Realty Income Faces Headwinds as Market Dynamics Shift

Realty Income Corporation (O), based in San Diego, California, specializes in acquiring and managing freestanding commercial properties that generate rental income through long-term net lease agreements. With a market capitalization of $49.4 billion, the company owns 15,450 properties leased to over 1,500 tenants across 90 industries.

Market Positioning and Performance

Regarded as “large-cap stocks,” companies with market caps of $10 billion or more, Realty Income, fitting snugly into this classification, reflects its substantial size and influence in the retail REITs industry. Its extensive portfolio of high-quality, long-term net lease properties, diverse tenant base, and strong financial standing contribute to its stable cash flows and steady growth, reinforcing its leadership in the REIT sector.

Recent Trading Trends

Realty Income reached its 52-week high of $64.88 on October 21 and is currently trading 14% lower than that peak. The stock has declined 11.2% over the past three months, in contrast to the Real Estate Select Sector SPDR Fund’s (XLRE) 4% decline during the same timeframe.

Long-Term Performance Insights

In the long run, Realty Income has seen a 3.6% increase over the past 52 weeks but has dropped 2.9% in 2024. This is in stark contrast to XLRE’s 13.9% gains over the last year and 7.7% returns year-to-date.

Technical Analysis Signals Weakness

The stock has been trading below its 50-day and 200-day moving averages since late October, indicating a bearish price trend.

Quarterly Performance Report

Realty Income released its Q3 earnings report on November 4, which caused a slight uptick in stock price. The company reported a topline figure of $1.3 billion, narrowly exceeding Wall Street expectations. Its adjusted funds from operations (FFO) stood at $1.05 per share, matching analysts’ forecasts closely.

Competitive Landscape

In comparison, Realty Income’s competitor, Kimco Realty Corporation (KIM), has performed strongly, with gains of 22.2% over the past year and 16.1% in 2024, outpacing Realty Income’s results in both periods.

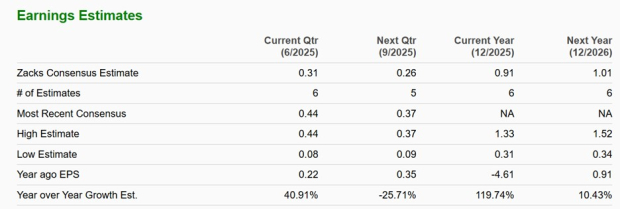

Analyst Outlook

Among analysts covering Realty Income, the consensus rating is a “Moderate Buy.” The average target price of $63.62 suggests a potential upside of 14.1% from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article are solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.