Investing in the AI Revolution: A Closer Look at IonQ and Nvidia

As artificial intelligence (AI) continues to shape our world, regulation around it has surged by 56% in 2023. Two leading companies in this field, IonQ (NYSE: IONQ) and Nvidia (NASDAQ: NVDA), are making significant strides in technology.

Both firms are revolutionizing the computing sector, driving their stocks upward. As of December 11, IonQ’s shares were up about 140% while Nvidia’s had surged by approximately 180% in 2024.

The key question for potential investors is: which company presents a more attractive long-term investment in AI? This analysis will provide insights into both companies.

Examining IonQ’s Quantum Technology

IonQ’s investment potential stems from its groundbreaking quantum computing technology, which can advance AI far beyond what traditional supercomputers achieve. Quantum computers process complex calculations using subatomic particles at speeds that would take regular computers years.

IonQ has a unique advantage: unlike many quantum systems that require extremely cold temperatures to function, its technology operates effectively at room temperature. This innovation has attracted key clients, including the Oak Ridge National Laboratory, which is utilizing IonQ’s solutions to update the U.S. power grid. Such partnerships have significantly boosted IonQ’s revenue.

In the third quarter, IonQ’s sales skyrocketed 102% from the previous year to $12.4 million. Additionally, the company secured $63.5 million in new customer orders during this period.

Despite its promising growth, IonQ isn’t yet profitable. The company recorded a net loss of $52.5 million in Q3, an increase from $44.8 million the year before, largely due to $33.2 million spent on research and development as it strives to innovate.

In November, IonQ announced its acquisition of Qubitekk, a quantum networking firm, enhancing its position in the market by aligning the network capabilities of its quantum computers with today’s AI demands.

Nvidia’s Position in the AI Sphere

Nvidia has capitalized on the AI boom, responding to the enormous demand for its semiconductor chips. Notably, it is estimated that ChatGPT utilized around 10,000 Nvidia chips during its development.

The company’s specialized graphics processing units (GPUs) are vital for AI, providing the power necessary to analyze vast amounts of data swiftly and efficiently. Demand for Nvidia’s technology remains robust, with revenue for its fiscal third quarter reaching a record $35.1 billion as of October 27. This marks a 94% increase year-over-year, with net income soaring to $19.3 billion, a 109% year-over-year rise.

Nvidia’s newest Blackwell platform, engineered expressly for advanced AI computing, could further drive its growth. Each Blackwell GPU contains over 200 billion transistors, enabling unprecedented processing capabilities. Demand is overwhelming; Nvidia stated that “demand greatly exceeds supply,” with government projects in Japan and Taiwan constructing AI supercomputers using the Blackwell platform.

Strong market demand has led Nvidia to forecast approximately $37.5 billion in Q4 revenue, an impressive rise from last year’s $22.1 billion.

Making a Choice: IonQ vs. Nvidia

Both companies present compelling investment opportunities based on their technologies. To choose between them, it’s important to consider additional factors.

Nvidia’s Blackwell technology is so advanced that it can simulate certain quantum computing functions. This is significant because current quantum machines face limitations in computation duration before experiencing breakdowns, preventing them from replacing classical systems in the near future.

However, the concept of quantum advantage, where quantum computers surpass classical ones, is anticipated to be achieved sometime post-2030. This suggests that IonQ’s technology might take years to reach maturity, making it a more speculative investment at this time.

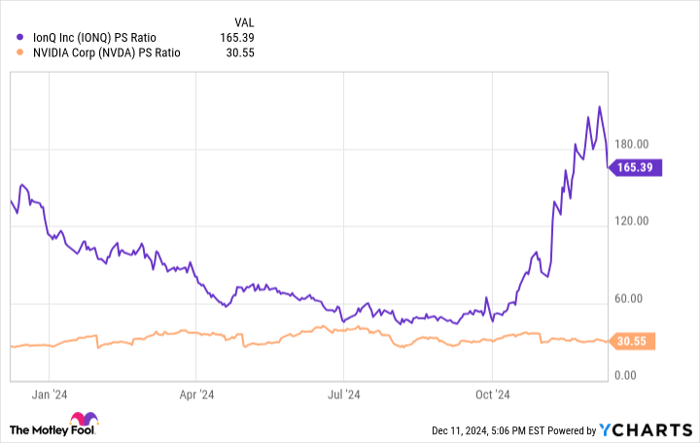

Given that both companies’ shares have increased in value this year, valuation becomes another critical aspect to consider. A comparison of their price-to-sales (P/S) ratios indicates that IonQ’s has surged recently, signaling a high valuation compared to Nvidia.

Here are three key takeaways when evaluating these two companies:

- IonQ’s stock appears overvalued.

- Nvidia is experiencing soaring profitability and demand for its Blackwell platform.

- IonQ’s technology is still several years away from mainstream adoption.

In the dynamic AI sector, Nvidia emerges as the favorable investment option between these two innovative firms.

Seize This Unique Investment Opportunity

Have you ever felt like you missed your chance to buy into a promising stock? Now might be your moment.

Our analysts occasionally issue “Double Down” stock recommendations for companies they believe are on the brink of significant growth. If you’re worried about missing out, this could be the ideal time to invest. The track record is impressive:

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $348,112!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $46,992!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $495,539!*

Right now, we are issuing “Double Down” alerts for three compelling companies, and this opportunity may not last long.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 9, 2024

Robert Izquierdo has positions in IonQ and Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.