market Comparison

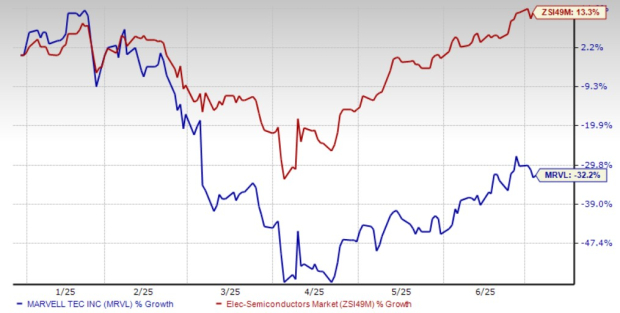

The financial data firm has seen a 2.1% decline from its 52-week peak of $631.70, reached on October 29. Over the last three months, MSCI’s shares increased by 10.8%, closely tracking the broader Financial Select Sector SPDR Fund’s (XLF) gains of 10.6% during the same period.

Looking back over the past year, MSCI has risen 22.1%, though it trails XLF’s impressive 37.6% returns. Year-to-date, MSCI shares are up 9.3%, notably lower than XLF’s 32.2% rise.

Trading Trends and Recent Earnings Report

In recent trading, MSCI has remained above its 200-day moving average since early August and has held steady above its 50-day moving average since late November. After releasing its Q3 earnings on October 29, shares dipped by 2.7%, despite a strong report. The company’s revenue grew by 15.9% year-over-year, totaling $724.7 million, which surpassed forecasts by 1.5%. Additionally, adjusted earnings per share reached $3.86, beating expectations of $3.77 and reflecting an 11.9% year-over-year increase.

Recurring subscriptions also rose by 15.4% compared to the same quarter last year, totaling $536.6 million. This was largely driven by strong demand for MSCI’s services. However, a noted slowdown in new recurring sales in the ESG and climate sector may have worried some investors.

Comparative Analysis with Rivals

In comparison, MSCI has trailed its competitor, S&P Global Inc. (SPGI), which saw increases of 23.6% over the past year and 16.5% year-to-date. Nevertheless, analysts remain cautiously optimistic about MSCI’s future. The stock has a consensus rating of “Moderate Buy” from 19 analysts, with a mean price target of $647.86, indicating a potential 4.7% increase from its current trading levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.