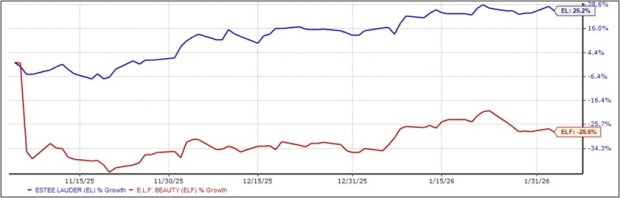

During the Q4 2025 earnings season, Estee Lauder (EL) and e.l.f. Beauty (ELF) are in focus, with significant performance disparities noted. Over the past year, EL shares have gained nearly 70%, while ELF shares have declined by 4.4%. Estee Lauder is set to report an expected EPS of $0.83, reflecting 33% year-over-year growth, while e.l.f. Beauty’s EPS is projected at $0.73, indicating a 1.2% decline.

Sales forecasts also show variance, with ELF expected to achieve 30% year-over-year growth compared to EL’s projected 5% growth. Estee Lauder’s more favorable profit margins and broader product diversification position it as a more stable investment, currently rated as a Zacks Rank #2 (Buy), while ELF holds a Zacks Rank #3 (Hold).