“`html

Key News Summary

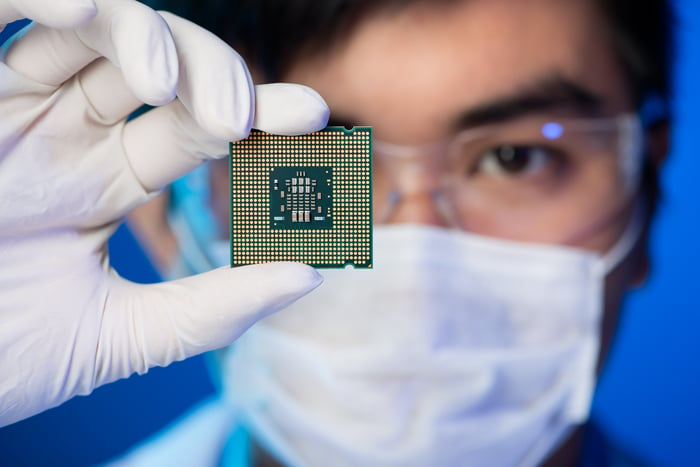

Shares of Advanced Micro Devices (NASDAQ: AMD) and Micron Technology (NASDAQ: MU) have risen 32% and 36%, respectively, over the past three months, driven by increasing demand for artificial intelligence (AI) chips. AMD reported a revenue of $7.4 billion in Q1 2025, a 36% year-over-year increase, while Micron’s earnings more than tripled in the previous quarter to $1.91 per share.

Both companies serve the AI market, but Micron is experiencing faster growth due to high demand for high-bandwidth memory (HBM), and is increasing its production capacity with a capital expenditure of $14 billion this fiscal year. Analysts forecast a sixfold jump in Micron’s earnings for the current fiscal year, while AMD anticipates a 17% jump in earnings this year, followed by a 45% increase in 2026.

Despite both companies showing solid growth, Micron is seen as a more attractive investment option due to its faster pace of growth and comparatively lower valuation.

“`