“`html

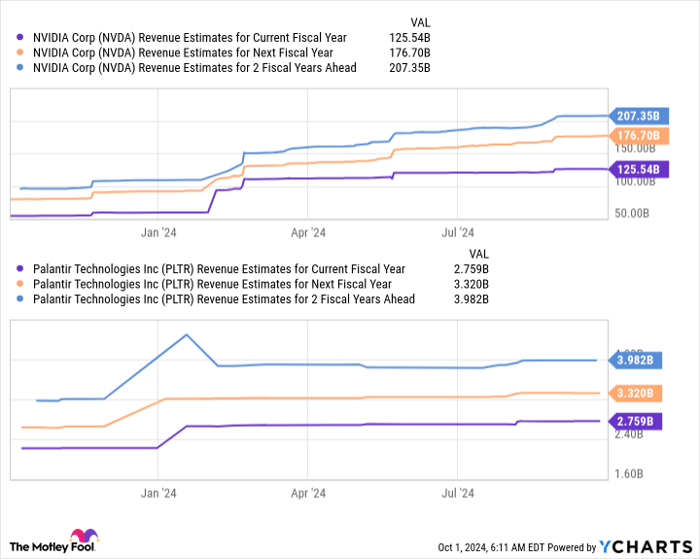

Nvidia (NASDAQ: NVDA) reported a staggering 122% year-over-year revenue growth in Q2 fiscal year 2025, reaching $30 billion, while Palantir (NYSE: PLTR) saw a revenue increase of only 27%, totaling $678 million. Analysts project Nvidia will continue to outperform, with expected growth rates of 106% for the current fiscal year compared to Palantir’s 24%.

Palantir’s growth is notably slower, and while it’s still seen as a solid investment, its valuation compared to Nvidia’s appears steep. For example, if Palantir maintains a 20% revenue growth rate, it could ultimately trade at 45 times trailing earnings, which indicates high expectations built into its stock price.

In summary, Nvidia emerges as the more attractive investment option due to its substantial revenue growth rates and more reasonable price-to-earnings metrics, suggesting a better value in the AI investment landscape.

“`