Nvidia and Navitas: Key Developments in AI and Chip Markets

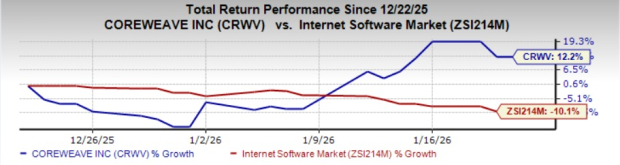

Nvidia (NASDAQ: NVDA), the world’s leading producer of data center GPUs, has seen its stock rise nearly 30% over the past year. Meanwhile, Navitas (NASDAQ: NVTS), a smaller chipmaker focused on gallium nitride (GaN) and silicon carbide (SiC) technologies, has experienced a stock rally of over 165%. Both companies are poised to benefit from the expanding artificial intelligence (AI) market, spurred by Nvidia’s significant partnerships and product innovations.

In 2027, Nvidia expects its revenue to grow at a compound annual growth rate (CAGR) of 47%. Conversely, analysts predict Navitas will witness revenue declines of 45% in 2025 followed by a rebound of 84% in 2027, largely relying on its partnership with Nvidia for power chip production. Currently, Navitas trades at a valuation of 63 times this year’s sales, significantly higher than Nvidia’s 25 times projected EPS for fiscal 2027, raising concerns about Navitas’ long-term growth sustainability.

Last year’s collaboration between Nvidia and Navitas involves integrating GaN and SiC chips into Nvidia’s AI data centers, set to commence significant production in 2027. This deal could enhance Navitas’ exposure to the AI market while Nvidia continues to dominate data center applications for major tech companies like Microsoft and Google.