Nvidia vs. Broadcom: Which AI Stock Should You Buy?

Two leaders in artificial intelligence (AI) investing are Nvidia (NASDAQ: NVDA) and Broadcom (NASDAQ: AVGO). Both companies stand to gain significantly from the competitive AI landscape, making them appealing options for investors.

Investors face a dilemma: which stock is the more prudent choice right now? For those looking to invest in one of these successful firms, let’s explore the options.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy currently. Learn More »

Nvidia and Broadcom: Competing for Market Share

Nvidia excels in producing graphics processing units (GPUs) and related hardware and software. Originally made for gaming graphics, GPUs can now be utilized in various fields, including cryptocurrency mining, engineering simulations, and autonomous driving. However, the most significant demand comes from the AI sector.

GPUs are favored because they handle numerous calculations simultaneously and can be clustered together, enhancing performance. As the leading GPU manufacturer, Nvidia’s stock performance reflects its industry dominance.

Broadcom, in contrast, offers a wider array of products, from mainframe computers to cybersecurity solutions. The segments capturing AI investors’ attention include custom accelerators and connectivity switches.

Broadcom’s connectivity switches manage dataflow in data centers, playing a critical role in system efficiency. Its custom AI accelerators compete directly with Nvidia’s GPUs, purpose-built with tech giants like Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL). However, these accelerators only outperform GPUs when workloads are optimized specifically for them.

The market for Broadcom’s custom accelerators is substantial, projected to reach between $60 billion and $90 billion by 2027. With AI-related revenue of $12.2 billion in fiscal year 2024, this growth indicates significant market opportunities, likely at Nvidia’s expense. Nvidia, in fiscal year 2025, reported data center revenue of $115 billion.

While the future of GPUs versus custom accelerators remains uncertain, it is essential to monitor Nvidia’s major clients to see if they stick with Nvidia or shift to proprietary designs.

Nvidia is Financially Favorable Compared to Broadcom

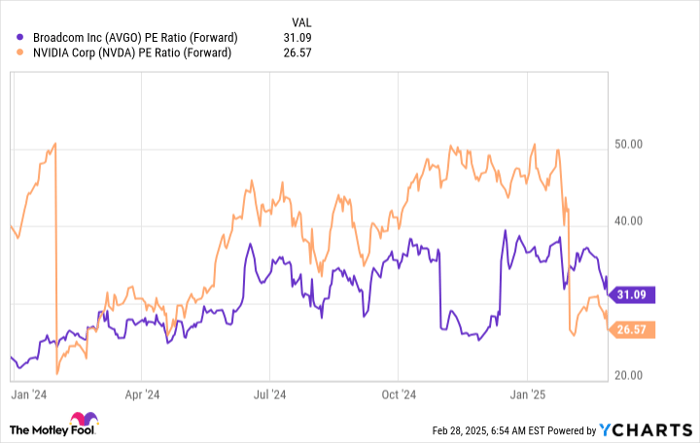

In comparing valuations, a trailing earnings metric isn’t viable due to a one-time effect impacting Broadcom. Instead, I will assess with the forward price-to-earnings (P/E) ratio to evaluate each stock’s valuation.

AVGO PE Ratio (Forward) data by YCharts

Nvidia’s forward P/E ratio sits at 27, making it cheaper than Broadcom’s valuations. Despite this, Nvidia’s growth trajectory is markedly higher than Broadcom’s.

Broadcom’s AI revenue represents about 24% of its total, totaling $12.2 billion in 2024. Although AI segments grow rapidly, they are overshadowed by broader company growth. While Broadcom reported a 44% year-over-year increase, this figure was heavily influenced by the VMware acquisition. Organic growth was just 9%. In stark contrast, Nvidia achieved 114% growth in fiscal year 2025, generating $130.5 billion in revenue. Thus, Nvidia clearly emerges as the superior investment choice.

Although Broadcom receives strong market enthusiasm, Nvidia remains the more compelling stock at present. Investors should consider acquiring Nvidia shares, especially as its stock has softened post-earnings report.

Is Investing $1,000 in Nvidia Worth It?

Before investing in Nvidia, remember this:

The Motley Fool Stock Advisor analyst team has identified what they consider to be the 10 best stocks for investors at this time… and surprisingly, Nvidia is not among them. The selected stocks could yield impressive returns.

Consider this: if you had invested $1,000 in Nvidia on April 15, 2005, based on their former recommendation, your investment would now be worth $699,020!

Stock Advisor offers clear guidance for building a successful portfolio, including regular updates from analysts, and new stock picks each month. The service has significantly outperformed the S&P 500 since its inception in 2002*. Don’t miss out on their current top 10 list, available upon joining the Stock Advisor.

See the 10 stocks »

*Stock Advisor returns as of March 3, 2025

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Keithen Drury holds positions in Alphabet and Nvidia. The Motley Fool owns shares of and recommends Alphabet and Nvidia. The Motley Fool also recommends Broadcom and maintains a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.