AI Hardware Showdown: Nvidia vs. Dell and Super Micro Computer for 2025

Investing in artificial intelligence (AI) spans a variety of companies. This includes everything from hardware and software to the end users of AI technologies. On the hardware front, Nvidia (NASDAQ: NVDA) stands out as the leading stock. Yet, other investment avenues are available within this sector.

Companies like Super Micro Computer (NASDAQ: SMCI) and Dell (NYSE: DELL) produce hardware for servers that perform complex AI calculations, both playing critical roles in the AI ecosystem. But which company might be the better buy for 2025? The answer may surprise you.

Dell and Supermicro: Key Players in Server Computing

You may recognize Dell from its commercials or personal computers. However, in this context, we focus on its server division that offers infrastructure for various computing tasks, especially AI.

Super Micro Computer, also known as Supermicro, provides a more premium server option. Their servers are customizable for different workloads and feature advanced liquid-cooling technology, which saves energy—up to 40%—and requires less space due to reduced airflow needs.

Both companies have a role to play, but how do they stack up against each other?

Analyzing Growth: Supermicro vs. Dell

Dell operates with two distinct segments: the Client Solutions Group, which focuses on PCs, and the Infrastructure Solutions Group, dedicated to servers. These segments are performing oppositely, impacting Dell’s overall results.

| Segment | Q3 FY 2025 Revenue | Year-Over-Year Q3 FY 2025 Revenue Growth |

|---|---|---|

| Infrastructure Solutions Group | $11.4 billion | 34% |

| Client Solutions Group | $12.1 billion | (1%) |

| Total | $24.4 billion | 10% |

Data source: Dell. Note: Q3 FY 2025 ended Nov. 1.

Clearly, the Infrastructure Solutions Group fuels much of Dell’s success. COO Jeff Clarke highlighted record demand in AI server orders, amounting to $3.6 billion in Q3, with a pipeline that has grown over 50% across various customer types.

This indicates robust performance in this segment.

In contrast, Supermicro faces challenges that could weigh heavily on its stock. While this company shows potential, recent allegations of accounting issues have created skepticism about its operations. Following a report from a short-seller and a Justice Department investigation, Supermicro’s auditor also resigned, which can signal underlying problems.

Fortunately, a special committee led by a forensic accounting firm found no evidence of wrongdoing, thus alleviating some concerns. Yet, past scrutiny has made some investors wary.

The company has yet to finalize its Q1 FY 2025 results due to waiting for approval from a new auditor. However, management has projected revenue to be between $5.9 billion and $6 billion, suggesting a notable increase year-over-year. Despite this, it fell short of previous expectations, leading to concerns over its Q2 revenue guidance of $5.5 billion to $6.1 billion, indicating a potential downturn.

This development is concerning, particularly since the broader tech industry doesn’t foresee a reduction in AI spending. Some reports suggest clients like Nvidia are adjusting orders because Supermicro struggles to meet demand. This situation merits close attention moving forward.

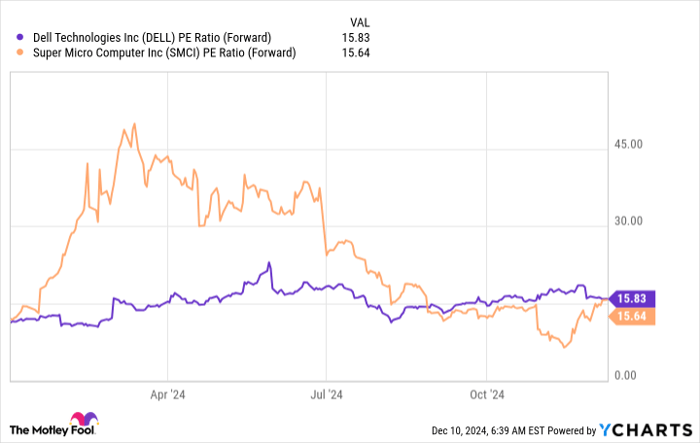

From a valuation perspective, both companies have comparable price-to-earnings ratios. Each trades at nearly identical forward earnings metrics.

DELL PE Ratio (Forward) data by YCharts

Supermicro’s faster growth could make it appear cheaper, but such investment decisions heavily rely on confidence in its management.

Ultimately, while Supermicro has cleared some allegations, ongoing turmoil raises questions about its stability. Dell presents its own difficulties, particularly within its Client Solutions Group. Given these uncertainties, investing in the established AI powerhouse, Nvidia, might be a more reliable choice.

It’s important not to overcomplicate investment choices; favoring one of these two companies over the more reliable Nvidia could lead to missed opportunities.

Is Now the Time to Invest $1,000 in Dell Technologies?

Before considering Dell Technologies, think carefully:

The Motley Fool Stock Advisor team recently pinpointed what they believe are the 10 best stocks for investment right now, none of which include Dell Technologies. The chosen stocks are expected to deliver significant returns in the coming years.

For instance, Nvidia was featured on April 15, 2005; investing $1,000 at that time would have grown to $853,765!

Stock Advisor equips investors with straightforward strategies for success, comprising portfolio-building advice, regular updates from analysts, and two new stock recommendations each month. Since its inception in 2002, the Stock Advisor service has significantly outpaced the S&P 500’s returns.

See the 10 stocks »

*Stock Advisor returns as of December 9, 2024.

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views expressed in this article belong to the author and do not necessarily reflect the opinions of Nasdaq, Inc.